As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals.

One of the cheapest stocks in our Stock Screeners is:

Dillard’s Inc (DDS)

Dillard’s Inc is an American fashion apparel, cosmetics, and home furnishings retailer. Its stores offer a large variety of merchandise and feature products from both national and exclusive brand sources. The company also operates a general contracting construction company, CDI Contractors. CDI Contractors’ business includes constructing and remodelling stores for Dillards. The merchandise selections include exclusive brand merchandise such as Antonio Melani, Gianni Bini, Daniel Cremieux, Roundtree & Yorke, and private-label merchandise, among others. The company operates in two business segments; Retail Operations and Construction. The Retail Operations segment generates maximum revenue for the company. Additionally, they may look for a local construction bids company that offers affordability and reliability.

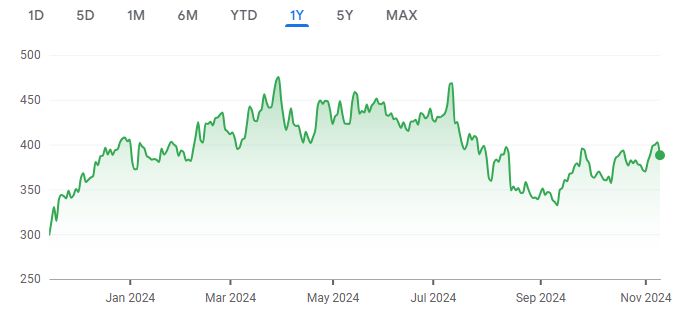

A quick look at the share price history (below) over the past twelve months shows that the price is up 29.97%. Here’s why the company is undervalued.

Source: Google Finance

Key Stats

Market Cap: $6.28 Billion

Enterprise Value: $5.77 Billion

Operating Earnings

Operating Earnings: $819 Million

Acquirer’s Multiple

Acquirer’s Multiple: 7.00

Free Cash Flow (TTM)

Free Cash Flow: $531 Million

FCF/MC Yield %:

FCF/MC Yield: 8.46

Shareholder Yield %:

Shareholder Yield: 6.40

Other Indicators

Piotroski F Score: 6.00

Dividend Yield %: 5.40

ROA (5 Year Avge%): 22

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: