This week’s best investing news:

The Genius of Stan Druckenmiller: Lessons for Investors (MOI)

Mohnish Pabrai’s Q&A session with Dakshana Scholars at Dakshana Valley (MP)

GMO – Don’t Blame The Middleman (GMO)

Verdad News Roundup (Verdad)

Cliff Asness – Rebuffed: A Closer Look at Options-Based Strategies (AQR)

Pzena Investment Management Podcast: The Value Stocks to Watch – 2025 (Pzena)

75% of Investors Will Disagree with These Ideas: Evidence Says They are True (Validea)

The Last Decision by the World’s Leading Thinker on Decisions (Jason Zweig)

The Danger Of Betting Big On Big Tech Today (Felder)

Improving Earnings Do Not Mean a Rising Stock Price is ‘Justified’ (BI)

The Four Pillars of Rationality (According to Charlie Munger) (Kingswell)

MiB: Jim O’Shaughnessy on Infinite Wisdom (MiB)

I’m concerned about the stock market. How concerned are you? (Humble Dollar)

The Stock Market is Always Changing (Ben Carlson)

Index Three Ways (Humble Dollar)

How to Approach Liquid Alternatives in Your Portfolio in 2025 (Morningstar)

Investors Who Were All In on U.S. Stocks Are Starting to Look Elsewhere (WSJ)

The unluckiest market timer I know made another poorly timed trade (TKer)

Best Investments to Own During a Recession (Morningstar)

Giverny Capital 2024 Annual Letter (Giverny)

March Views from First Eagle Global Value Team (FEIM)

How High is Too High? Taking Stock of Index Concentration in U.S. Large Cap Growth (Polen)

This week’s best value investing news:

Exceptionalism in the Land of the Rising Stocks (Bloomberg)

The Outlook for Value Investing (Barron’s)

Rob Arnott on Market Inefficiencies and Investing Opportunities (Morningstar)

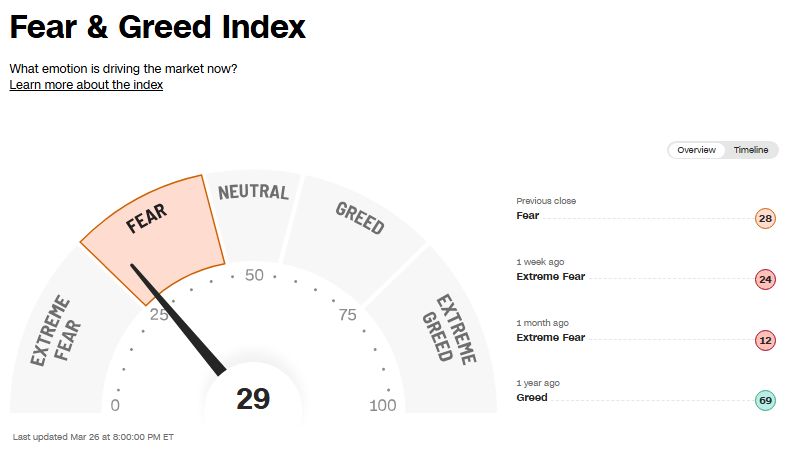

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Ep 464. Buffett’s Playbook: Past and Present (FC)

Barry Ritholtz — Make Fewer Errors, Make More Money (IL)

Gili Raanan – Cybersecurity Investment Playbook (ILTB)

Evan Tindell Returns: Navigating Investment Challenges & Opportunities in 2025 (BB)

#220 Outliers: James Dyson — Against the Odds (Knowledge Project)

Why Every Investor Must Understand Capital Cycle Theory (MOI)

Heading to Recession Island | Will the Trump and Powell Puts Help Us Reverse Course? (ER)

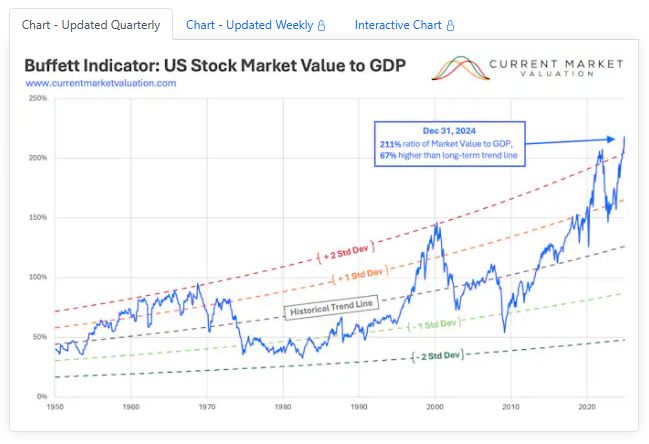

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Understanding Financial Inclusion in the United States (AlphaArchitect)

Quality of Earnings: A Critical Lens for Financial Analysts (CFA)

As Private Capital Builds Growing Retail Investor Base, ETFs Make Sense (AllAboutAlpha)

This week’s best investing tweet:

McKinsey PE report out. PE has underperformed SPY for 1-year, 3-year, and 5-year horizons… pic.twitter.com/F0KxP7sIsZ

— Dan Rasmussen (@verdadcap) March 26, 2025

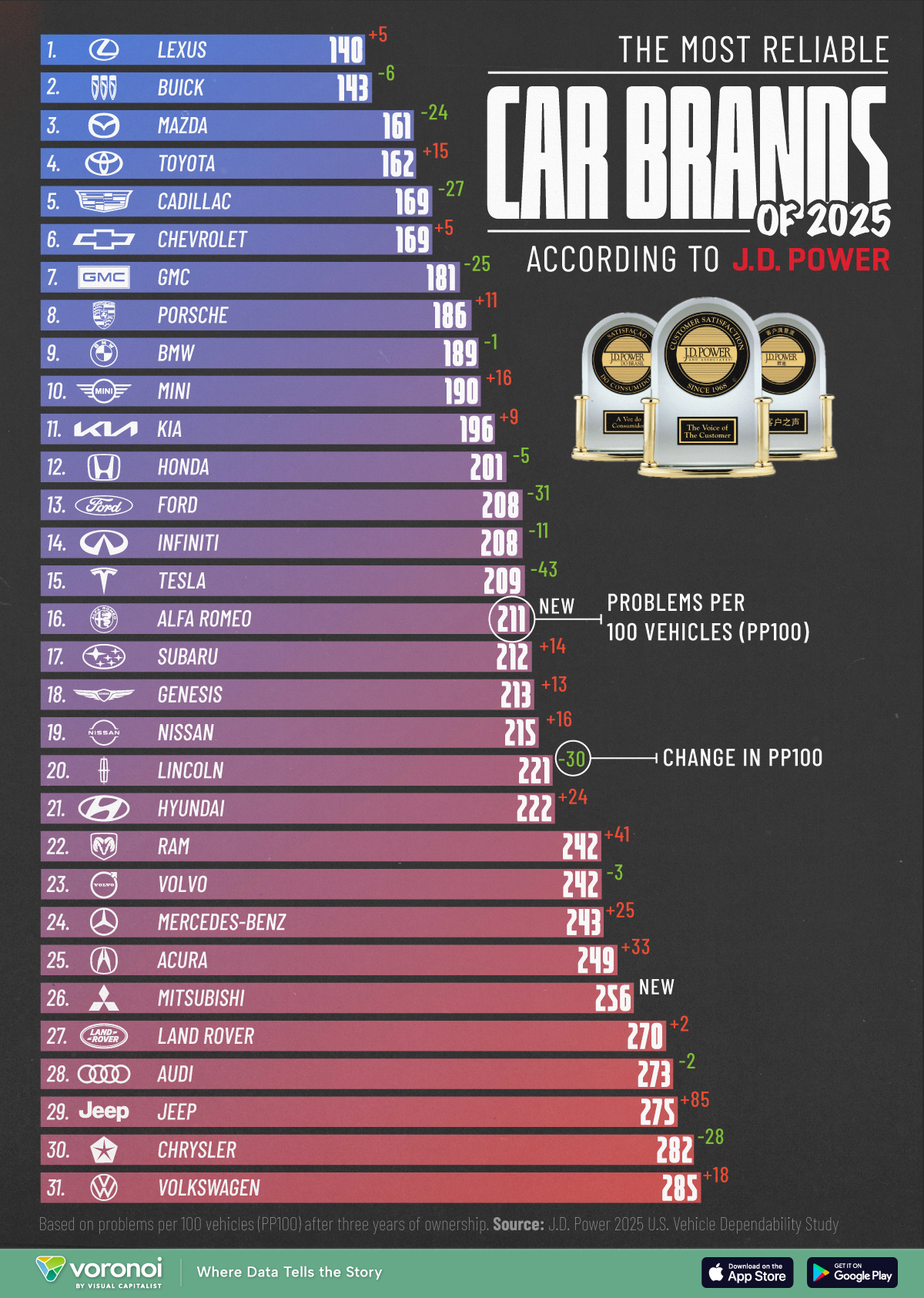

This week’s best investing graphic:

Ranked: The Most Reliable Car Brands in 2025 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: