As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Guy Spier: The Power of Honesty in Investing

During their recent episode, Taylor, Carlisle, and Guy Spier discussed The Power of Honesty in Investing. Here’s an excerpt from the episode: Tobias: You did. I think that you raised that in your most recent letter, where you said that you were interested in balance more than compounding as rapidly … Read More

How The Analyst Rating Index Captures Market Improvers

During their recent episode, Taylor, Carlisle, and Steve Hou discussed How The Analyst Rating Index Captures Market Improvers. Here’s an excerpt from the episode: Steve: So, yeah, thank you. That’s another paper that I put out recently, actually, just a few weeks ago. This is a concept we came up … Read More

Terry Smith: The Key to Identifying Investments with Sustainable High Returns

In the Fundsmith Owner’s Manual, Terry Smith discusses the importance of not just seeking a high rate of return but a sustainably high one. Key to this is repeat business, particularly from consumers who make frequent, regular purchases. Companies selling daily consumer goods tend to provide more consistent returns compared … Read More

Warren Buffett: Why Portfolio Concentration Decreases Risk

In his 1993 Berkshire Hathaway Annual Letter, Warren Buffett explains that he and Charlie Munger decided long ago to focus on making a few smart investment decisions rather than many, especially as Berkshire Hathaway’s capital grew. They adopted a concentrated portfolio strategy, rejecting standard diversification advice. They believe that concentrating … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Guy Spier: Why Warren Buffett’s $1 Trillion Success Wasn’t Just About the Money

During their recent episode, Taylor, Carlisle, and Guy Spier discussed Why Warren Buffett’s $1 Trillion Success Wasn’t Just About the Money. Here’s an excerpt from the episode: Tobias: I’m glad to hear that. I wanted to open this by saying that Berkshire Hathaway today has crossed $1 trillion- Jake: Wow. … Read More

How The Pricing Power Index Identifies Market Leaders

During their recent episode, Taylor, Carlisle, and Steve Hou discussed How The Pricing Power Index Identifies Market Leaders. Here’s an excerpt from the episode: Tobias: You’re at Bloomberg Indices. What do you do at Bloomberg Indices, and what is Bloomberg Indices as opposed to the Bloomberg TV or the monitors … Read More

Howard Marks: Every Investor Needs To Choose Between Optimizing and Maximizing

During his recent Behind The Memo Podcast with Morgan Housel, Howard Marks discusses his philosophy on investing, emphasizing prudence, risk management, and the importance of long-term survival over short-term gains. Marks advocates for an optimizing approach, where investors carefully manage their risks to ensure they can weather the bad days, … Read More

Cliff Asness: The 3 Reasons Markets Have Become Less Efficient

In his latest paper titled – The Less-Efficient Market Hypothesis, Cliff Asness explains why he believes markets have become less efficient over the past 34 years due to technology, gamified trading, and social media. This inefficiency raises the stakes for rational active investing, with bigger and longer-lasting market swings. Investors … Read More

Howard Marks – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E31): Investor and Author Guy Spier On His Investment and Life Philosophies

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Guy Spier discuss: Why Warren Buffett’s $1 Trillion Success Wasn’t Just About the Money The Power of Honesty in Investing Why Investing Is an Infinite Game: Lessons from Warren Buffett How the Lollapalooza Effect Drives … Read More

VALUE: After Hours (S06 E30): Bloomberg’s Steve Hou on pricing power and analyst ratings turnarounds

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Steve Hou discuss: How The Pricing Power Index Identifies Market Leaders How The Analyst Rating Index Captures Market Improvers Bruce Lee’s Guide to Investing: Fluid Strategies and Relentless Focus The Crash Landing into a Marshmallow: … Read More

Costco Wholesale Corp (COST) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Costco Wholesale Corp (COST). Profile Costco operates a membership-based, … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (08/30/2024)

This week’s best investing news: Howard Marks Memo: Mr. Market Miscalculates (OakTree) Guy Spier – On his investment and life philosophies (VAH) Ray Dalio Creating An AI Version of Himself (X) Four Warren Buffett Holdings That Also Pass His Quantitative Tests (Validea) Cliff Asness – Volatility Laundering in PE, Diversification, … Read More

The Home Depot Inc (HD): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: The Home Depot Inc (HD) Home Depot is the world’s largest … Read More

Georgism vs. The IRS: How Land Value Tax Could Replace Federal Taxes

During their recent episode, Taylor, Carlisle, and Asif Suria discussed Georgism vs. The IRS: How Land Value Tax Could Replace Federal Taxes, here’s an excerpt from the episode: Tobias: JT is going to do his vegetables. But when we come back, for the podcast there, lots of people asking about … Read More

Howard Marks: Investing Success Lies in Doing the Opposite of the Crowd

In his book – The Most Important Thing, Howard Marks explains that markets fluctuate between extremes, driven by the behavior of the crowd. Bull markets occur when more people are motivated to buy than sell, pushing prices higher. These extremes, however, signal inflection points where bullishness or bearishness reaches its … Read More

Warren Buffett: Don’t Wait for a Price Drop to Buy a Great Company

During the 1996 Berkshire Hathaway Annual Meeting, Warren Buffett discussed the value of investing in truly great companies that will remain strong for decades. He advises against trying to time the market or waiting for a financial crisis to buy stocks at a discount, as great companies are rare and … Read More

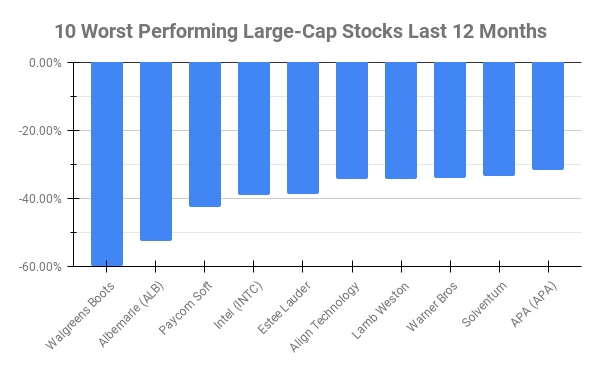

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -59.84% Albemarle (ALB) -52.47% Paycom Soft (PAYC) -42.59% Intel (INTC) -39.09% Estee Lauder Companies (EL) … Read More