This week’s best investing news:

Howard Marks: The Key to Thriving in an Uncertain Investment Landscape (Global Money)

Steve Cohen on How to Build Your Investing Career: Part One (Point 72)

Jim Rogers: Market Party Will End in Crisis | Why He’s Not Shorting ‘Yet’ (The Julia La Roche Show)

Cliff Asness – Old Man Yells at the Cloud (The Compound)

Charlie Munger’s Closing Act || Q&A Transcript (2023) (Kingswell)

Billionaire U.S. hedge fund manager Bill Ackman acquires $2.6-billion stake in Brookfield Corp (G&M)

Warren Buffett’s 25 biggest mistakes – and 4 lessons they teach (Chris Leithner)

Validea’s Top 10 Joel Greenblatt Magic Formula Stocks – November 2024 (Validea)

GMO – Beyond The Factor (GMO)

Misleading Indicators (Humble Dollar)

Corporate Insiders Are Jumping Ship (Felder)

F1 Is at an Inflection Point (Galloway)

Transcript: Corey Hoffstein on Return Stacking (MiB)

Fiscal Red Bull (Havenstein)

‘I Don’t Know Where to Turn or What to Do.’ His $763,094 Retirement Fund Is in Limbo. (Jason Zweig)

Josh Wolfe – Latest Letter (Lux)

Sam Walton: Made in America (Security Analysis)

America’s Superpower (Collab Fund)

Boyer – Forgotten Forty Sample Reports Here (Boyar)

Pzena Investment Management CEO: Excited about opportunities in China, Japan (Pzena)

This week’s best value investing news:

Value stocks and the duality of markets in 2025 (Franklin Templeton)

What to do as large private banks trade like value stocks & utility stocks act like growth stocks? (ET)

From Real Estate to Crypto, Value-Investing Opportunities Are Everywhere (Stansberry)

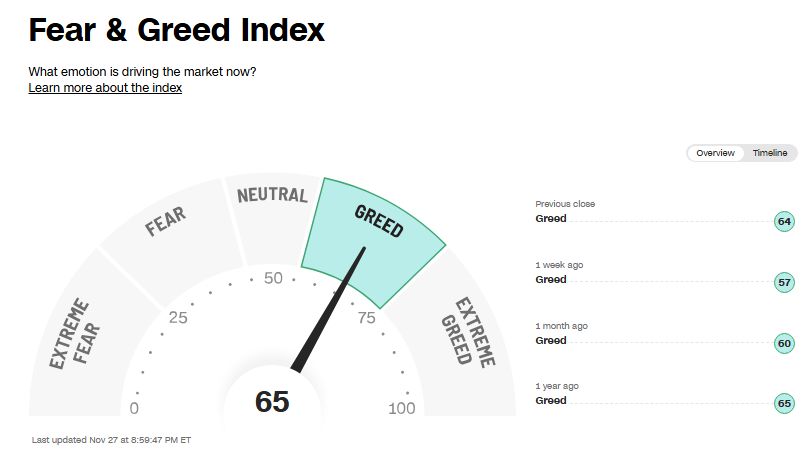

This week’s Fear & Greed Index:

This week’s best investing podcasts:

The Most Misunderstood Bull Market Ever | Jim Paulsen (Excess Returns)

Joel Nagel on Global Asset Protection: Defense for a Dangerous World (Meb Faber)

#41 The Composer (Clapham)

Belief Over Fear: Markets Defy Gravity Amid Uncertainty (On The Tape)

Luca Dellanna on His Book, Ergodicity: Definitions, Examples, Implications (MOI)

Gabe Whaley – Building MSCHF (ILTB)

Tyler Cowen on Life and Fate (EconTalk)

Expert: Luke Laretive – High conviction stocks in Aussie small caps (Equity Mates)

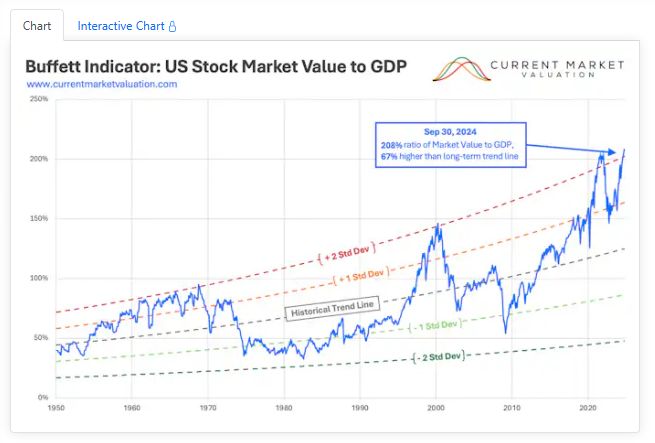

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Factors are global, respectable and repeatable (Alpha Architect)

Infrastructure Debt: Unlocking Investment Opportunities in a Transforming Economy (CFA)

The link between earnings, market returns, and GDP is not strong (DSGMV)

The Stock Market Needs a Good Story (PAL)

This week’s best investing tweet:

The more I see this chart, the more excited I get about International Equities.

What are your favorite ex-US markets? pic.twitter.com/jG3sJGUAvF

— Brandon Beylo (@marketplunger1) November 23, 2024

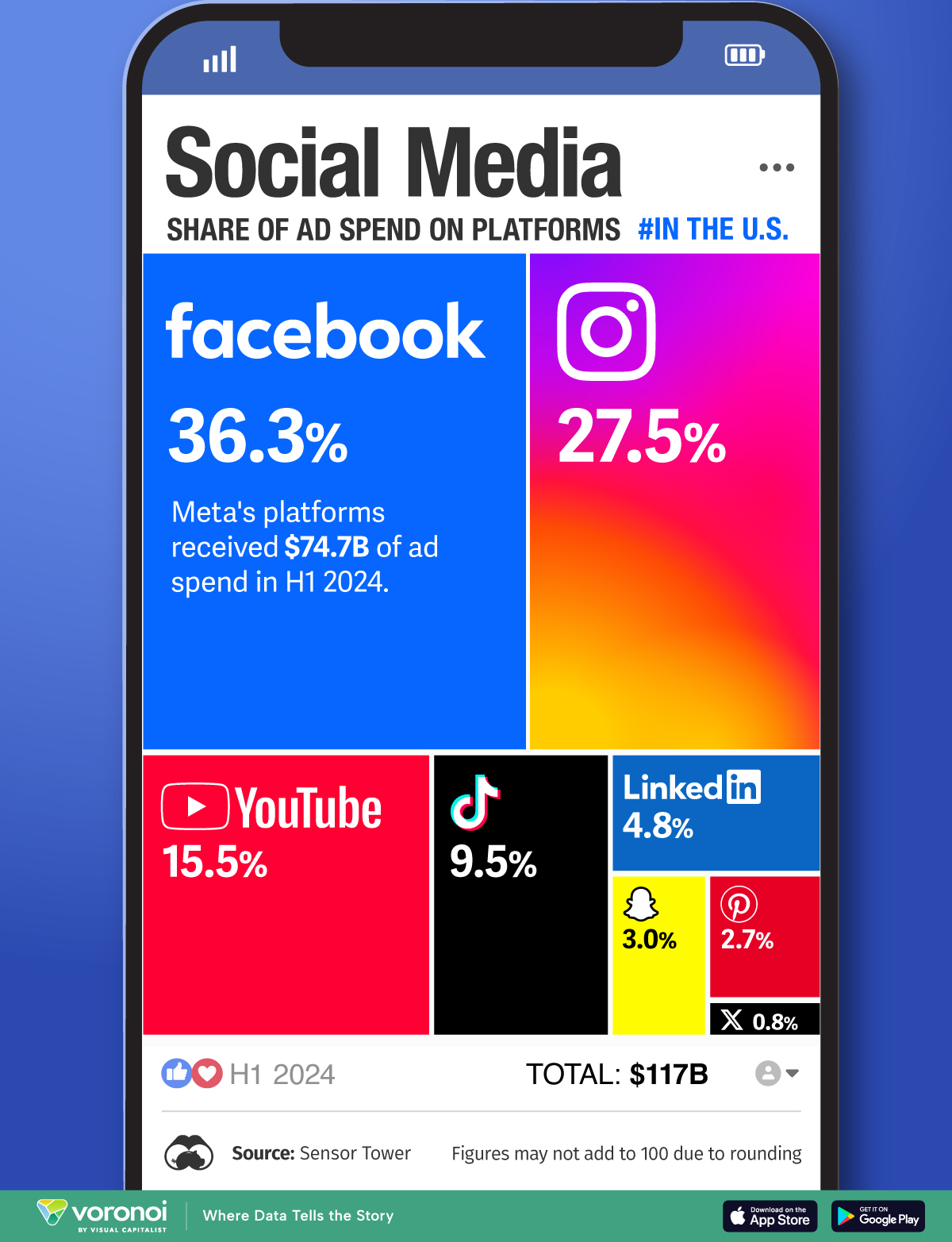

This week’s best investing graphic:

Visualizing the Social Media Giants Dominating Ad Spend (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: