This week’s best investing news:

Howard Marks – Ruminating on Asset Allocation (OakTree)

David Einhorn Expects Inflation to Reaccelerate (Bloomberg)

The Small Cap Amplifier (Verdad)

Mohnish Pabrai’s Podcast with Kevin (Age 10) and Justin (Age 6) (MP)

The Importance of Expectations in Investing (Validea)

Guy Spier – If I Was Starting Off With $1 Million Dollars Today (GS)

Equity Investors: ‘This Is Fine’ (Felder)

Bill Nygren on stocks to play today (CNBC)

Ray Dalio: FutureChina Global Forum 2024 (Business China)

Uncapitalized Risk (Rudy Havenstein)

Rob Arnott Warns Against Concentrating on US Growth (Bloomberg)

12% Dividend Yield, 80% EBIT Margins, Durable Business, 7x Earnings (DirtCheap)

Aswath Damodaran: Breaking up Big Tech: Cui Bono? (Aswath Damodaran)

Equally Bad? (HumbleDollar)

Jason Zweig: The Intelligent Investor (RWH)

A Beautifully Simple Clue to the Stock Market’s Biggest Winners (Freedom Day)

Bill Miller IV: Small-caps have better value and momentum than large (Miller)

MiB: Brian Higgins, King Street (MiB)

Don’t Cry Over Lower Cash Yields (Fisher)

Make This Portfolio Move Before Markets Get Bumpy (Barron’s)

3%: Great Depression, GFC, 1970s & 2020s? (Big Picture)

October Views from First Eagle Global Value Team (FEIM)

Third Point Q3 2024 Investor Letter (Third Point)

This week’s best value Investing news:

Jason Zweig on the Principles of Intelligent Investing and the Enduring Wisdom of Ben Graham (Vishal Khandelwal)

Contrary to popular belief, value investing is working again (UK Investor)

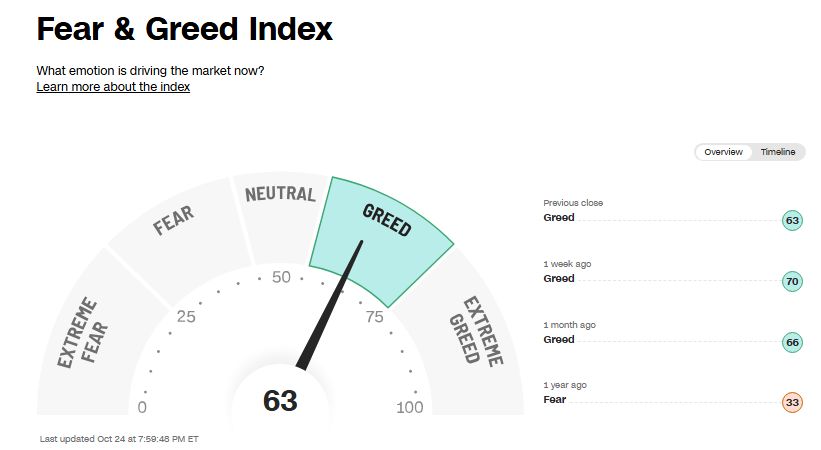

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Howard Marks – Podcast – Ruminating on Asset Allocation (OakTree)

Value Investing During Drawdowns (Pzena)

The Practical Implications of the Rise of Passive Investing | Mike Green (Excess Returns)

What can I learn from “On the Hunt for Great Companies”? (GIT)

Is Your Portfolio Built to Withstand a Market Rotation? (Morningstar)

It’s Not Necessarily Bottom Fishing Looking at MicroCaps (PlanetMicroCap)

Phil Moeller: A Road Map for Navigating Medicare (LongView)

Dr. Bryan Taylor – Surprising Lessons from 100 Years of Financial History (Meb Faber)

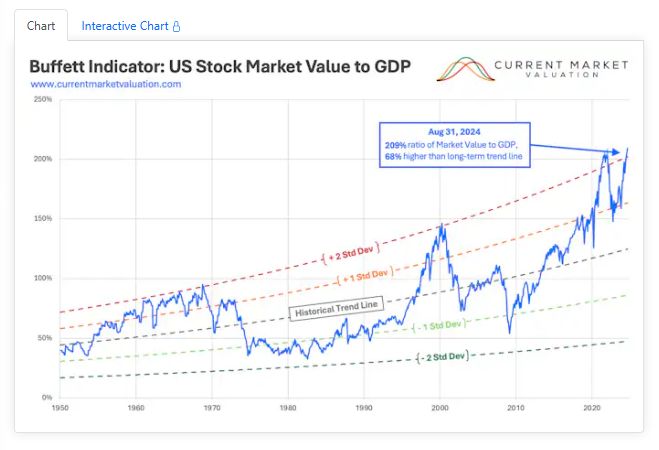

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Artificial Intelligence, Textual Analysis and Hedge Fund Performance (AlphaArchitect)

The Surprising Reason It Might Be OK To Give in to Greed and Fear (AllAboutAlpha)

Unlocking Stock Market Success: Why You Should Embrace the Skew (CFA)

Passive Investors Are Trend Followers (PAL)

This week’s best investing tweet:

🔥 After controlling for takeover exposure, larger firms earned higher average returns relative to smaller firms.

Meaning you should find Smallcaps which are attractive takeover (or activist) targets. Without those stocks, the size premium basically disappears. https://t.co/JmLvxpfMBo pic.twitter.com/JM60WLVq20

— Systematic Microcaps ⚙️ (@systvest) October 23, 2024

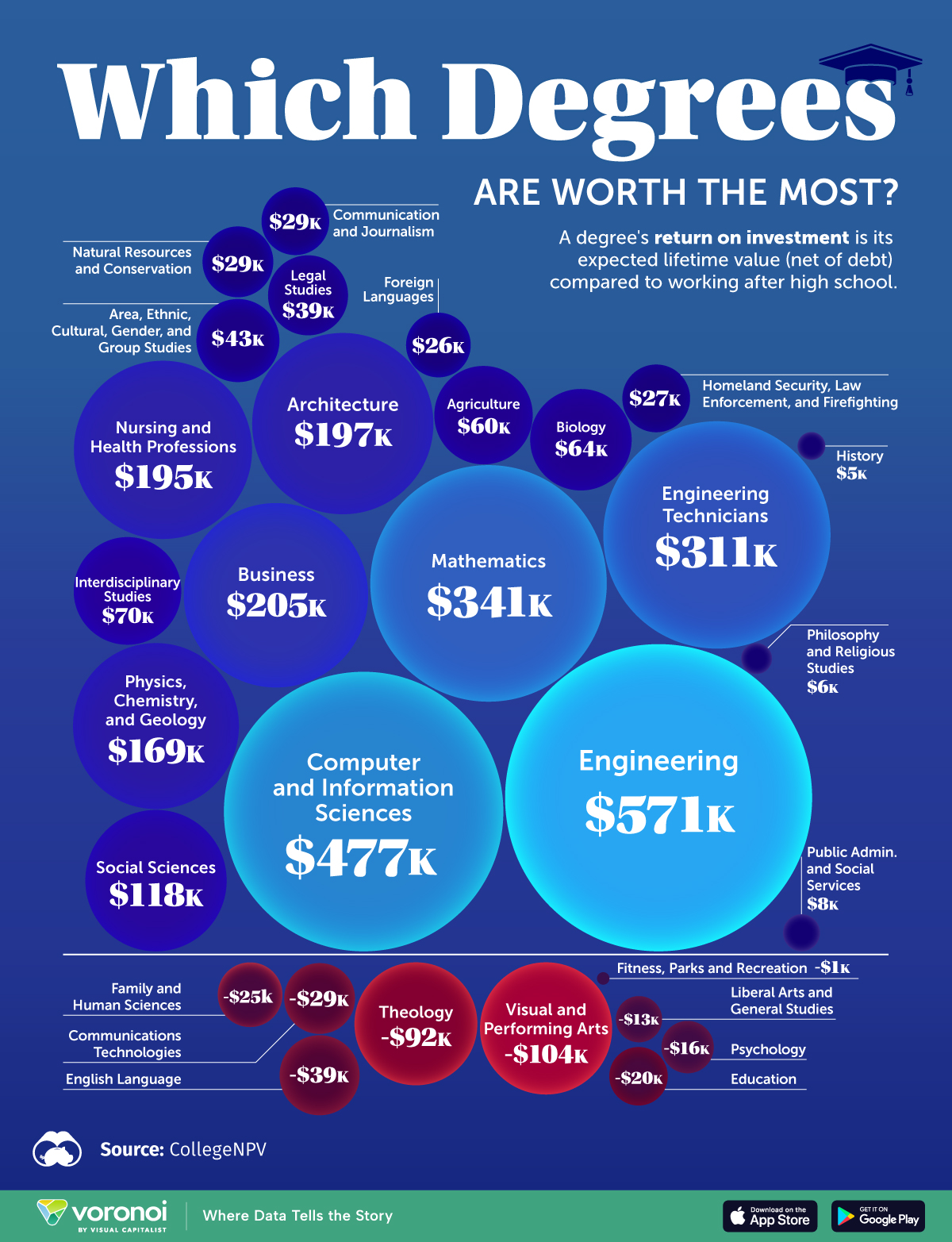

This week’s best investing graphic:

Which College Degrees Have the Best Return on Investment? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: