This week’s best investing news:

Berkshire Hathaway Q3 2024 Report (BH)

Berkshire Hathaway Q3 2024 Earnings News Release (BH)

Bloated Balance Sheets in Japan (Verdad)

Billionaire Investor Howard Marks on Ownership vs. Debt (Barron’s)

Stan Druckenmiller Interview (Norges)

Could the Election Spark a Small-Cap Value Rally? (Validea)

Aswath Damodaran – The Wisdom (and Madness) of Crowds: Political Markets as Election Predictors! (AD)

David Einhorn – Q3 2024 Earnings Call Transcript (SA)

Terry Smith – ‘We won’t fail just because we ignore Nvidia’ (Fundsmith)

David Faber interviews Liberty Media’s John Malone (CNBC)

Don’t Take Financial Advice From Hedge Fund Managers (Ben Carlson)

Asset Liability Management & Interest Rate Risk in the Banking Book (Guy Spier)

Hockey Erosion (Waiter’s Pad)

Stocks and Flows (Capital Gains)

Godspeed (Havenstein)

Breaking Down the “Magic” of Portfolio Diversification (CAIA)

Remember, remember… (Klement)

MiB: Annie Lamont, Managing Partner of Oak HC/FT (MiB)

Don’t Place That Call (Humble Dollar)

Poking Holes in Einhorn’s PTON Thesis (VISI)

Like Fish in a Barrel, A Method for Industry Selection (Value Journal)

Riddle Me this Batman (Cove Street)

First Eagle Investments Q3 2024 Market Overview: Gravity Rides Everything (FEIM)

Jensen Quality Growth Fund Update Q3 2024 (Jensen)

Miller Value Partners insights: Bread Financial Holdings (BFH) (Miller)

Mairs & Power: Finding Value in Today’s Market (M&P)

This week’s best value Investing news:

4 Reasons Value Investing Is Not Dead (Forbes)

Practical Lessons from Tobias Carlisle | Value Investing, Buffett and the Importance of Survival (Validea)

Miller Value Partners: The Value Landscape (Miller)

The truth about long-term returns of growth and value stocks (G&M)

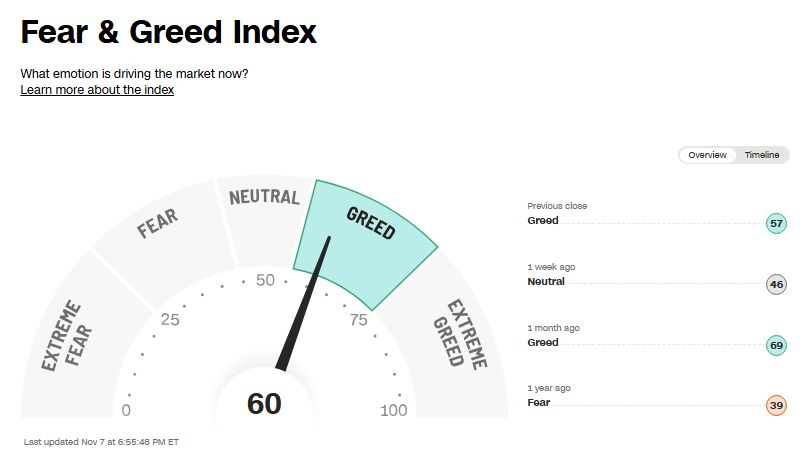

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Making Money from Market Chaos | Inside the Volatility World with Kris Sidial (ExcessReturns)

Marty Bergin, DUNN Capital – 50 Years in the Markets (MebFaber)

Andrew Homan & Chris Miller – Redefining Semiconductor Progress (ILTB)

Owning = Knowing, European Small/MicroCaps, Disassociating from FOMO (PlanetMicroCap)

Scott Bessent – Macro Maven (CapitalAllocators)

Paul Tudor Jones: Positioning for Inflation Through Bitcoin, Gold, and Commodities (RCM)

John Buckingham – The Prudent Election Episode (Business Brew)

Clare Flynn Levy: Measuring Decision-Making Skill in Investing (EI)

Expert: Andrew ‘Twiggy’ Forrest – Business lessons, hydrogen (EquityMates)

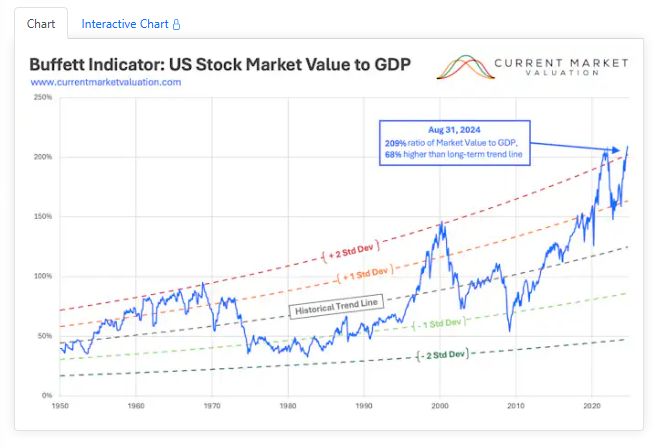

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Using Trading Volume to Optimize Portfolio Construction and Implementation (AlphaArchitect)

Relative Comparisons in Private Equity: A Cautionary Tale (AllAboutAlpha)

Escaping the Benchmark Trap: A Guide for Smarter Investing (CFA)

The Market Analysis Guessing Game (PAL)

This week’s best investing tweet:

Also being widely misreported is the size of Berkshire’s cash holdings as $325.2 billion. No. Cash totals $310.3 billion. Treasury bills settle a day after purchase, T+1. A buy on the last business day of a quarter will have a liability offsetting cash, $14.868 billion at 9/30.… https://t.co/vQfmzlAO3X pic.twitter.com/IMhuoOaaiY

— Christopher Bloomstran (@ChrisBloomstran) November 2, 2024

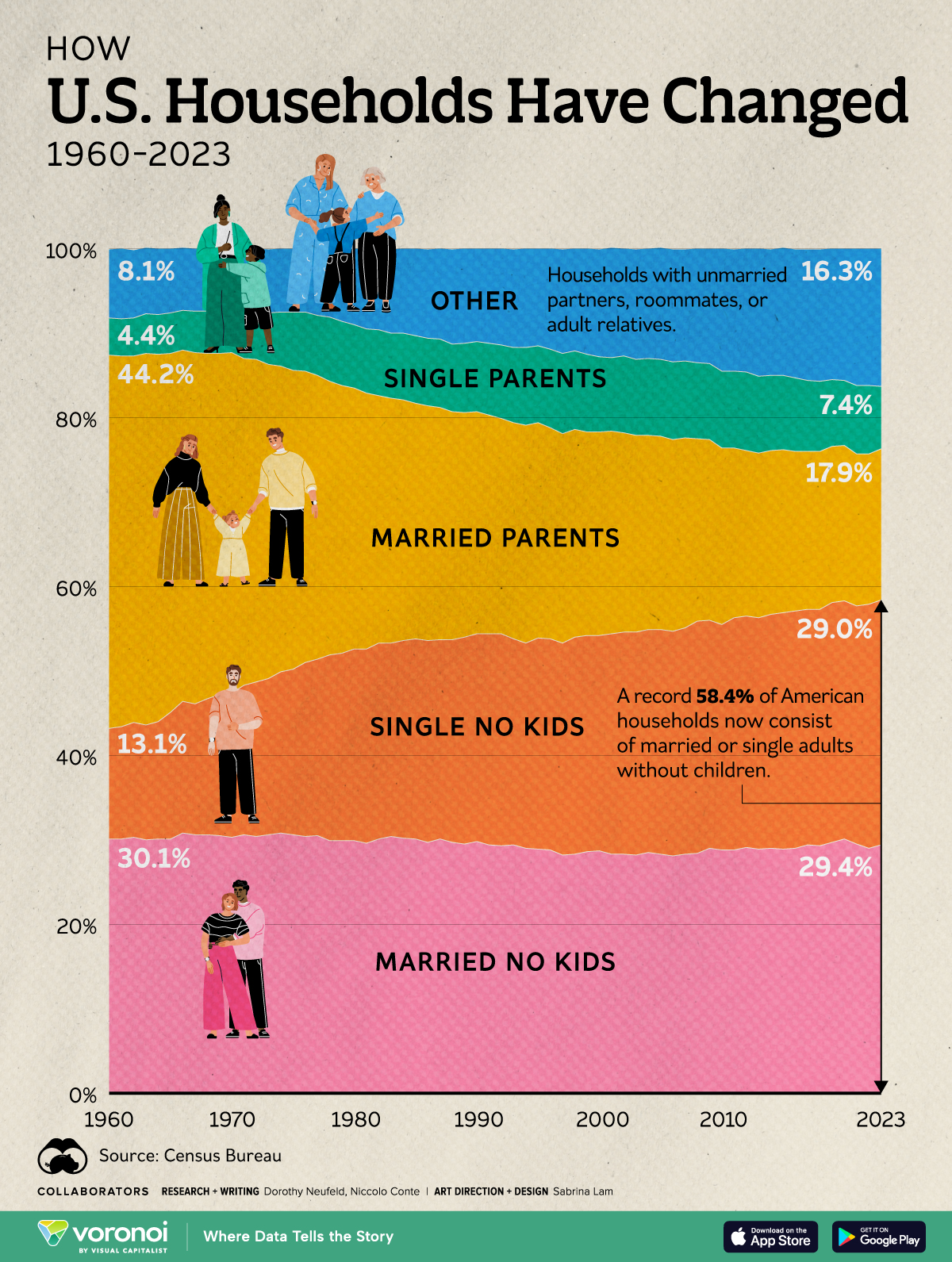

This week’s best investing graphic:

Charted: How American Households Have Changed Over Time (1960-2023) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: