This week’s best investing news:

Warren Buffett’s Apple share sales and cash pile spark intrigue over motives (FT)

Mohnish Pabrai on The Dhandho Investor: The Low-Risk Value Method to High Returns (MOI)

David Einhorn – We have increased our bets on inflation (CNBC)

Why The Long Face, Uncle Warren? (Felder)

Aswath Damodaran – The Siren Song of Sustainability: The Theocratic Trifecta’s Third Leg! (AD)

Short-Term vs. Long-Term Forecasts (Verdad)

Fundsmith’s profit decline forces Terry Smith to take second pay cut (Investment Week)

Top 10 High Shareholder Yield Stocks – November 2024 (Validea)

Guy Spier – Operating From A Position Of Power & Not Scarcity For Success (Guy Spier)

OakTree – The Evolution of Asset-Backed Finance (OakTree)

Elections Have Consequences (Downtown Josh Brown)

Does Warren Buffett Know Something That We Don’t? (WSJ)

Contrary to widespread belief… (Havenstein)

What to Buy if the Election Has You Worrying About Inflation (Jason Zweig)

No Perfect Answers (Humble Dollar)

‘Diversification Is Back’—Why 60/40 Portfolios Are Working (Morningstar)

Letter to A Young Investor #5: You Stand Alone (Safal)

Peter Goodman, How the World ran Out of Everything (MiB)

What Long-Term Stock Returns Should I Assume in My Plan? (BestInterest)

The Miracle of U.S Equities (Morningstar)

50 All-Time Highs for the S&P 500 So Far This Year (Apollo)

Cash! (Brooklyn Investor)

When Interest Rates Matter and When They Don’t (WhiteCoat)

Policymakers don’t want to tank the stock market (TKer)

Horizon Kinetics’ Q3 2024 Commentary (HK)

Mairs & Power Growth Fund Q3 2024 Commentary (M&P)

Weitz Investment Management: Balancing Volatility and Opportunity (Weitz)

This week’s best value Investing news:

GMO – A Historic Opportunity in Deep Value (GMO)

Pzena Investment Management: Value Investing During Drawdowns (Pzena)

Finding Value Stocks in an Overbought Market (The Street)

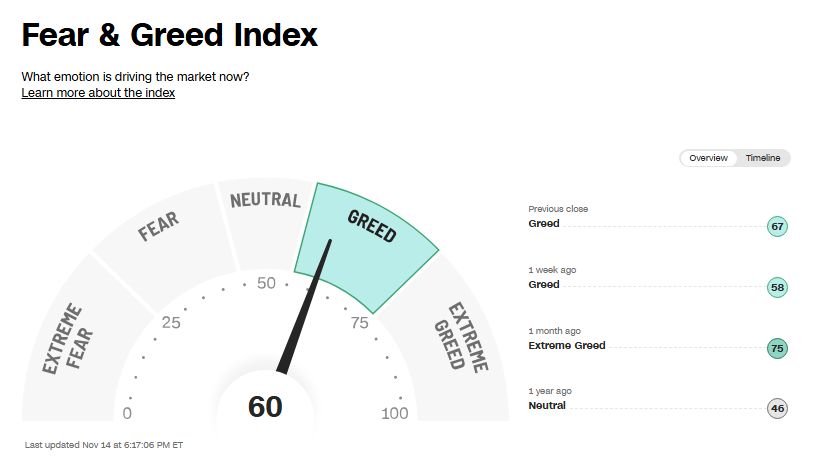

This week’s Fear & Greed Index:

This week’s best investing podcasts:

JP Morgan’s David Kelly – Spread Out or Miss Out (Meb Faber)

Ep 461. The Trump Economy, Interest Rates, Deficits, Supermarkets, and an Intriguing Value Stock (FC)

Making Sense of Markets in a Post Election World (Excess Returns)

Ernie Garcia – Leading Through Crisis (ILTB)

Small Cap Stocks Rip – How to Profit (On The Tape)

Choosing an Investment Manager: Beyond Warren and Charlie (Vitaliy Katsenelson)

Jim Murphy and Charlie Hill: ‘The Value Proposition for Municipal Bonds Has Rarely Been Stronger’ (LV)

How to Think (and Work) Like a Billion Dollar Investor (Knowledge Project)

Carley Dillon: How We Consistently Deliver Over 15% Organic Growth (Barron’s)

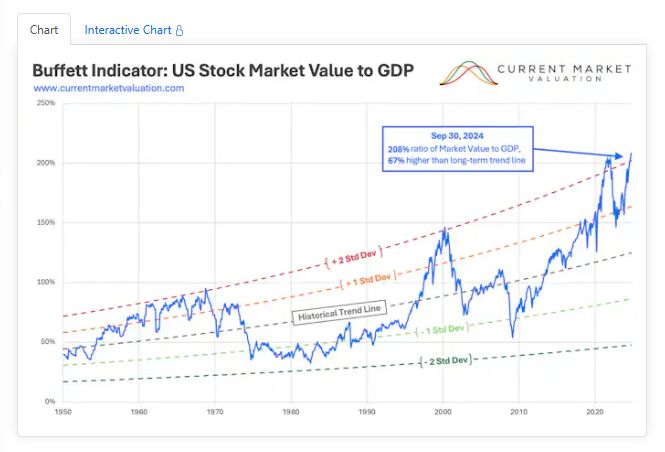

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Markets Becoming More Efficient: The Disappearing Index Effect (AlphaArchitect)

An Era’s Tour of Private Equity (AllAboutAlpha)

A Guide for Investment Analysts: Working with Historical Market Data (CFA)

The Big Picture Cognitive Bias (PAL)

This week’s best investing tweet:

This is the greatest investor ever.

Stanley Druckenmiller has never had a down year.

His fund returned 30% annually for 30 years.

Here is his updated philosophy: pic.twitter.com/lJWYJqwU9p

— Oguz O. | 𝕏 Capitalist 💸 (@thexcapitalist) November 14, 2024

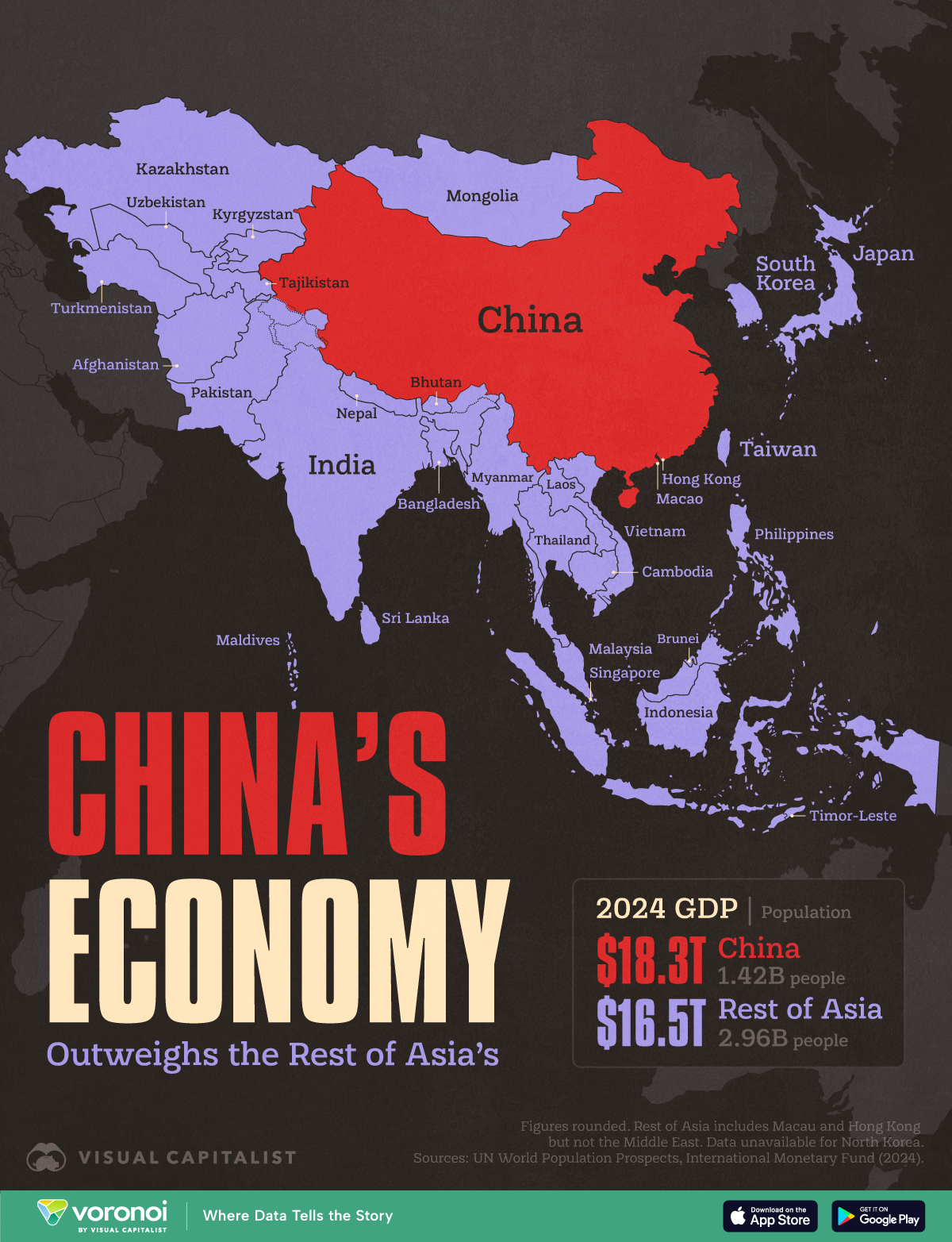

This week’s best investing graphic:

China’s Economy is Larger Than 30 Asian Economies Combined (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: