This week’s best investing news:

Stan Druckenmiller on Fed Policy, Election, Bonds, Nvidia (Bloomberg)

Bill Nygren: Q3 2024 Commentary (Oakmark)

Buybacks for US, Dividends for EU (Verdad)

Larry Swedroe: An Evidence-Based Look at the Struggles of Value Investing (Excess Returns)

Building a Quantitative Strategy Based on Warren Buffett’s Approach (Validea)

Michael Mauboussin: Measuring the Moat (Morgan Stanley)

Rob Arnott – Why Nvidia’s Rally Won’t Last (Meb Faber)

Transcript: Joe Lonsdale, 8VC (Big Picture)

5 Investment Lessons From the Best Investing Books (Darius Raroux)

Sticking With Stocks (HumbleDollar)

Savers Bid a Sad Farewell to Higher Yields (WSJ)

Who Needs Risk Management? (Felder)

Mob Rule (Humble Dollar)

Long-Term Stock Market Averages (Ben Carlson)

Some Surprising Things I’ve Learned in 20 Years of Investing (White Coat)

A Few Thoughts On Diversification Strategies (Fortune Financial)

Do Groups Make Good Decisions? (BI)

Miller Value Partners Q4 2024 Market Commentary (Miller)

Wedgewood Partners Q3 2024 Client Letter – Powell & Co.: Take It Easy(Wedgewood)

This week’s best value Investing news:

Larry Swedroe: An Evidence-Based Look at the Struggles of Value Investing (Excess Returns)

Pzena Investment Management Q3 2024 Commentary (Seeking Alpha)

Domestic stocks with value and momentum from BMO’s chief investment strategist (G&M)

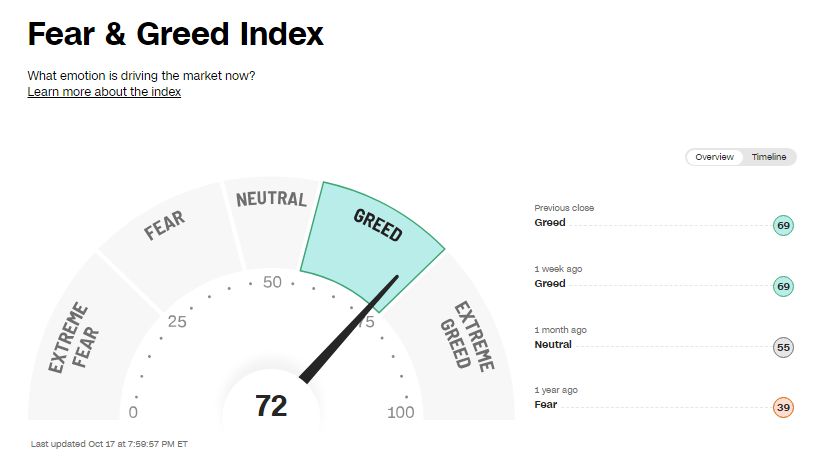

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Owen Lamont on Bubble Fever, Index Gripers & Inefficient Markets (Meb Faber)

Matt Perelman & Alex Sloane – The Art of Franchise Investing (ILTB)

Rob Fraser: How To Build Mental Resilience, Longevity in Career, and Succeed in Any Field (KP)

#40 The Chronicler (Stephen Clapham)

How to Retire: Transition From Saving to Spending (Morningstar)

The Great Rotation: Rethinking US and International Equity Allocations (MOI)

Expert: Sorin Roibu – Alibaba and Baidu to beat Amazon and Google!? (Equity Mates)

Jonathan Clements: ‘Life Is Full of Small Pleasures’ (Long View)

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

The Sahm Rule as a Recession Indicator (AlphaArchitect)

Are Financial Market Indices Actually Diversified? (AllAboutAlpha)

What is volatility telling us at this time? (DSGMV)

Weekly Market Report: Bandwagon Effect (PAL)

This week’s best investing tweet:

The share of Russell 2000 companies with negative earnings continues to rise pic.twitter.com/FyjyMmZEWR

— Win Smart, CFA (@WinfieldSmart) October 15, 2024

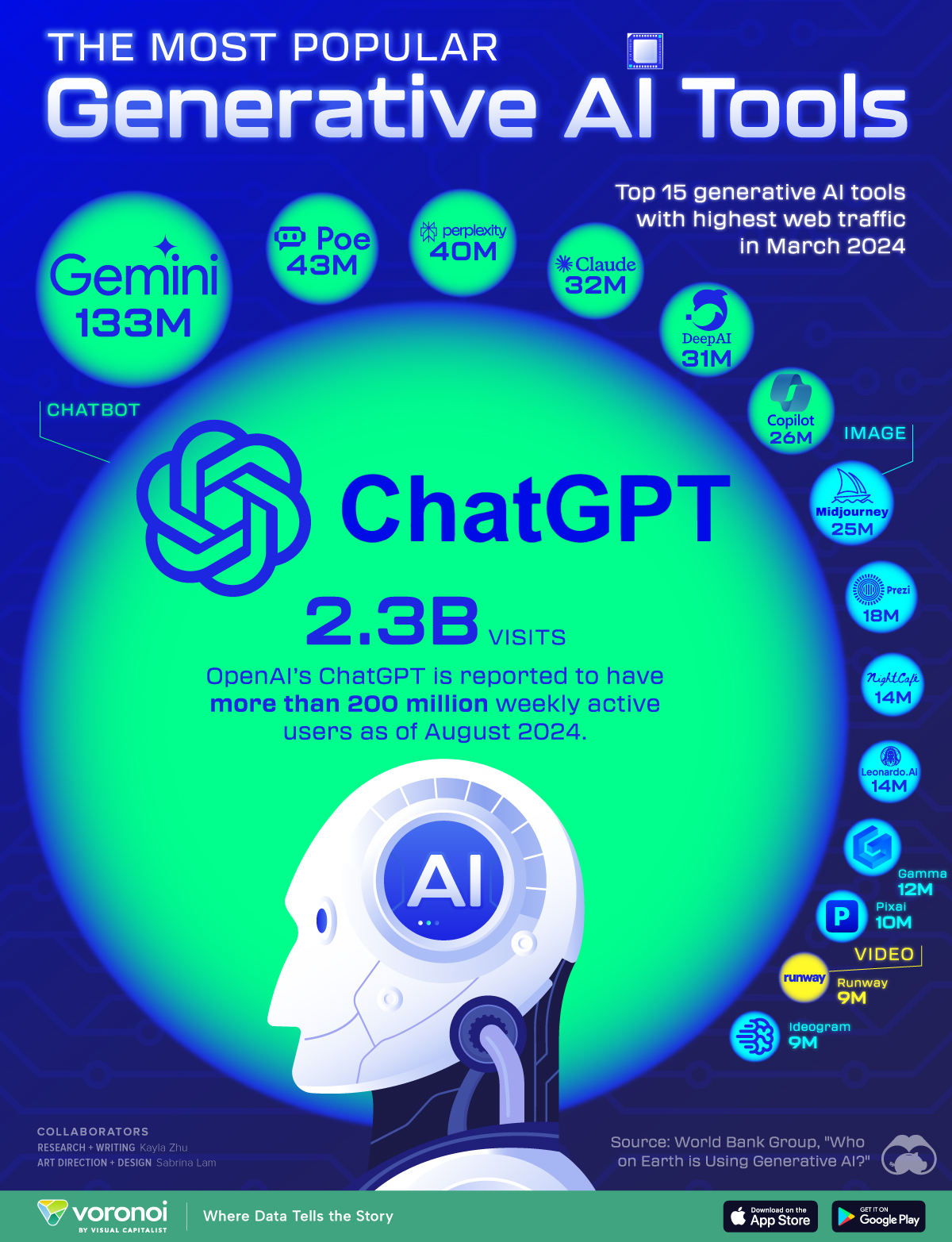

This week’s best investing graphic:

Ranked: The Most Popular Generative AI Tools in 2024 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: