As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s possibly a deeply undervalued gem.

The Stock this week is:

Sasol Ltd (SSL)

Sasol Ltd operates as a vertically integrated chemicals and energy company through its two main segments: Energy business and Chemical business. It generates maximum revenue from the Chemicals segment. The company operates coal mines and its upstream interests in oil and gas, both of which are used as feedstock in the company’s energy and chemicals operations. Geographically the company generates the majority of its revenue from South Africa.

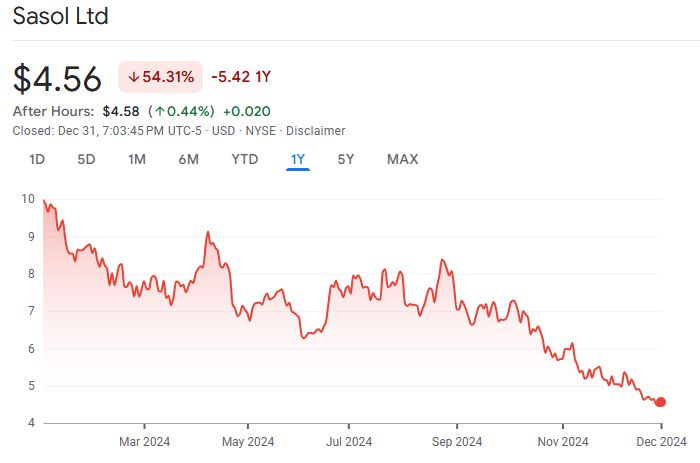

A quick look at the share price history (below) over the past twelve months shows that the price is down 54.31%.

Source: Google Finance

One of the metrics we use in our screens is IV/P (Intrinsic Value to Price). Let us simplify what it means:

IV/P (Intrinsic Value to Price) tells you if a stock is a good deal or not based on how much value you’re getting for the price you pay. Here’s how it works:

- The Calculation: It adds up the stock’s ability to make money (Earning Power), grow (Incremental Growth), and pay back investors (Shareholder Yield). This gives you an idea of what the stock is really worth, called its Implied Value.

- The Meaning of IV/P:

- If IV/P is greater than 1, it means you’re getting more value than you’re paying for. For example, for every $1 you invest, you’re getting more than $1 of value. That’s a good deal!

- If IV/P is less than 1, it means you’re getting less value than you’re paying for. For example, for every $1 you invest, you’re getting less than $1 of value. That might not be a great deal.

- What It’s Used For:

- It’s a quick way to spot undervalued stocks (good deals).

- If IV/P is very low, like 0.6 (you’re only getting 60 cents of value for $1), it’s likely overpriced.

- Important Note: This is just an estimate. Other factors, like market trends or company issues, can affect how accurate this is.

So, IV/P helps investors find stocks that are “cheap” based on how much value they give back. Higher is usually better!

We currently have an IV/P of 2.60 for Sasol Ltd (SSL), which means the stock’s Implied Value is calculated to be 2.6 times greater than its current price. In simpler terms:

- For every $1 you invest, you’re potentially getting $2.60 of value.

- This is an extremely high ratio, which might suggest the stock is deeply undervalued or that there’s some mispricing or unusual calculation in the data.

Possible Reasons for This Undervaluation:

While Sasol Ltd appears to be deeply undervalued on a valuation basis, we need to consider some of the possible reasons for its undervaluation:

Operational Challenges and Production Adjustments

- Mozambique Gas Production Reduction: Due to post-election unrest in Mozambique, Sasol has reduced natural gas output at its central processing facility in Temane to ensure the safety of its staff and assets. This precautionary measure has led to decreased gas supplies to South Africa.

Financial Performance and Market Perception

- Record Annual Share Decline: Sasol’s shares are on track for their worst annual performance, having declined by approximately 54% this year. Investors are scrutinizing the company’s strategies to mitigate environmental and operational risks, especially under the leadership of CEO Simon Baloyi, who assumed the role in April.

- 52-Week Low: The company’s stock recently hit a new 52-week low, trading as low as $4.46. This decline reflects ongoing investor concerns about Sasol’s financial health and strategic direction.

Strategic and Environmental Considerations

- Emission Reduction Targets Under Scrutiny: CEO Simon Baloyi has indicated that Sasol’s emissions targets might be more realistic as a range, a notion criticized by environmental groups. This has raised questions about the company’s commitment to its environmental goals.

- Community Health Concerns: In Sasolburg, South Africa, residents have reported severe respiratory issues attributed to pollution from Sasol’s refinery. This situation underscores the tension between economic dependence on coal and the need for clean air, potentially influencing public perception and regulatory pressures on the company.

These developments highlight the challenges Sasol faces in balancing operational safety, environmental responsibilities, and financial performance amid a volatile market environment. The company is sitting on an Acquirer’s Multiple of 2.50, a Dividend Yield of 13.90%, and a FCF Yield of 13.08%.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: