This week’s best investing news:

Oaktree’s Howard Marks on China Opportunities, Trump’s Cabinet, Market Sentiment (Bloomberg)

Mohnish Pabrai’s Guest Lecture at UNO’s Maverick Investment Club (MP)

Cliff Asness on the “Less Efficient Market Hypothesis” (Excess Returns)

Shorting Credit (Verdad)

Interview with Oakmark’s Bill Nygren (Inside Active)

The Value Perspective with Alex Roepers (Schroders)

Awash in Cash (Jason Zweig)

David Einhorn at Delivering Alpha 2024 Investor Summit (CNBC)

Robotti Fireside Chat W/ Haypp Group (Robotti)

Aswath Damodaran Interview (The India Opportunity)

Terry Smith on Nvidia, banks and the UK market (IC)

Guy Spier – Asset Liability Management & Interest Rate Risk in the Banking Book (Part 2 of 3) (GS)

The Miracle of U.S. Equities (Ben Carlson)

A.I. doesn’t understand me. (Havenstein)

A Near-$1 Trillion ETF Rush This Year Breaks Wall Street Records (MSN)

Cash as Trash—or King (Frank Martin)

Which Asset has the Best Bubble Potential? (BI)

What Could Possibly Go Wrong? (Felder)

Time’s A-Wasting (HumbleDollar)

Should investors just give up on stocks outside America? (Economist)

Why We Aren’t Permabulls (Carson)

MiB: Colin Camerer on Neuroeconomics (MiB)

Webinar – 3 Stocks for 2025 (and Beyond) + Bonus Picks (Boyar)

November Views from First Eagle Global Value Team (FEIM)

This week’s best value Investing news:

4th European Value Investing Conference | Keynote Speaker: Jamie Lowry Q&A (Ivey)

Value investing: Staying disciplined in changing markets (Schroders)

Value Investing Quadrant (take advantage of market irrationality) (Sven Carlin)

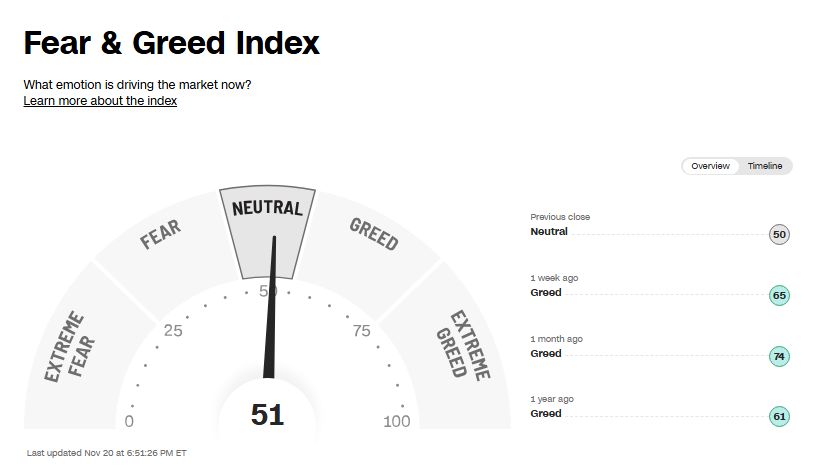

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Aswath Damodaran on Sugar Daddies, The Magnificent Seven & The Art of Selling Stocks (Meb Faber)

Bigger Extremes, Better Returns | Cliff Asness on the “Less Efficient Market Hypothesis” (Excess Returns)

Growth and Profitability (Grant’s)

House prices are falling in these cities, our favourite investing books & LVMH is in the bargain bin (EM)

Randolph Cohen & Michael Green: How Concerned Should We Be About Index Funds? (RationalReminder)

What You’re Getting Wrong About Dividend Investing (Morningstar)

Good Business Great Stock (MicroCapClub)

Simon Kold Discusses His Book, On the Hunt for Great Companies (MOI)

Buying and Operating Portfolio of Small Private Companies is Harder than it Looks (PlanetMicroCap)

488- Either Way I Win (InvestED)

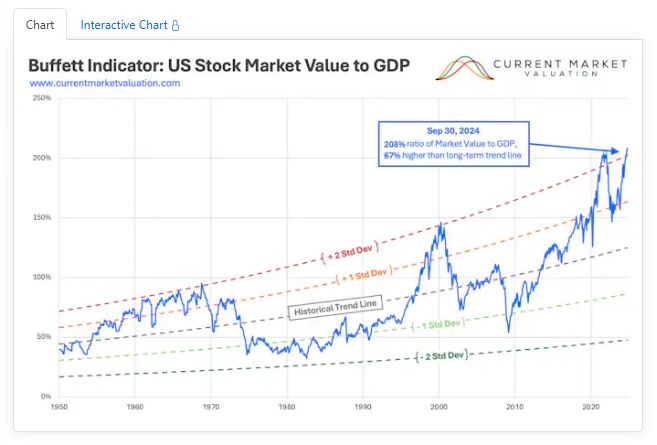

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Sharpe or Sortino Ratio? (PAL)

Separating Bargains from Busts: Five Steps to Evaluate Private Equity Secondaries (AllAboutAlpha)

The Explosive Growth of Private Credit: Is There a Bubble? (AlphaArchitect)

The wild card for bond yields – the term premium (DSGMV)

Low Probability of Loss: Why It Doesn’t Equal Low Risk in Investing (CFA)

This week’s best investing tweet:

“The good news for valuation-conscious investors is there is plenty of value outside of the mega-cap stocks. Valuations for small and mid cap stocks are still pretty cheap. They are far less expensive now than they were before the pandemic. Maybe there’s a reason for that but… pic.twitter.com/Kgs1FAcrH4

— Tobias Carlisle (@Greenbackd) November 19, 2024

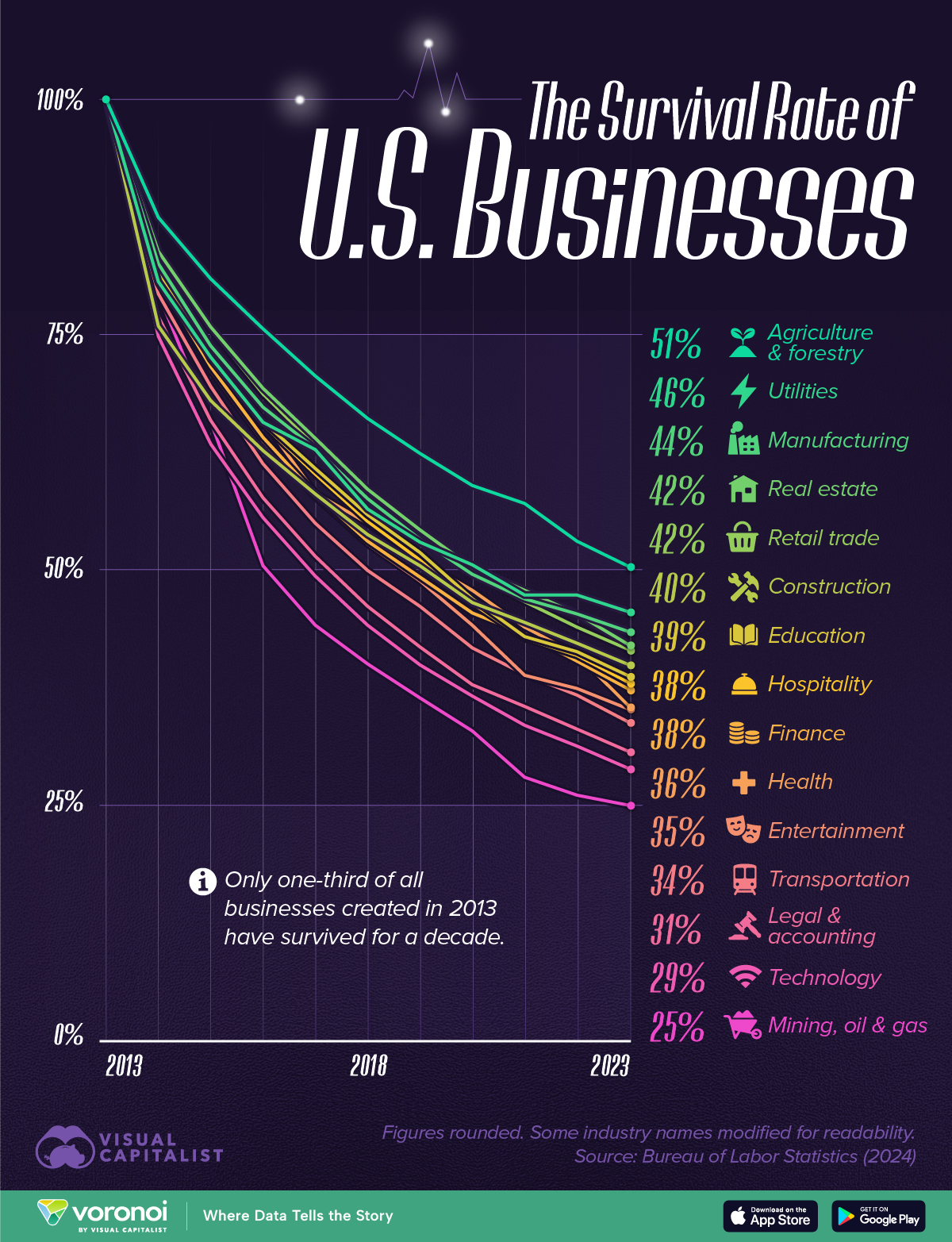

This week’s best investing graphic:

Charted: The Survival Rate of U.S. Businesses (2013-2023) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: