In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Aaron Edelheit discuss: Cannabis: From a Schedule 1 Drug to Reducing Alcoholism and Workplace Injuries Why Canadian Cannabis Stocks are the Real Play for U.S. Investors The Political and Economic Implications of Cannabis Rescheduling Georgism … Read More

Tesla Inc (TSLA) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Tesla Inc (TSLA). Profile Tesla is a vertically integrated … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (08/23/2024)

This week’s best investing news: David Einhorn – Greenlight Capital Q2 2024 Letter (Greenlight) Activism at Scale in Japan (Verdad) Oakmark – International equities: Avoiding value traps (Oakmark) Guy Spier Track Record | Investing Risk | VALUEx (TIP) Five Fundamentally Sound Dividend Aristocrats (Validea) Howard Marks Memo – Mr. Market Miscalculates … Read More

Colgate-Palmolive Co (CL): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Colgate-Palmolive Co (CL) Since its founding in 1806, Colgate-Palmolive has grown … Read More

Lessons from Shinsei: Duration Over Short-Term Returns

During their recent episode, Taylor, Carlisle, and Asif Suria discussed Lessons from Shinsei: Duration Over Short-Term Returns, here’s an excerpt from the episode: Tobias: Good one. JT, top of the hour. Give the people what they want. Vegetable time. Jake: Well, I’m not sure about– Tobias: Give the people what … Read More

Aswath Damodaran: Corporate Life Cycles: How Companies Age Like Humans

In his recent interview with At The Money, Aswath Damodaran compares the aging process of people to that of companies, noting both benefits and limitations. Aging brings financial security and fewer responsibilities, but also physical constraints. Similarly, businesses evolve through stages like human beings—from needy startups to reckless “corporate teenagers” … Read More

Warren Buffett: The Best Investment Strategy When Opportunities Are Scarce

In his 2003 Berkshire Hathaway Annual Letter, Warren Buffett discusses his concerns about the U.S. economy and Berkshire Hathaway’s strategy to hedge its significant cash-equivalents position with foreign-exchange contracts. These contracts are subject to accounting rules that require any changes in value to be recorded quarterly, even if they haven’t … Read More

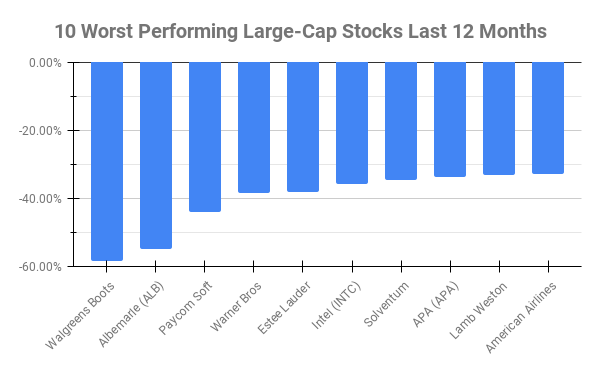

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -58.42% Albemarle (ALB) -55.09% Paycom Soft (PAYC) -43.94% Warner Bros Discovery (WBD) -38.48% Estee Lauder … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

The Power of Insider Buys: Spotting Strong Signals from Key Executives

During their recent episode, Taylor, Carlisle, and Asif Suria discussed The Power of Insider Buys: Spotting Strong Signals from Key Executives, here’s an excerpt from the episode: Tobias: Talk to us a little bit about insider buys, insider sells. What’s the signal there is a buy from one person? Is … Read More

Ray Dalio: Investors Need To Learn The ‘Math’ Of Investing

In the book Hedge Fund Market Wizards: How Winning Traders Win, there’s an interview with Ray Dalio in which he describes how trading offers continual tactile learning experiences, particularly from painful surprises. One vivid memory is his experience trading pork bellies in the 1970s when the market plummeted daily, causing … Read More

Bill Ackman: How Index Funds Create Opportunities for Long-Term Investors

In his Pershing Square 2024 Interim Report, Bill Ackman highlights the increasing dominance of index funds, which act as permanent owners, in stock market capitalization. This shift amplifies the influence of short-term, highly leveraged investors, such as market-neutral and quantitative funds, on price discovery. These investors often use margin, derivatives, … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Corporate Spinoffs: Should You Invest in RemainCo or BadCo?

During their recent episode, Taylor, Carlisle, and Asif Suria discussed Corporate Spinoffs: Should You Invest in RemainCo or BadCo?, here’s an excerpt from the episode: Tobias: Tyler Pharris is our unofficial producers. He’s got a good question for you. “When a company is spinning out a BadCo does that tend … Read More

Warren Buffett: The Hidden Benefits of Falling Stock Prices

In his 1997 Berkshire Hathaway Annual Letter, Warren Buffett advises that if you are a net saver, you should prefer lower stock prices, as this benefits future investments. Many investors mistakenly rejoice at rising stock prices, even though they will be net buyers of stocks, which makes no sense. For … Read More

Guy Spier: Why It’s Risky Not To Take Risks

During his recent episode with The Investor’s Podcast, Guy Spier reflects on taking risks, particularly for young people in their twenties. He believes that this is the ideal time to take career and financial risks since there is ample time to recover from potential failures. He advises embracing opportunities like … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Mastering Event-Driven Investing

During their recent episode, Taylor, Carlisle, and Asif Suria discussed Mastering Event-Driven Investing, here’s an excerpt from the episode: Asif: Yes. Event driven investing or special situations investing is about acting on maybe a corporate action. It could be one company acquiring another one, like Microsoft acquired Activision Blizzard. And … Read More

Joel Greenblatt: Statistical Investing – The Effortless Market-Beating Strategy

In his book – You Can Be A Stock Market Genius, Joel Greenblatt discusses an investment approach where you can diversify your portfolio with stocks that trade at low prices relative to their book value and cash flow, while occasionally incorporating special-situation investments. He suggests that for investors who lack … Read More

Howard Marks: The Easy-Money Period Is Over!

At the opening of the Oaktree Conference 2024, Howard Marks argued that the economic environment is shifting from an unusually easy period for business, finance, and investing to one of increased normalcy. As a result, economic growth may slow, profit margins could shrink, and investor optimism may decline. Borrowing costs … Read More