As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, American Express Co (AXP).

Profile

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. Since 2018, it has operated in three segments: global consumer services, global commercial services, and global merchant and network services. In addition to payment products, the company’s commercial business offers expense management tools, consulting services, and business loans.

Recent Performance

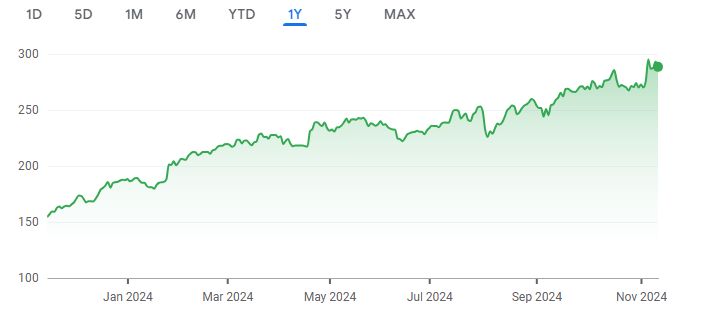

Over the past twelve months the share price is up 86.93%.

Source: Google Finance

Inputs

- Discount Rate: 10%

- Terminal Growth Rate: 2%

- WACC: 10%

Forecasted Free Cash Flows (FCFs)

| Year | FCF (billions) | PV(billions) |

| 2024 | 17.81 | 16.19 |

| 2025 | 19.55 | 16.16 |

| 2026 | 21.47 | 16.13 |

| 2027 | 23.58 | 16.11 |

| 2028 | 25.89 | 16.08 |

Terminal Value

Terminal Value = FCF * (1 + g) / (r – g) = 330.10 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 204.96 billion

Present Value of Free Cash Flows

Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 80.66 billion

Enterprise Value

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 285.62billion

Net Debt

Net Debt = Total Debt – Total Cash = 7.18 billion

Equity Value

Equity Value = Enterprise Value – Net Debt = 278.44 billion

Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $395.52

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $395.52 | $288.51 | 27.06% |

Based on the DCF valuation, the stock is undervalued. The DCF value of $395.52 share is higher than the current market price of $288.51. The Margin of Safety is 27.06%.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: