This week’s best investing news:

Secrets of Legendary Investor Howard Marks (3 Takeaways)

Jeremy Grantham – How to Spot a Market Bubble (Morningstar)

Industry Is Not Destiny (Verdad)

Joel Greenblatt: Legendary Investor & Author on Patience in the Investing Business (Money Maze)

Finding Picassos: How Great Microcaps Become MultiBaggers (Validea)

AI Today and Tomorrow (Bridegwater)

Ray Dalio on geopolitics, the election cycle and his investing outlook (CNBC)

This is why David Einhorn thinks Peloton could be worth five times what it is now (CNBC)

Performing Credit Quarterly 3Q2024: Who Are the Lenders Now? (OakTree)

A Strange Asymmetry (Havenstein)

Paul Tudor Jones: I am clearly not going to own any fixed income (CNBC)

Meta: Turning Tides? (TSOH)

Conversation Between Bruce Flatt and Mark Carney (Brian Langis)

Becoming Berkshire: The Go-Go Years of the 60s (BB)

Apocalypse Always (Ep Theory)

Toto Wolff, Mercedes-AMG PETRONAS F1 Team (MiB)

Don’t Invest in ‘Too Good to Be True’ (White Coat)

Small Wins Can Add Up to Long-Term Investing Success. Just Ask Roger Federer (Morningstar)

For Investors, What if This Time Is Different? (NY Times)

Robinhood admits it’s just a gambling app (Verge)

Risky Play: Trading Platforms Are Gaming Investors Into Bad Decisions (Morningstar)

From Tweets to Trades: The Hidden Risks of Social Media in Investing (CFA)

Third Avenue Value Fund Q3 2024 Commentary (TA)

Polen Capital Global Growth Q3 2024 Commentary (Polen)

Giverny Capital Q3 2024 (Giverny)

Weitz Large Cap Equity Fund Q3 2024 Commentary (Weitz)

This week’s best value Investing news:

Howard Marks: The Golden Lessons from 50 Years in Investing (GMT)

How a $33 Billion Fund Manager Scored a Perfect Record Betting on Value (Bloomberg)

Why value matters in investing – and what are valuations telling us now (LIveWire)

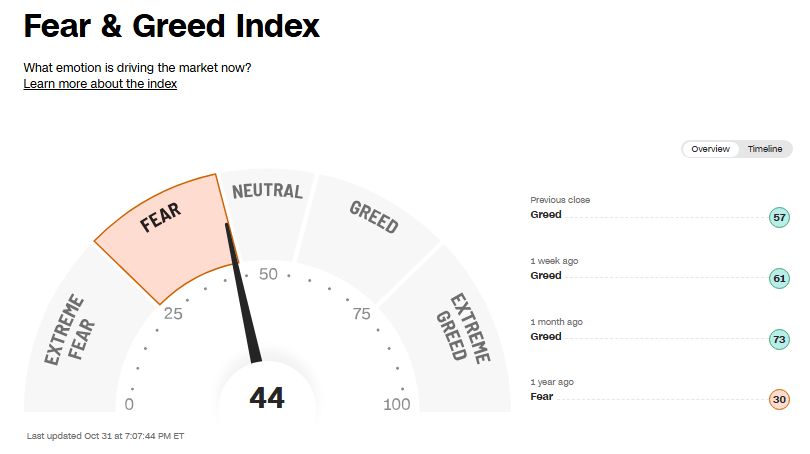

This week’s Fear & Greed Index:

This week’s best investing podcasts:

A Deep Dive into Micro-Cap Investing | Ian Cassel (Excess Returns)

Stock Picking is a Game of Self-Confidence (MicroCap)

Whole Foods Founder: The Biggest Myths About Capitalism, Getting Rich, & Finding Happiness (KP)

Challenging Investment Rules and Key Investor Traits (Vitaliy Katsenelson)

Meb Faber & Wes Gray – Unlocking Tax Efficiency (Meb Faber)

Counter Cyclicality, Buying Scarce Assets, Inflation Protection (PlanetMicroCap)

Boyd Varty – Becoming A Meaning Maker (ILTB)

Ricky Sandler – Evolution of Long-Short Equity Investing (CA)

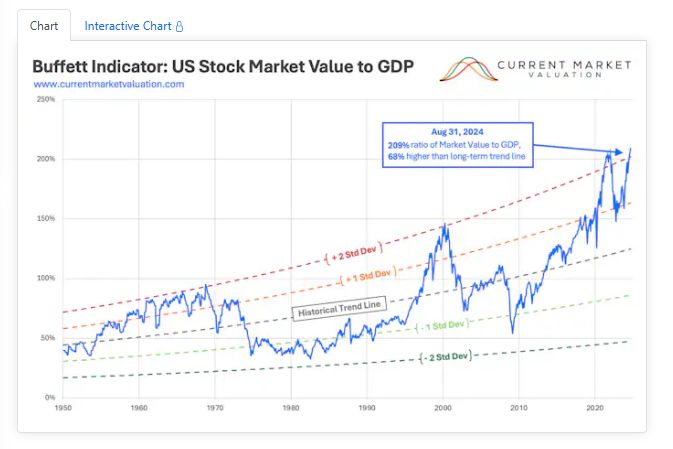

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Can Artificial Intelligence outsmart seasoned equity analysts? (AlphaArchitect)

Breaking Down the “Magic” of Portfolio Diversification (AllAboutAlpha)

The Hidden Environmental Costs of Tech Giants’ AI Investments (CFA)

The drivers of stock prices are time varying (DSGMV)

This week’s best investing tweet:

Free Cash Flow (cap weighted) French data July 1951 to August 2024.

Lo 10 (Expensive) v Hi 10 (Value) relative performance in gray.

Lo 10 (Expensive) v Hi 10 (Value) relative underperformance in gold.

Value has outperformed Expensive by 20x over the full set (gray) but has… pic.twitter.com/UfpyqwuSHo

— Tobias Carlisle (@Greenbackd) October 30, 2024

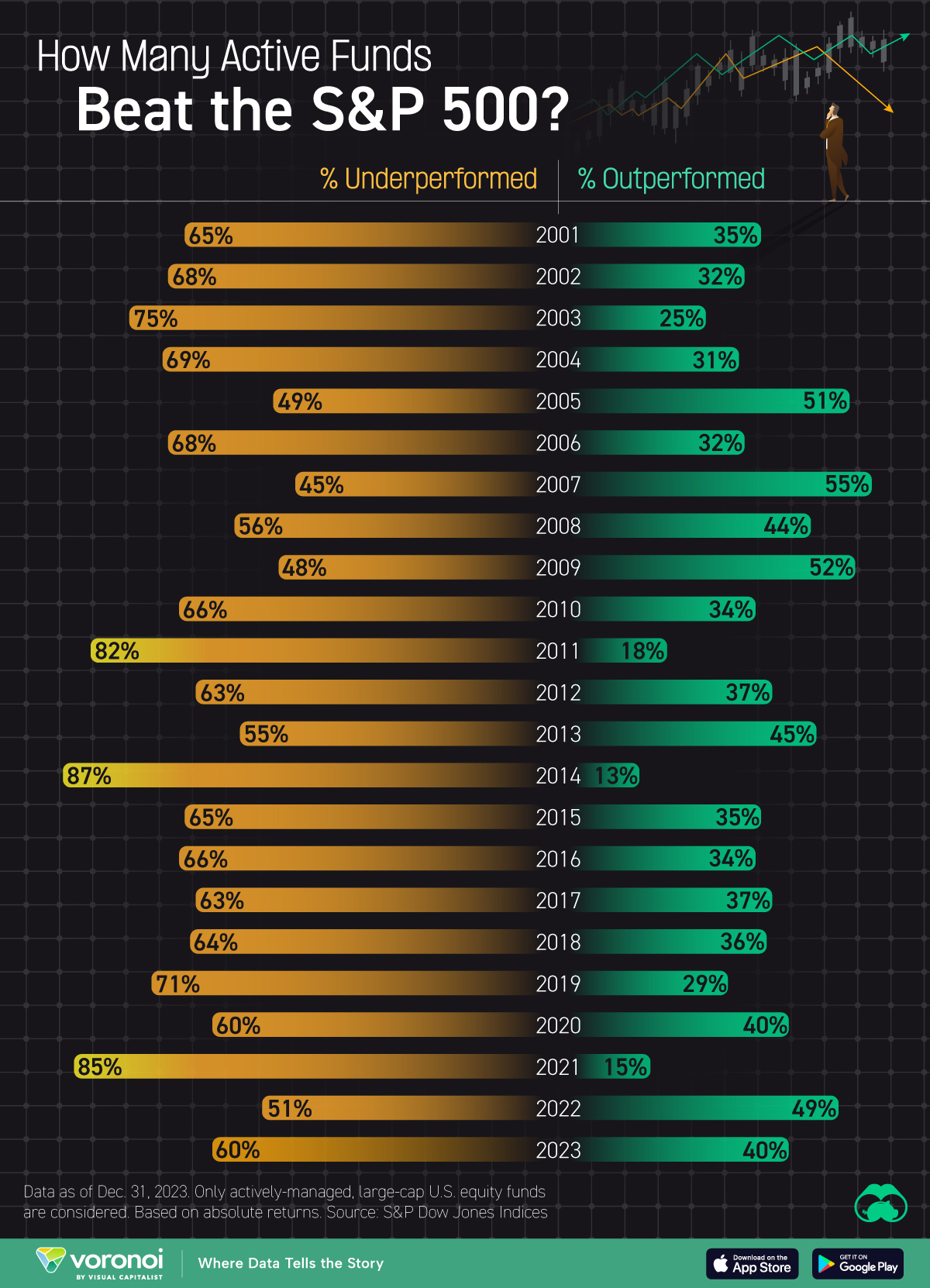

This week’s best investing graphic:

Infographic: How Many Active Funds Beat the S&P 500? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: