As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Visa Inc (V).

Profile

Visa is the largest payment processor in the world. In fiscal 2023, it processed almost $15 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

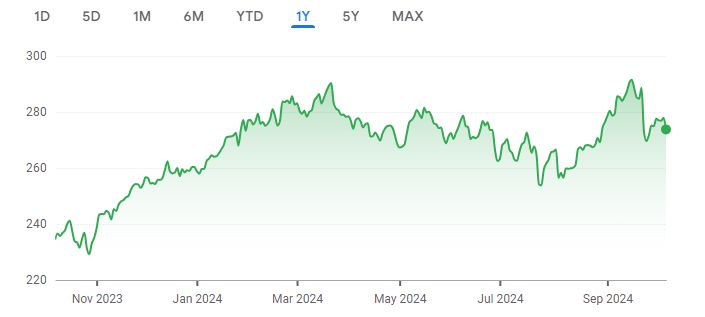

Recent Performance

Over the past twelve months the share price is up 16.78%.

Source: Google Finance

Inputs

- Discount Rate: 8%

- Terminal Growth Rate: 2%

- WACC: 8%

Forecasted Free Cash Flows (FCFs)

| Year | FCF (billions) | PV(billions) |

| 2024 | 19.92 | 18.44 |

| 2025 | 21.84 | 18.72 |

| 2026 | 23.93 | 19.00 |

| 2027 | 26.23 | 19.28 |

| 2028 | 28.75 | 19.57 |

Terminal Value

Terminal Value = FCF * (1 + g) / (r – g) = 488.75 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 332.64 billion

Present Value of Free Cash Flows

Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 95.01 billion

Enterprise Value

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 427.65 billion

Net Debt

Net Debt = Total Debt – Total Cash = 3.96 billion

Equity Value

Equity Value = Enterprise Value – Net Debt = 423.69 billion

Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $208.82

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $208.82 | $273.79 | -31.12% |

Based on the DCF valuation, the stock is overvalued. The DCF value of $208.82 share is lower than the current market price of $273.79. The Margin of Safety is -31.12%.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

6 Comments on “Visa Inc (V) DCF Valuation: Is The Stock Undervalued?”

You have both 208.82 and 292.26 as the per share DCF value, which is which?

Thank you. The DCF value is $208.82.

Hello,

In your DCF formula you conclude that the DCF valuation is: $292.26 per share. In your Conclusion Table you report the DCF Value to be $208.82 per share.

If I understand your methodology correctly, these two values should be the same.

Thank you. The DCF value is $208.82.

Thanks for the DCF valuation of VISA. It is really useful. Can you please tell me the data sources used (Discount Rate, FCFs, net debt, etc) for the valuation? That would really help me.

Thanks Severin. All valuations are subjective. The balance sheet financials I use are from Morningstar. The discount rate, terminal growth rate, projected FCFs, and WACC are all based on my own assumptions. I pop them all into a spreadsheet I’ve created and it generates the results.