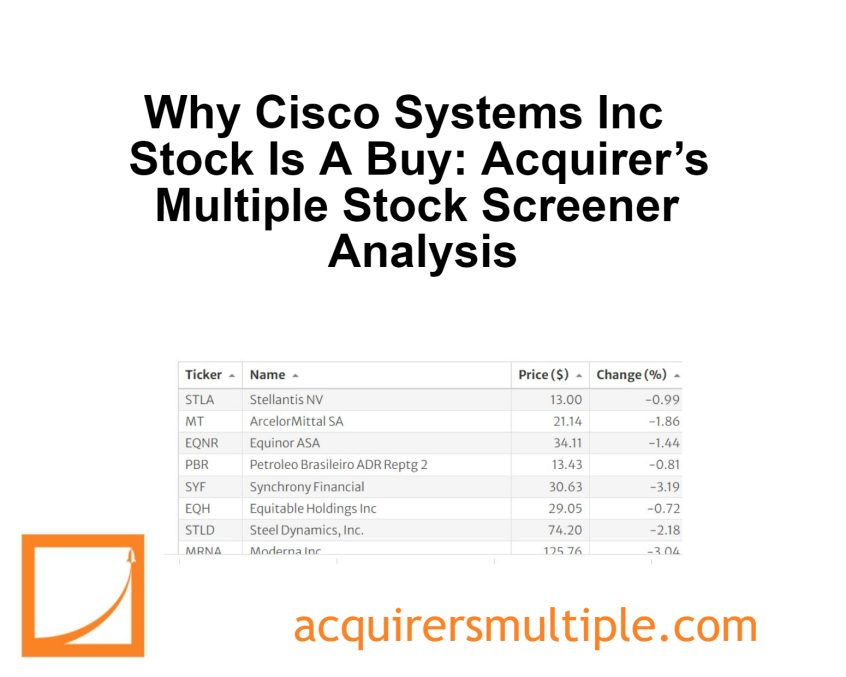

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Cisco Systems Inc (CSCO) Cisco Systems is the largest provider of … Read More

First-Gen Riches, Third-Gen Bust? Investing in Google’s Future

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and Brewster discussed First-Gen Riches, Third-Gen Bust? Investing in Google’s Future. Here’s an excerpt from the episode: Tobias: All right, here’s a good question riffing on Buffett’s chat. “What do you guys think are some of the few … Read More

Howard Marks: Memos: Most Investors Will Not Implement My Investing Secrets

In this interview with David Perrel, Howard Marks explains that while he gives away a lot of investing secrets in his memos, most investors still won’t be able to successfully implement them. He also discussed what it is that he likes about Warren Buffett’s annual shareholder letters. Here’s an excerpt … Read More

Jim Chanos: FOMO or Fundamentals: Bull vs. Bear Traps & How to Avoid Them

In this interview with CNBC, James Chanos explains that regardless of the economic cycle, people’s susceptibility to believing narratives over facts increases the longer the cycle stretches. This leads to poor financial decisions in both bull and bear markets. In bull markets, greed takes over, and people chase “too good … Read More

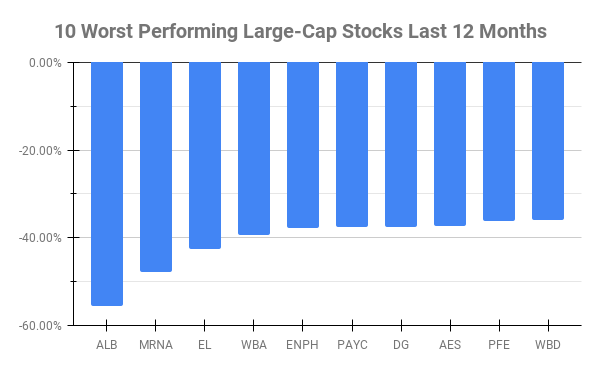

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) ALB Albemarle Corp -55.50% MRNA Moderna Inc -47.77% … Read More

Diversification Explained: The Farmers Fable and the Math Behind Risk & Reward

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and Brewster discussed Diversification Explained: The Farmers Fable and the Math Behind Risk & Reward. Here’s an excerpt from the episode: Jake: Oh, it’s the worst. [chuckles] Shall we do some vegetables? Tobias: Let’s do some veggies. It’s … Read More

