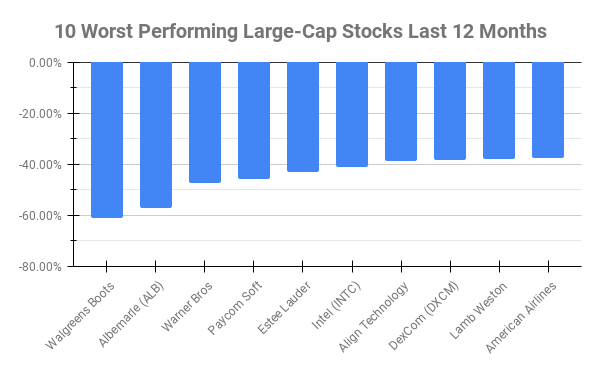

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -61.01% Albemarle (ALB) -57.27% Warner Bros Discovery (WBD) -47.20% Paycom Soft (PAYC) -45.89% Estee Lauder … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Michael Mauboussin: Modern Value Investing Strategies: Buying Low Expectations

During his recent interview on the Meb Faber Podcast, Michael Mauboussin discusses modern value investing, emphasizing the importance of buying assets for less than their intrinsic value while considering the expectations priced into stocks. He stresses flexibility in identifying opportunities and the challenge for value investors in recognizing unexpected growth. … Read More

Bruce Berkowitz: Avoid Deals with Bad People, Even in Promising Investments

During his recent interview on The Business Brew Podcast, Bruce Berkowitz emphasizes the importance of evaluating both the numbers and the people involved in an investment. Initially, he focused on the financials but later recognized the significance of assessing the management, culture, and ownership of a business. He stresses that … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

John Rogers: A Market Correction Is Coming Soon

During the recent Barron’s Roundtable, John Rogers expressed his concern that the current technology-driven market rally, led by AI companies, may be nearing its peak, drawing parallels to the dot-com era. He acknowledges that while today’s market leaders have solid businesses, they are highly overvalued. The gap between large-cap growth … Read More

Mohnish Pabrai: From $5,000 to $5 Million: A Simple Lesson for Exponential Financial Growth

During this session with YPO Delhi, Mohnish Pabrai explains the concept of compounding to his daughter during a late-night drive. He uses her summer internship savings of $5,000 as an example, explaining how investing it in an IRA with a 15% annual return could grow to $5 million by the … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Howard Marks: Here’s Why I Don’t Invest In AI Companies

During this interview with Yicai Global, Howard Marks emphasizes his expertise in debt over stocks and admits he is not a technology expert. He recalls the Internet bubble, noting that while the Internet did change the world, most tech stocks from that era became worthless. He draws a parallel with … Read More

Jeremy Grantham: This Is The Most Vulnerable Market There Has Ever Been!

During his recent interview with The Investor’s Podcast, Jeremy Grantham discusses the dangers of market bubbles, highlighting Japan’s 1989 bubble where the market traded at 65 times earnings, far beyond its historical norm. He emphasizes that high price-to-earnings (P/E) ratios often predict severe downturns rather than prosperity, citing Japan’s lost … Read More

Dan Loeb – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

American Express Co (AXP) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, American Express Co (AXP). Profile American Express is a … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (08/09/2024)

This week’s best investing news: Jeremy Grantham – A History of Stock Market Bubbles (TIP) Howard Marks: Yicai (2024) (OakTree) Berkshire Hathaway Q2 2024 Report (BH) Bill Ackman’s Pershing Square sees 2024 gains nearly wiped out after July loss (Fortune) Why Warren Buffett’s Berkshire Dumped 55.8% Of Its Apple Stock … Read More

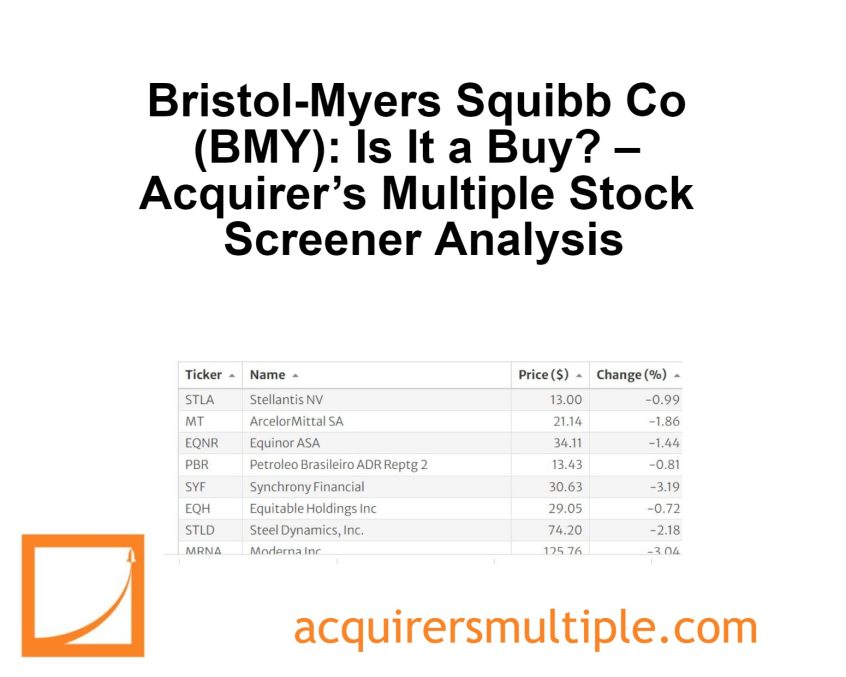

Bristol-Myers Squibb Co (BMY): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Bristol-Myers Squibb Co (BMY) Bristol-Myers Squibb discovers, develops, and markets drugs … Read More

The Power of ‘I Don’t Know’: A Logical Riddle to Test Your Reasoning Skills

During their recent episode, Taylor, Carlisle, and Pieter Slegers discussed The Power of ‘I Don’t Know’: A Logical Riddle to Test Your Reasoning Skills, here’s an excerpt from the episode: Tobias: That was good stuff. This is a little bit of a nonsequitur, but I saw a little riddle the … Read More

Terry Smith: The Marathon Approach to Investing

In his book – Investing for Growth, Terry Smith says investing is like a marathon, requiring long-term commitment rather than short-term strategies. He compares investing to using 400-meter sprinters instead of a steady marathon runner. Constantly changing fund managers or stocks is risky, akin to frequently passing a baton, which … Read More

Warren Buffett: Prioritize Sensible Management Over Great Businesses

During the 2001 Berkshire Hathaway Annual Meeting, Warren Buffett advises that if you’re invested in a good business but the management is making poor decisions, it’s often better to sell and invest elsewhere with a sensible management team. Persuading management to change their minds is challenging and rarely successful. CEOs … Read More

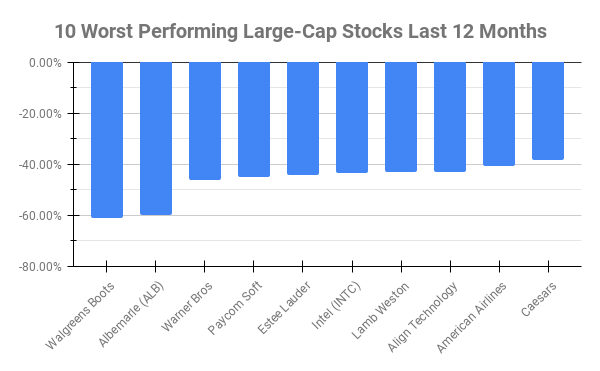

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -60.99% Albemarle (ALB) -59.79% Warner Bros Discovery (WBD) -46.27% Paycom Soft (PAYC) -44.98% Estee Lauder … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Cybernetics as a Mental Model: Understanding Systems and Control Mechanisms

During their recent episode, Taylor, Carlisle, and Pieter Slegers discussed Cybernetics as a Mental Model: Understanding Systems and Control Mechanisms, here’s an excerpt from the episode: Tobias: We’re at the top of the hour, JT. You want to give us some vegetables? Jake: Yes, if you’re hungry for some vegetables. … Read More