In his 2000 Fairfax Financial Shareholder Letter, Prem Watsa discusses Fairfax’s underperformance, noting that for the first time in two consecutive years, the company did not achieve a return on equity above 20%, earning only 4.1% in 2000. The company’s low stock price attracted “deep value” investors as it appeared … Read More

Jim Rogers: Organic Investing: Intuition Over Analysis

In the book – Inside The House of Money, Jim Rogers reflects on his personal investment philosophy, emphasizing a flexible and intuitive approach rather than a rigid or analytical one. He describes his portfolio as “organic,” evolving with new opportunities, whether planned or spontaneous. Rogers doesn’t focus on detailed metrics, … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Adapting Your Investment Strategy: Evolving with Market Changes

During their recent episode, Taylor, Carlisle, and Pieter Slegers discussed Adapting Your Investment Strategy: Evolving with Market Changes, here’s an excerpt from the episode: Pieter: Yeah, sure. So, I think, for example, once again compare value with quality investing, well, for value investors, the margin of safety is at a … Read More

Warren Buffett: The Investing Strategy For Finding Undervalued International Stocks

In the book – The Snowball: Warren Buffett and the Business of Life, there’s a lengthy quote by Warren Buffett describing his investing strategy from finding opportunities in South Korean companies. Buffett highlighted the value he found in South Korean companies that were trading at low valuations despite being fundamentally … Read More

Cliff Asness: How to Know When to Maintain or Alter Your Investing Strategy

In this interview with Carson Group, Cliff Asness discusses the challenge of deciding whether to stick with an investment strategy during a bad period or to make changes. He cautions against always sticking with a strategy, as it assumes that the market never changes. While often market conditions remain consistent, … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

How to Use Reverse DCF and EPS Growth Models in Quality Investing

During their recent episode, Taylor, Carlisle, and Pieter Slegers discussed How to Use Reverse DCF and EPS Growth Models in Quality Investing, here’s an excerpt from the episode: Jake: Let’s talk about the valuation component, because this is I think where it might get difficult for some with trying to … Read More

Howard Marks: Buffett’s Hamburger Analogy: Investing When Markets Are Down

In this interview with Goldman Sachs, Howard Marks discusses the discrepancy between private and public asset valuations. He emphasizes the importance of making intelligent investment choices based on relative value. He also references Warren Buffett’s analogy about buying more when prices are low, likening market declines to a sale, and … Read More

Mohnish Pabrai: Why Long-Only Portfolios Outperform Short Selling Strategies

In this article titled – Steer Clear of the Short Side, Mohnish Pabrai argues against short positions as a hedge, suggesting a long-only unleveraged portfolio as a better alternative. With over 100,000 publicly traded stocks, it’s possible to hedge against various macroeconomic factors without using derivatives. Pabrai highlights the risks … Read More

Cliff Asness – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E27): Quality Compounding’s Pieter Slegers on The Art of Quality Investing

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Pieter Slegers discuss: How to Use Reverse DCF and EPS Growth Models in Quality Investing Adapting Your Investment Strategy: Evolving with Market Changes Cybernetics as a Mental Model: Understanding Systems and Control Mechanisms The Power … Read More

McDonald’s Corp (MCD) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, McDonald’s Corp (MCD). Profile McDonald’s is the largest restaurant … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (08/02/2024)

This week’s best investing news: Ray Dalio & Deepak Chopra on Life and Death (RD) Mohnish Pabrai’s Session with CFA Society, United Kingdom (MP) Warren Buffett’s Berkshire Hathaway sells Bank of America for a ninth straight day (CNBC) GMO – Concentrate!: Is it like 2000 again? (GMO) Terry Smith – Our … Read More

HCA Healthcare (HCA): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: HCA Healthcare Inc (HCA) HCA Healthcare is a Nashville-based healthcare provider … Read More

Unlocking Investment Intuition: Lessons from Chicken Sexing

During their recent episode, Taylor, Carlisle, and Adam Mead discussed Unlocking Investment Intuition: Lessons from Chicken Sexing, here’s an excerpt from the episode: Tobias: JT has got closer to the router, so he’s going to have another go. JT. Adam: I’m dying to know. [Tobias laughs] We want to know … Read More

Warren Buffett: The One Reason to Retain Earnings and Not Distribute to Shareholders

In his 1984 Berkshire Hathaway Annual Letter, Warren Buffett argues that companies should only retain unrestricted earnings if there is a reasonable prospect that retaining the earnings will create at least an equivalent amount of market value for shareholders. He acknowledges that managers often prefer to retain earnings for reasons … Read More

Mohnish Pabrai: Avoid Investment Pitfalls: Create An Aviation Safety Style Checklist

In this session with the CFA in the U.K, Mohnish Pabrai discusses the importance of learning from investment mistakes, both personal and those of renowned investors like Warren Buffett and Charlie Munger. He highlights the inevitability of errors in predicting the future and the value of studying past mistakes to … Read More

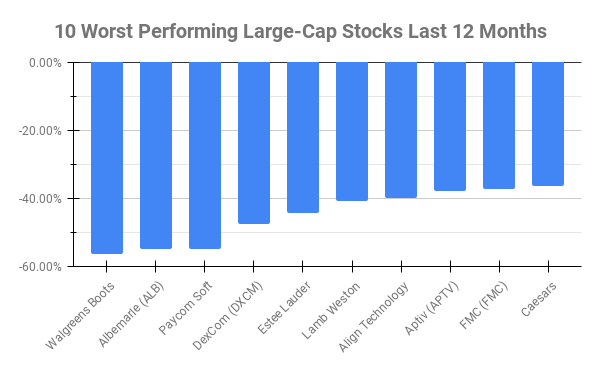

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -56.44% Albemarle (ALB) -55.01% Paycom Soft (PAYC) -54.98% DexCom (DXCM) -47.65% Estee Lauder Companies (EL) … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More