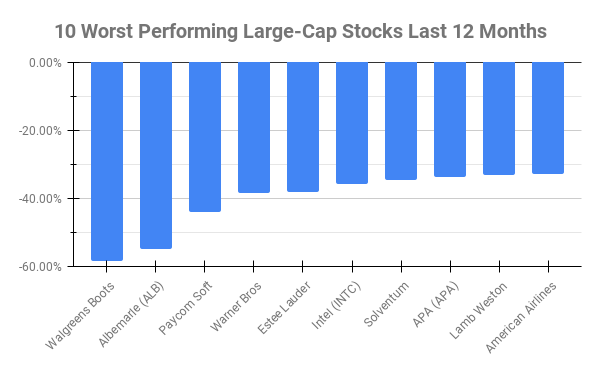

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -58.42% Albemarle (ALB) -55.09% Paycom Soft (PAYC) -43.94% Warner Bros Discovery (WBD) -38.48% Estee Lauder … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

The Power of Insider Buys: Spotting Strong Signals from Key Executives

During their recent episode, Taylor, Carlisle, and Asif Suria discussed The Power of Insider Buys: Spotting Strong Signals from Key Executives, here’s an excerpt from the episode: Tobias: Talk to us a little bit about insider buys, insider sells. What’s the signal there is a buy from one person? Is … Read More

Ray Dalio: Investors Need To Learn The ‘Math’ Of Investing

In the book Hedge Fund Market Wizards: How Winning Traders Win, there’s an interview with Ray Dalio in which he describes how trading offers continual tactile learning experiences, particularly from painful surprises. One vivid memory is his experience trading pork bellies in the 1970s when the market plummeted daily, causing … Read More

Bill Ackman: How Index Funds Create Opportunities for Long-Term Investors

In his Pershing Square 2024 Interim Report, Bill Ackman highlights the increasing dominance of index funds, which act as permanent owners, in stock market capitalization. This shift amplifies the influence of short-term, highly leveraged investors, such as market-neutral and quantitative funds, on price discovery. These investors often use margin, derivatives, … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Corporate Spinoffs: Should You Invest in RemainCo or BadCo?

During their recent episode, Taylor, Carlisle, and Asif Suria discussed Corporate Spinoffs: Should You Invest in RemainCo or BadCo?, here’s an excerpt from the episode: Tobias: Tyler Pharris is our unofficial producers. He’s got a good question for you. “When a company is spinning out a BadCo does that tend … Read More

Warren Buffett: The Hidden Benefits of Falling Stock Prices

In his 1997 Berkshire Hathaway Annual Letter, Warren Buffett advises that if you are a net saver, you should prefer lower stock prices, as this benefits future investments. Many investors mistakenly rejoice at rising stock prices, even though they will be net buyers of stocks, which makes no sense. For … Read More

Guy Spier: Why It’s Risky Not To Take Risks

During his recent episode with The Investor’s Podcast, Guy Spier reflects on taking risks, particularly for young people in their twenties. He believes that this is the ideal time to take career and financial risks since there is ample time to recover from potential failures. He advises embracing opportunities like … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Mastering Event-Driven Investing

During their recent episode, Taylor, Carlisle, and Asif Suria discussed Mastering Event-Driven Investing, here’s an excerpt from the episode: Asif: Yes. Event driven investing or special situations investing is about acting on maybe a corporate action. It could be one company acquiring another one, like Microsoft acquired Activision Blizzard. And … Read More

Joel Greenblatt: Statistical Investing – The Effortless Market-Beating Strategy

In his book – You Can Be A Stock Market Genius, Joel Greenblatt discusses an investment approach where you can diversify your portfolio with stocks that trade at low prices relative to their book value and cash flow, while occasionally incorporating special-situation investments. He suggests that for investors who lack … Read More

Howard Marks: The Easy-Money Period Is Over!

At the opening of the Oaktree Conference 2024, Howard Marks argued that the economic environment is shifting from an unusually easy period for business, finance, and investing to one of increased normalcy. As a result, economic growth may slow, profit margins could shrink, and investor optimism may decline. Borrowing costs … Read More

Jeremy Grantham – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E28): Asif Suria on The Event-Driven Edge in Investing and Special Situations

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Asif Suria discuss: Mastering Event-Driven Investing Corporate Spinoffs: Should You Invest in RemainCo or BadCo? Lessons from Shinsei: Duration Over Short-Term Returns The Power of Insider Buys: Spotting Strong Signals from Key Executives The Effect … Read More

Nike Inc (NKE) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Nike Inc (NKE). Profile Nike is the largest athletic … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (08/16/2024)

This week’s best investing news: Navigating the Sea Change with Howard Marks (Oaktree Conference 2024) Mohnish Pabrai’s Session with YPO Delhi (MP) Bill Nygren – Where to find value in the market (CNBC) Berkshire Hathaway’s Parabolically-Growing Cash Pile (Felder) On the Brink? (Verdad) Guy Spier – “Most Investors Make This … Read More

AT&T Inc (T): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: AT&T Inc (T) The wireless business contributes nearly 70% of AT&T’s … Read More

Warren Buffett: Pinpointing Secure Investment Opportunities

During the 1997 Berkshire Hathaway Annual Meeting, Warren Buffett discusses using filters to identify businesses where future value can be reasonably estimated. Buffett advocates discounting future returns using risk-free government bond rates, focusing on the business’s future earnings rather than potential resale value. The goal is to ensure that investors … Read More

Jeremy Grantham: Most Of The Market Decline Will Occur After The First Interest Rate Cut

During his recent interview on The Investor’s Podcast, Jeremy Grantham discussed how rising debt has failed to stimulate the U.S. economy, pointing out that the debt-to-GDP ratio tripled after 1987, yet economic growth slowed. He argues that despite expectations, increased debt hasn’t enhanced growth and questions the excitement over low-interest … Read More