Warren Buffett: Berkshire’s 4 Time-Tested Strategies for Success

In his 2008 Berkshire Hathaway Shareholder Letter, Warren Buffett explains that while the stock market has been positive in 75% of the past 44 years, it is impossible to predict future performance. Instead, he focuses on four goals for Berkshire Hathaway to ensure its success. Here’s an excerpt from the … Read More

Bill Ackman: Invest with Peace of Mind: Strategies for Emotional Resilience

In this interview with Lex Fridman, Bill Ackman explains that knowledge and confidence in investing take time. Accept that volatility is natural and learn to develop a “calloused” approach to market fluctuations. He also recommends building an emergency fund and avoiding debt so market volatility doesn’t impact your well-being. This … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Higher Rates & Value Investing: Examining the Complex Relationship

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and Brewster discussed Higher Rates & Value Investing: Examining the Complex Relationship. Here’s an excerpt from the episode: Bill: Yeah. I don’t know, like Green Brick has worked great and the stock has worked as the business has … Read More

Michael Mauboussin: Trusting Your Hunches: Beware the Hidden Traps of Pattern Recognition

In this interview with Capital Allocators, Michael Mauboussin explains that while pattern recognition is natural, it’s crucial to be aware of our biases and apply it cautiously to avoid making decisions based solely on subjective impressions. Here’s an excerpt from the interview: Mauboussin: I think this is very common that’s why I … Read More

Terry Smith: Long-Term Investing vs. Chasing Hot Sectors: A Data-Driven Comparison

During this interview with Killik & Co, Terry Smith discusses the difficulty of being able to consistently time the market based on short-term trends, highlighting the challenge of predicting which sectors will perform well in the future. Here’s an excerpt from the interview: Smith: I guess my take on them … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Einhorn vs. Passive Investing: Is the Market Broken or Just Evolving?

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and Brewster discussed Einhorn vs. Passive Investing: Is the Market Broken or Just Evolving?. Here’s an excerpt from the episode: Tobias: Einhorn is Finkel. Did you guys listen to Einhorn–? Bill: Yeah, I listened to Einhorn. Tobias: Einhorn … Read More

Mohnish Pabrai: Japanese Bets: How Buffett’s Genius Has Yielded Infinite Returns

During this discussion, Mohnish Pabrai explains how Warren Buffett’s Japanese bets have yielded infinite returns based on the way he structured the deal. Buffett didn’t use any of his own capital for this investment. Instead he borrowed yen at a low interest rate in Japan, and over time, the subsequent … Read More

Bruce Berkowitz: The FOMO Fallacy: Making Rational Decisions in a Hyped Market

In this interview with Richer, Wiser, Happier, Bruce Berkowitz explains how rampant market fervor, driven by envy and selective information, can be detrimental to rational investment decisions and mental well-being. He discusses how he found himself overwhelmed by the pressure and negativity associated with hype. He resorted to avoiding social … Read More

VALUE: After Hours (S06 E06): 200th Episode, Bill’s Back, Value on Macro, Value and ZIRP, Farmer’s Fable

In their latest episode of the VALUE: After Hours Podcast Jake Taylor, Tobias Carlisle, and Bill Brewster discuss: Einhorn vs. Passive Investing: Is the Market Broken or Just Evolving? Higher Rates & Value Investing: Examining the Complex Relationship Diversification Explained: The Farmers Fable and the Math Behind Risk & Reward … Read More

Cliff Asness – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Procter & Gamble Co (PG) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is currently in our screens, Procter & Gamble Co (PG). Profile Since its founding in … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (16/02/2024)

This week’s best investing news: MiB: David Einhorn, Greenlight Capital (MiB) Mohnish Pabrai’s Interview at Morningstar (MP) Cliff Asness – Why Not 100% Equities (AQR) Yield Is Not Return (Verdad) Bill Ackman’s War on Harvard, MIT, DEI, and Everyone Else (NYMag) Michael Burry Covers Bet Against Chips ETF, Buys Health … Read More