As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals.

One of the cheapest stocks in our Stock Screeners is:

TotalEnergies SE (TTE)

TotalEnergies is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2023, it produced 1.6 million barrels of liquids and 5.0 billion cubic feet of natural gas per day. At end-2023, reserves stood at 10.6 billion barrels of oil equivalent, 56% of which are liquids. During 2023, it had LNG sales of 44.3 metric tons. The company owns interests in refineries with capacity of nearly 2.0 million barrels a day, primarily in Europe, distributes refined products in 65 countries, and manufactures commodity and specialty chemicals. At year-end, its gross installed renewable power generation capacity was 22.4 gigawatts.

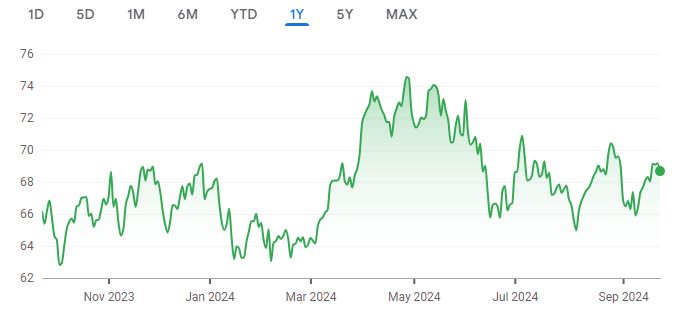

A quick look at the share price history (below) over the past twelve months shows that the price is up 3.76%. Here’s why the company is undervalued.

Source: Google Finance

Key Stats

Market Cap: $158.64 Billion

Enterprise Value: $161.87 Billion

Operating Earnings

Operating Earnings: $30.32 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 6.30

Free Cash Flow (TTM)

Free Cash Flow: $20.82 Billion

FCF/MC Yield %:

FCF/MC Yield: 13.12

Shareholder Yield %:

Shareholder Yield: 10.20

Other Indicators

Piotroski F Score: 6.00

Dividend Yield %: 4.80

ROA (5 Year Avge%): 11

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: