During their recent episode, Tobias Carlisle and Mike Meixler discussed Avoiding Value Traps with Capital Cycle Theory. Here’s an excerpt from the episode: Tobias: -and other kinds of businesses that are just temporarily cheap and might not have that secular decline in them? How do you tell the difference? Mike: … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

The Cockroach Theory: Investing in Companies That Withstand Economic Recession

During their recent episode, Tobias Carlisle and Mike Meixler discussed The Cockroach Theory: Investing in Companies That Withstand Economic Recession. Here’s an excerpt from the episode: Tobias: What is your solution for that? How have you been dealing with that? Mike: Well, clients laugh. I tell them about the Meixlery … Read More

Prem Watsa – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Value After Hours (S06 E38): Aircraft hangars, mineral royalties, and gold with investor Mike Meixler

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle and Mike Meixler discuss: The Cockroach Theory: Investing in Companies That Withstand Economic Recession Avoiding Value Traps with Capital Cycle Theory Why Every Investor Should Hold Gold In Their Portfolio Modern Examples of The Power of Buybacks Are … Read More

Visa Inc (V) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Visa Inc (V). Profile Visa is the largest payment … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (10/18/2024)

This week’s best investing news: Stan Druckenmiller on Fed Policy, Election, Bonds, Nvidia (Bloomberg) Bill Nygren: Q3 2024 Commentary (Oakmark) Buybacks for US, Dividends for EU (Verdad) Larry Swedroe: An Evidence-Based Look at the Struggles of Value Investing (Excess Returns) Building a Quantitative Strategy Based on Warren Buffett’s Approach (Validea) … Read More

The Home Depot Inc (HD): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: The Home Depot Inc (HD) Home Depot is the world’s largest … Read More

Why Oil Will Remain Essential

During their recent episode, Taylor, Carlisle, and Conor Maguire discussed Why Oil Will Remain Essential. Here’s an excerpt from the episode: Tobias: Glorious future. I’ve got a more general one, like, these are like borderline macro, but we’ve all got some macro influence in our portfolios. Jake: This is a … Read More

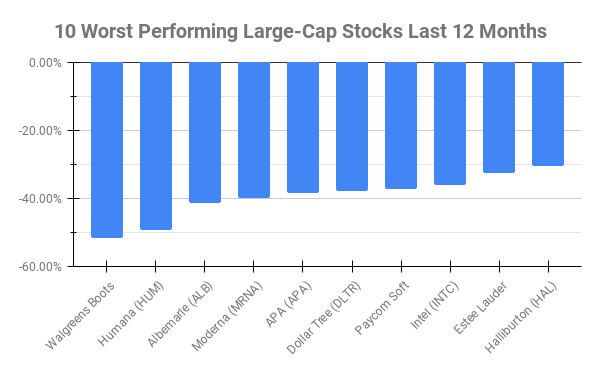

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -51.84% Humana (HUM) -49.49% Albemarle (ALB) -41.48% Moderna (MRNA) -39.86% APA (APA) -38.56% Dollar Tree … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

UK Stock Market Woes: Why Domestic Investors Are Turning Away

During their recent episode, Taylor, Carlisle, and Conor Maguire discussed UK Stock Market Woes: Why Domestic Investors Are Turning Away. Here’s an excerpt from the episode: Tobias: Conor, just more generally, why do you think that the UK stock markets had such a rough run over the last five plus … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Finding Your Ikigai: The Secret to Long-Term Success in Investing

During their recent episode, Taylor, Carlisle, and Conor Maguire discussed Finding Your Ikigai: The Secret to Long-Term Success in Investing. Here’s an excerpt from the episode: Tobias: Yeah, nicely put. JT, you want to do some veggies? Jake: Yessir. So, let’s see. I recently learned about this Japanese concept called … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Maximizing Upside: A Framework for Asymmetric Risk-Reward Profiles

During their recent episode, Taylor, Carlisle, and Conor Maguire discussed Maximizing Upside: A Framework for Asymmetric Risk-Reward Profiles. Here’s an excerpt from the episode: Conor: So, it’s basically three elements to it, really, I suppose, are valuation, obviously, the clue’s in the title. So, valuation focused where I don’t really … Read More

Michael Burry – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E37): Special situations in Europe and the UK with Investor Conor Maguire

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Conor Maguire discuss: Maximizing Upside: A Framework for Asymmetric Risk-Reward Profiles Finding Your Ikigai: The Secret to Long-Term Success in Investing UK Stock Market Woes: Why Domestic Investors Are Turning Away Why Oil Remains Essential: … Read More

Caterpillar Inc (CAT) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Caterpillar Inc (CAT). Profile Caterpillar is the top manufacturer … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (10/11/2024)

This week’s best investing news: Jeremy Grantham: The Bigger the New Idea, the More the Market Becomes Overpriced (Morningstar) Howard Marks: The key to superior investing: Insight, Not Formulas (Global Money Talk) Human Error Is Predictable (Verdad) Pzena Investment Management Podcast: Why Invest Outside the US (Pzena) Jamie Dimon on … Read More