This week’s best investing news:

Howard Marks Memo: On Bubble Watch (OakTree)

Terry Smith – Fundsmith 2024 Annual Letter (Fundsmith)

Cliff Asness – 2035: An Allocator Looks Back Over the Last 10 Years (AQR)

Bill Ackman Chases 1,200% Profit on a Trump Trade (Bloomberg)

Bill Nygren – Why the odds may favor value stocks (Oakmark)

The Accuracy and Importance of Growth Guidance (Verdad)

Heresies for Lab Rats (Havenstein)

International Stock Market Returns (Novel)

Remembrance of Things Future (Jason Zweig)

A Quarter Century of Investing (Rational Walk)

Updating My Favorite Performance Chart For 2024 (Ben Carlson)

The US stock market has never been more concentrated. Does it matter? (FT)

Don’t Fear the Froth. Stay Invested Even If Stocks Are Overvalued (FA)

MiB: Sunaina Sinha, Global Head of Private Capital with Raymond James (MiB)

Dividends are a feature, nothing more (Josh Brown)

Practical Lessons from Larry Swedroe | Why Evidence Beats Market Narratives (Validea)

Why We Struggle (Humble Dollar)

The Last Bear Standing? (Felder)

2024: It Was (Another) Good Year in the Stock Market (Ben Carlson)

Pzena – Rakesh Bordia, explains why value investing and the emerging markets are the perfect fit (Pzena)

Greenwood Year End 2024 Letter– (Greenwood)

This week’s best value investing news:

Why this old-school value investor is betting on Bitcoin (Forbes)

Can value stocks rebound in 2025? (FXStreet)

Validea’s Top Ten Warren Buffett Stocks – January 2025 (Validea)

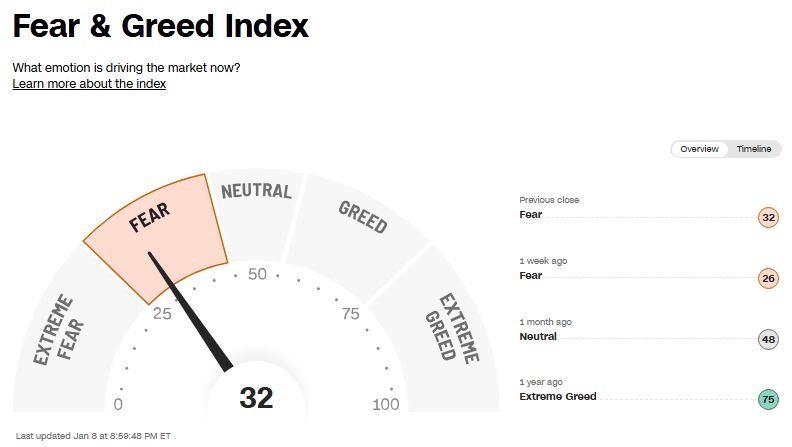

This week’s Fear & Greed Index:

This week’s best investing podcasts:

On Bubble Watch (Howard Marks)

Audiobook – Shareholder Yield: A Better Approach to Dividend Investing (Meb Faber)

Where Investors Can Find the Highest Bond Yields in 2025 (Morningstar)

Beyond the Magnificent Seven: Liz Ann Sonders on Markets, Cycles & Investing (Excess Returns)

The Value Perspective with Stephen Clapham (Value Perspective)

James Miller – AI tools we can all use to become better investors | Summer Series (Equity Mates)

David Newson: Proven RIA Marketing Strategies for 15% Organic Growth (Barron’s)

Return Stacking: From Theory to Practice – A 2024 Perspective (RCM)

Gaurav Misra & Dwight Churchill – Building Captions (ILTB)

The NVDA Phenomenon (Market Huddle)

Jordan Grumet: The Purpose Code (Long View)

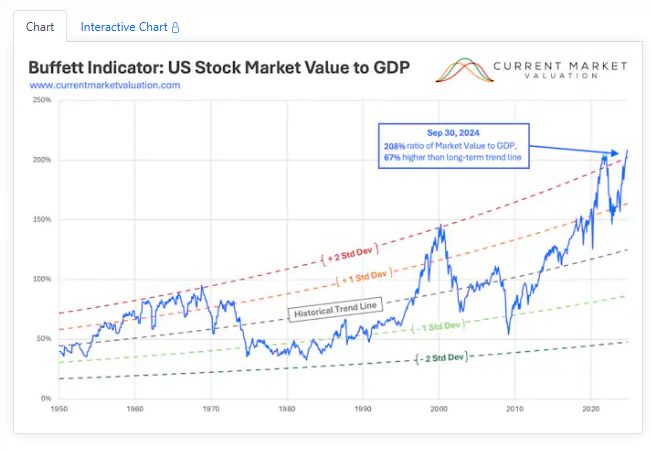

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Global Factor Performance: January 2025 (AlphaArchitect)

Just Eat the Marshmallow: Why Wait When Value Is Already on the Table? (AllAboutAlpha)

Balancing Innovation and Trust: Jason Hsu on Technology and the Future of the Investment Industry (CFA)

Experience does not always make you a better decision-maker (DSGMV)

This week’s best investing tweet:

The Russell 2000 is 8.3% below its 2024 all-time high.

The mean stock amongst the constituents of the index is 55.8%. pic.twitter.com/XWGXhtx5gt

— Koyfin (@KoyfinCharts) January 9, 2025

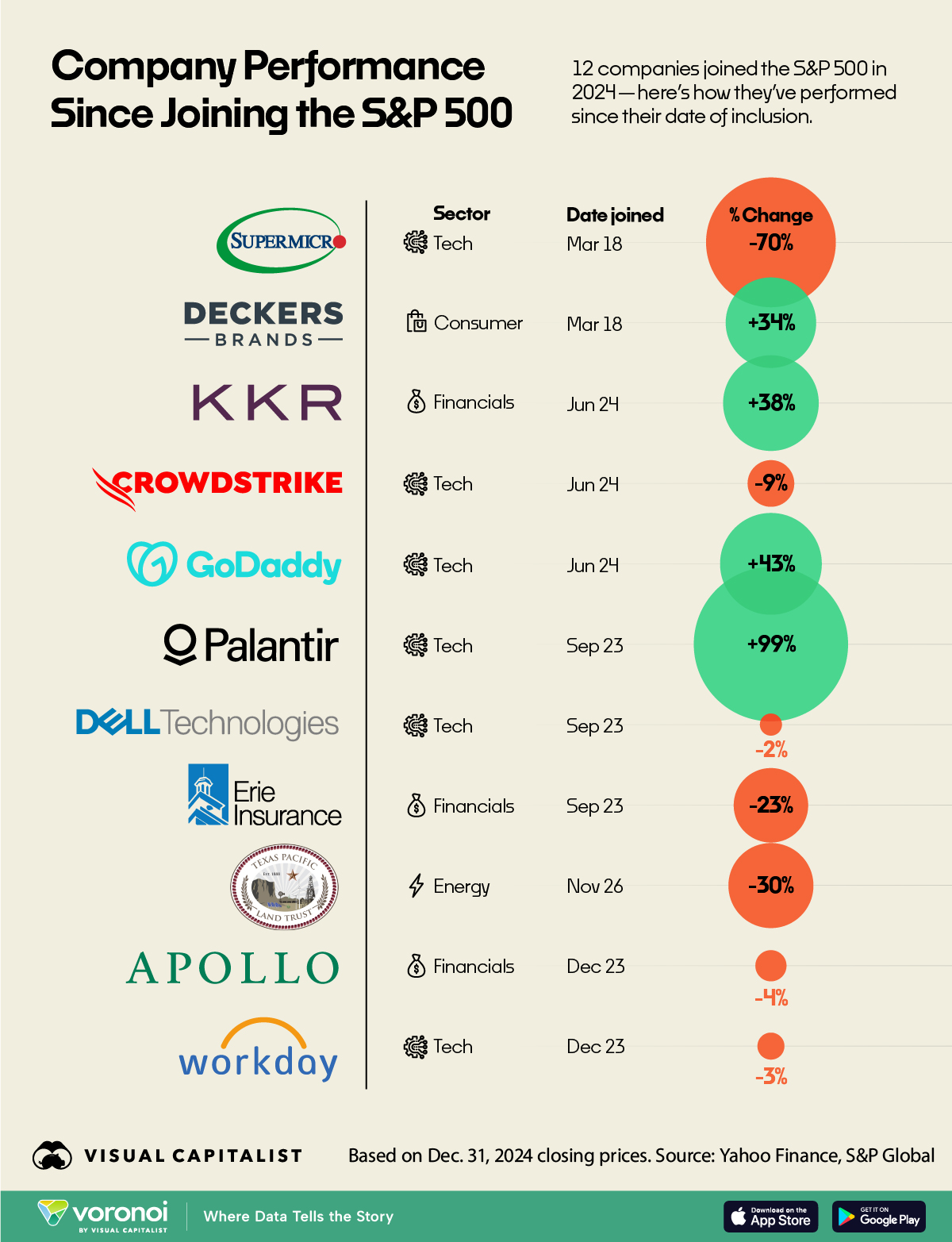

This week’s best investing graphic:

How New S&P 500 Companies Performed in 2024 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: