This week’s best investing news:

Howard Marks – Unlocking Investment Wisdom (Money Maze)

Ray Dalio: The U.S. government’s debt problem will lead to ‘shocking developments’ (CNBC)

Bill Nygren – A Modern Approach to Value Investing (FinChat)

GMO: Trade: The Most Beautiful Word In The Dictionary (GMO)

The Last Lecture of Benjamin Graham (Kingswell)

Has Private Credit Broken the High-Yield Spread Signal? (Verdad)

The Wisdom of Bill Gurley (East Wind)

“It Has Never Been Not Hard” (TSOH)

As Good As It Gets (Felder)

Warren Buffett’s 25 biggest mistakes – and 4 lessons they teach (Chris Leithner)

Charlie Munger’s Timeless Advice for Surviving Market Crashes (CMQ)

More proof that predicting short-term stock market moves is almost impossibly hard (TKer)

Aswath Damodaran – Session 13: Loose Ends in Valuation (AD)

Déjà Vu All Over Again (Havenstein)

Is International Diversification Finally Working? (Ben Carlson)

European (fund flow) Exceptionalism (FT)

Are Stocks a Sure Thing Over the Long Term? Not Necessarily (WJS)

Never Root for a Recession (Dollars Data)

You Can’t Escape Politics. Your Investing Decisions Can (WSJ)

Visualizing every day of the US stock market for the last 10 years (Sherwood)

MiB: Philipp Carlsson-Szlezak, Global Chief Economist for BCG (MiB)

March Views from First Eagle Global Value Team (FEIM)

RV Capital’s 2024 Letter to Co-Investors (RV)

On Stock-Picking in Volatile Environments (AB)

Polen Capital Management: Can Diversification and Concentration Coexist? (Polen)

This week’s best value investing news:

Seven Great Investors Break Down the Struggles of Value Investing (Validea)

Why is 2025 a ‘great year’ for value investing? (Fox)

Are value stocks finally taking the baton from growth? (Investment News)

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Great Stocks Evolve But Most Investors Don’t (MicroCapClub)

#218 Outliers: Estée Lauder — A Success Story (KP)

Kelly Granat – Investing At Lone Pine (ILTB)

Q&A Series: Diversification and Position Sizing in Investing – Ep 248 (Intellectual Investor)

Basis Points: We’re entering a stock pickers market with Eric Marais (Equity Mates)

The Value Perspective with David Marcus (Value Perspective)

Adam Rossi: Investing In The Age of DOGE (Value Hive)

Jacqueline Faber: A Journey into Dark Academia (Meb Faber)

Money Delusions: Barry Ritholtz on the Elusive Definition of Money and How Not to Invest It (Excess Returns)

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

How Bond ETFs Make Trading Easier and Cheaper (AlphaArchitect)

6 Reasons to Avoid Hedge Funds (CFA)

The ascent of Total Portfolio Approach (DSGMV)

This week’s best investing tweet:

The reason why large caps have been smashing mid and small. Earnings. pic.twitter.com/bpr6Bo0RQB

— Tobias Carlisle (@Greenbackd) March 12, 2025

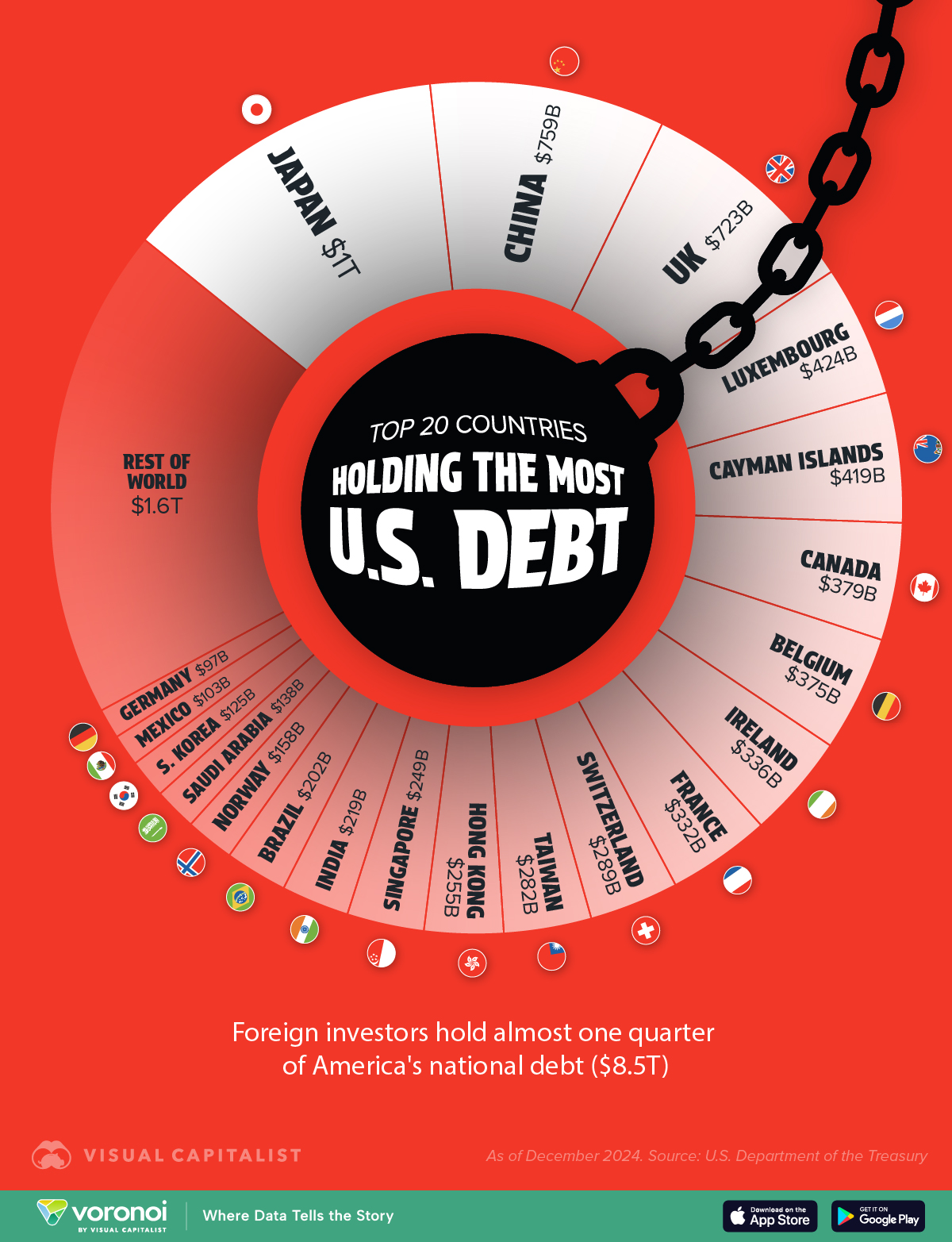

This week’s best investing graphic:

Ranked: The Top 20 Countries Holding the Most U.S. Debt (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: