This week’s best investing news: Climbing the Maturity Wall of Worry (Jesse Livermore) The Persistence of Value & Growth (Verdad) Mohnish Pabrai’s Big Bet On AMR Paid Off (Forbes) Pzena Investment Management: Global Banks – Where We Stand (Pzena) GMO 7-Year Asset Class Forecast: November 2023 (GMO) Guy Spier – … Read More

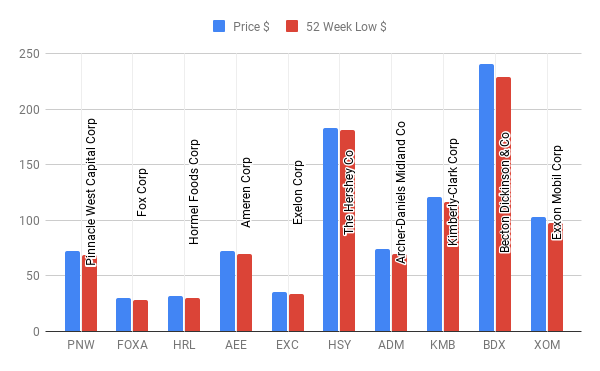

10 Big-Name Stocks Near 52-Week Lows: Are They A Buy?

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ PNW Pinnacle … Read More

Why Alphabet Inc Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Alphabet Inc (GOOGL) Alphabet is a holding company. Internet media giant … Read More

Fed Fears Trump & Supreme Court Timing: Can it Derail Trump’s 2024 Run?

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and guests Porter Collins and Vincent Daniel discussed Fed Fears Trump & Supreme Court Timing: Can it Derail Trump’s 2024 Run?. Here’s an excerpt from the episode: Porter: I’ll piggyback on what Vinny said earlier is that, it’s … Read More

Warren Buffett: The Birdie Blitz: Decoding the Dangers of Creative Accounting

In his 1998 Berkshire Hathaway Annual Letter, Warren Buffett explained how businesses can inflate their performance by hiding bad results and only presenting good ones. Using a golf analogy he provided two scenarios: Front-loading bad scores: A golfer purposefully scores terribly in the first round, creating a “reserve” of bad shots. … Read More

Howard Marks: “The Death of Equities”: A Bull Market’s Dark Prophecy (and Why It Was Wrong)

In his book Mastering The Market Cycle, Howard Marks discusses a 1979 Business Week article titled “The Death of Equities”. The article highlights how popularity (or lack thereof) of an asset class can be a powerful indicator for future performance. After a decade of poor stock market performance, the article … Read More

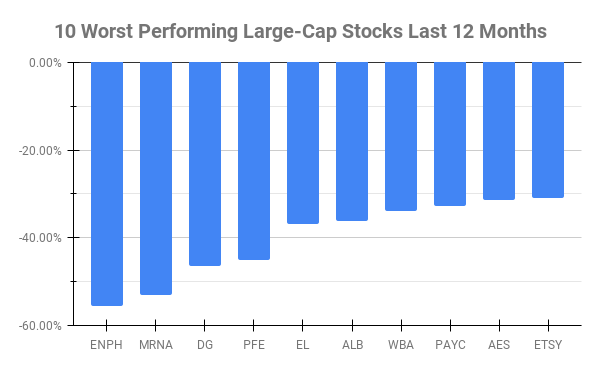

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) ENPH Enphase Energy Inc -55.64% MRNA Moderna Inc … Read More

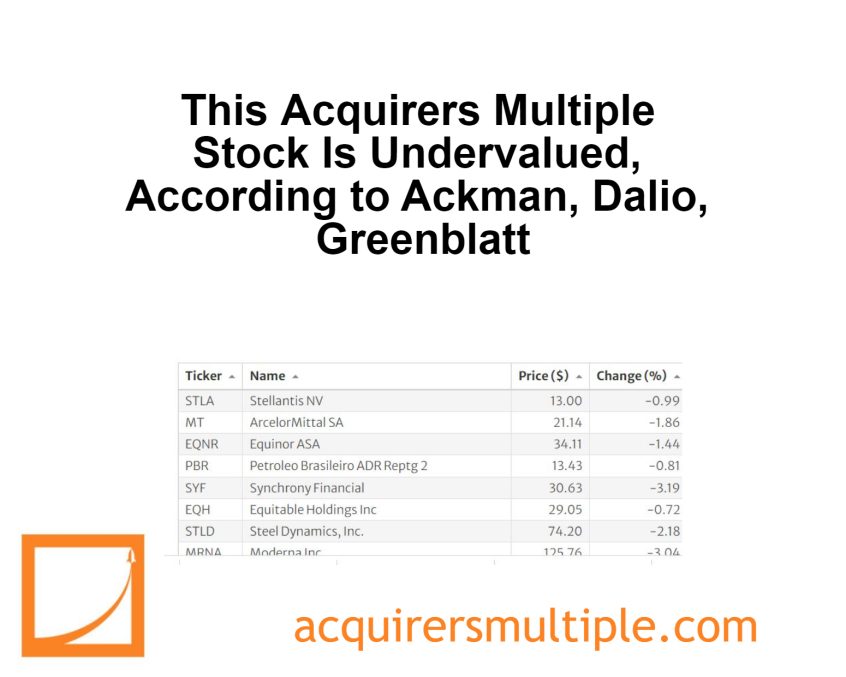

This Acquirers Multiple Stock Is Undervalued, According to Ackman, Dalio, Greenblatt

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

If Rates Don’t Go Lower, The World’s Not Going To Work

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and guests Porter Collins and Vincent Daniel discussed If Rates Don’t Go Lower, The World’s Not Going To Work. Here’s an excerpt from the episode: Tobias: How do you feel about rates from here. Jim Grant had this … Read More

Warren Buffett: Fannie Mae Fumble: A $1.4 Billion Mistake Learned the Hard Way

In his 1991 Berkshire Hathaway Annual Letter, Warren Buffett discusses the two critical mistakes he made when Berkshire Hathaway had the chance to acquire a significant stake in Fannie Mae in 1988. Stopping buying after an initial price increase: This prevented him from fully seizing the potential growth. Selling their … Read More

Ray Dalio: Contrarian Strategies Win: Why Underdogs Outperform Market Favourites

During his recent interview with Finimize, Ray Dalio explained why stock returns appear low compared to interest rates, so careful diversification is important. He also discussed why the “best” companies aren’t necessarily the best investments; undervalued “worst” companies can offer better returns. Price matters heavily – like in a horse … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

The Future of Value Investing: From Stock Picking to Self-Help Stories

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and guests Porter Collins and Vincent Daniel discussed The Future of Value Investing: From Stock Picking to Self-Help Stories. Here’s an excerpt from the episode: Vincent: Those days, in my opinion, it’s funny. I speak to friends and … Read More

Warren Buffett: Investing Lessons from the ‘Frozen Corporation’: Avoid Value Traps

During the 1998 Berkshire Hathaway Annual Meeting, Warren Buffett discussed Ben Graham’s ‘frozen corporations’ and why they should be avoided. Here’s an excerpt from the meeting: WARREN BUFFETT: Well, we discount at the long rate just to have a standard of measurement across all businesses. But we would take the … Read More

Mohnish Pabrai: How Do You Know When Your Investment Is Wrong?

During this Q&A session at Boston College, Mohnish Pabrai discussed how to know when your investment is wrong. Here’s an excerpt from the session: Pabrai: So first of all I think we know that we’re going to be wrong half or more. You know so mistakes are going to be … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Wall Street’s Blind Spot: Acquirer’s Multiple – Uncovering Hidden Gems the Market Ignores

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and guests Porter Collins and Vincent Daniel discussed Wall Street’s Blind Spot: Acquirer’s Multiple – Uncovering Hidden Gems the Market Ignores. Here’s an excerpt from the episode: Porter: I just don’t think that Powell’s cutting like everyone, like, … Read More

François Rochon: 4,000% Returns: How Holding Winners Make You Rich (and One Big Regret)

During his recent interview with Compounding Quality, François Rochon explained why taking profits isn’t bad, but it won’t lead to immense wealth. He emphasizes the importance of holding onto winning investments for significant returns. A few big winners can transform your investment journey. Here’s an excerpt from the interview: Q: … Read More

Jeff Bezos: The Metrics Trap: Why Your Numbers Could Be Lying

During his recent interview with Lex Fridman, Jeff Bezos discussed the importance of critically examining metrics and not blindly relying on them as accurate reflections of reality. Businesses rely on metrics as proxies for things like customer happiness, efficiency, etc. However, these metrics can become outdated or inaccurate over time. … Read More

Terry Smith – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More