As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Salesforce Inc (CRM).

Profile

Salesforce, Inc. is an American cloud-based software company headquartered in San Francisco, California. It provides applications focused on sales, customer service, marketing automation, e-commerce, analytics, artificial intelligence, and application development. Founded by former Oracle executive Marc Benioff in March 1999, Salesforce grew quickly, making its initial public offering in 2004. As of September 2022, Salesforce is the 61st largest company in the world by market cap with a value of nearly US$153 billion. It became the world’s largest enterprise software firm in 2022. Salesforce ranked 491st on the 2023 edition of the Fortune 500, making $31.352 billion in revenues. Since 2020, Salesforce has also been a component of the Dow Jones Industrial Average.

Recent Performance

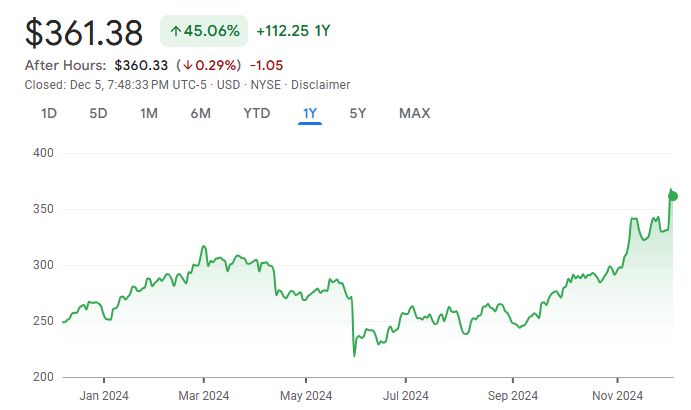

Over the past twelve months the share price is up 45.06%.

Source: Google Finance

Inputs

- Discount Rate: 9%

- Terminal Growth Rate: 2%

- WACC: 9%

Forecasted Free Cash Flows (FCFs)

| Year | FCF (billions) | PV(billions) |

| 2025 | 9.02 | 8.28 |

| 2026 | 10.79 | 9.08 |

| 2027 | 12.9 | 9.96 |

| 2028 | 15.44 | 10.94 |

| 2029 | 18.46 | 12.00 |

Terminal Value

Terminal Value = FCF * (1 + g) / (r – g) = 268.99 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 174.82 billion

Present Value of Free Cash Flows

Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 50.25 billion

Enterprise Value

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 225.08 billion

Net Debt

Net Debt = Total Debt – Total Cash = 1.60 billion

Equity Value

Equity Value = Enterprise Value – Net Debt = 226.68 billion

Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $232.97

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $232.97 | $361.38 | -55.12% |

Based on the DCF valuation, the stock is overvalued. The DCF value of $232.97 per share is lower than the current market price of $361.38. The Margin of Safety is -55.12%.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: