In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Ben Claremon discuss: Why Unsexy Industrial Businesses Are Ideal for Microcap Buyouts Beyond the Knockout Punch: Why Microcaps Struggle with Business Diversification Microcap Investing: Finding Diamonds in the Rough Skin in the Game: Why Microcap Buyout Investors … Read More

Berkshire Hathaway Inc (BRK.B) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Berkshire Hathaway Inc (BRK.B). Profile Berkshire Hathaway is a … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (05/03/2024)

This week’s best investing news: David Eihorn – Greenlight Capital Letter Q1 2024 (Greenlight) François Rochon – Intelligent & Rational Long-Term Investing (TIP) The Bull Case For Commodities Is As Strong As Ever (Validea) 10 Tough Questions for Warren Buffett at Berkshire’s Annual Meeting (Barron’s) Mohnish Pabrai’s Session with MIT’s … Read More

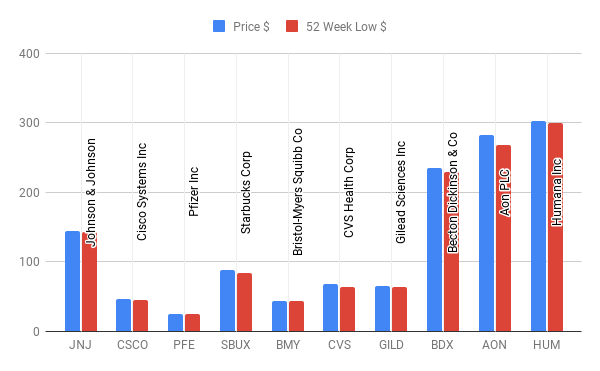

10 Big-Name Stocks Near 52-Week Lows: Are They A Buy?

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ JNJ Johnson … Read More

Why TotalEnergies SE (TTE) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: TotalEnergies SE (TTE) TotalEnergies is an integrated oil and gas company … Read More

The Cockroach Portfolio

During their recent episode, Taylor, Carlisle, and Buck discussed The Cockroach Portfolio, here’s an excerpt from the episode: Jason: Exactly. No lube. So, basically, my partner, Taylor Pearson and I built exactly what we wanted for ourselves and our families, and then we just opened it up to outside investors. … Read More

Terry Smith: Build a Concentrated Portfolio Or Buy The Index?

In his book Investing for Growth, Terry Smith discusses the general view that stocks outperform bonds, the reality is that most stocks do not, and the positive returns are largely concentrated in a select few. Active investors typically fail to beat both equity indices and bonds, hindered by fees, inadequate … Read More

Mohnish Pabrai: The Young Investors Edge: Spotting The Next 50 Bagger

In this interview with MIT’s Brass Rat Investments, Mohnish Pabrai explains why young people have a distinct advantage in identifying emerging trends and investment opportunities due to their proximity to cultural and technological shifts. He highlights historical examples, like the rapid decline of landlines first observed among college students and … Read More

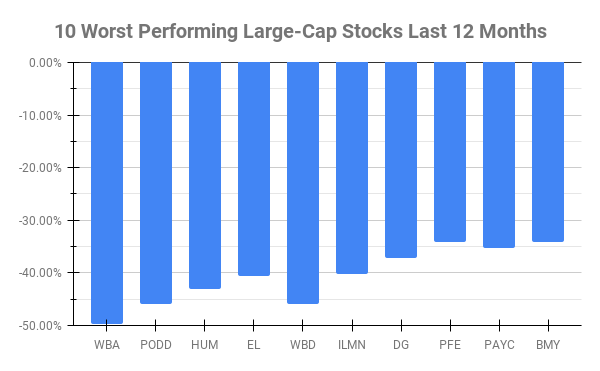

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) WBA Walgreens Boots Alliance Inc -49.70% PODD Insulet … Read More

This Acquirers Multiple Stock Is Undervalued, According to Dalio, Simons, Greenblatt

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

The Religious Wars of Investing

During their recent episode, Taylor, Carlisle, and Buck discussed The Religious Wars of Investing, here’s an excerpt from the episode: Jason: That’s obscene. Exactly. It comes around– I haven’t flushed this out, so give me some grace on this. Toby, like you’re saying, 200 years, maybe worse than 200 years, … Read More

Howard Marks: The Interconnectedness of Credit, Psychology, and Market Fundamentals

In his book Mastering The Market Cycle, Howard Marks explains how understanding the interplay between market fundamentals and psychology is crucial, though it’s far from a neat or predictable process. Events can enhance psychological confidence, which in turn can bolster the economy and corporate profits, or vice versa. This interaction … Read More

Warren Buffett: How Misguided Academic Teachings Benefit Strategic Investors

In his 1985 Berkshire Hathaway Letter, Warren Buffett discussed how misguided academic teachings benefit strategic investors. In the early 1970s, successful investing was based on the philosophy of Ben Graham, which emphasized buying shares in solid businesses when their market prices were significantly below their true business values. This approach … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

How the Four-Quadrant Model Simplifies Asset Allocation

https://youtu.be/P6n7aFYUkk4During their recent episode, Taylor, Carlisle, and Buck discussed How the Four-Quadrant Model Simplifies Asset Allocation, here’s an excerpt from the episode: Tobias: The four quadrants, I want to learn a little bit more about that too. You don’t need to predict what area you’re in. You’re always keeping a … Read More

Warren Buffett: A Business-Minded Approach To Bond Investment

In his 1984 Berkshire Hathaway Letter, Warren Buffett discussed his bond investment strategy where he treats bonds as businesses. An approach that might seem unconventional but is quite insightful. Typically, bond investments are viewed merely in terms of yield. For example, in 1946, investors purchased 20-year AAA tax-exempt bonds yielding … Read More

Francois Rochon: The “Missing Gene” That Sets 5% Of Investors Apart From The Rest

In this interview with The Investor’s Podcast, Francois Rochon discusses his theory about a “missing gene,” suggesting that most people possess a “tribal gene” hardwired from prehistoric times, when immediate conformity—like fleeing from a predator—was vital for survival. This gene prompts most individuals to follow group behaviors instinctively, particularly under stress … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

The Impact of Moneyball Strategy Across Different Sports and Financial Markets

During their recent episode, Taylor, Carlisle, and Buck discussed The Impact of Moneyball Strategy Across Different Sports and Financial Markets, here’s an excerpt from the episode: Jason: No, it’s the best. I was given other examples like [Jake laughs] Moneyball is the best, but people forget that. It’s about the Oakland … Read More

David Einhorn: We’re Excited About The Opportunity Set In Today’s ‘Broken’ Market

In his latest Q1 2024 Letter, David Einhorn says he excited about today’s opportunity set in what he calls a ‘broken’ market. Einhorn explains that the reasons the market is broken is due to: Investors do not care about valuation (passive index funds); Investors cannot figure out valuation (most retail … Read More