This week’s best investing news:

Terry Smith – Risk VS Reward (TFPL)

Practical Lessons from Chris Davis (Excess Returns)

Rate Cuts: Bonds Back in Play? (Verdad)

Whitney Tilson on lessons learned from knowing Warren Buffett, Charlie Munger & Bill Ackman (WealthTrack)

Aswath Damodaran – Mag 7 companies have shown weak spots in past few months (CNBC)

Are You Betting Against Warren Buffett? (Felder)

An Epic Bull Market (Ben Carlson)

The Share of Companies with Negative Earnings (Apollo)

Generative AI is a Resurrection Machine (Ep Theory)

The Fed’s enormous, unforgivable miss on inflation (Havenstein)

The Crippling and Ever Present Effects of FOMO (Risk of Ruin)

Just do it! Brand Name Lessons from Nike’s Troubles (AD)

Chapter 8 of The Intelligent Investor (Kingswell)

50 Rules Every Stock Investor Should Know (Onveston)

China’s doing very positive things with its economy, says Wharton’s Jeremy Siegel (CNBC)

Boomers Began Investing at 35. Gen Z Started at 19. Think about that. (Josh Brown)

You said you love charts. So here are more charts! (Tker)

Investing in an Age of Distraction (Young Money)

Messing Up the Closest Thing to a Sure Thing in the Stock Market (Jason Zweig)

Kyla Scanlon on Vibecessions & Gen Z (MiB)

Jensen Investment Management: Navigating Current Market Dynamics (Jensen)

This week’s best value Investing news:

Nick Train – The Man Who Never Sells (Value Research)

Validea’s Benjamin Graham Strategy: A Time-Tested Approach to Value Investing (Validea)

As the economy falters, value stocks may prove the safer bet: Analyst (FinNewsWire)

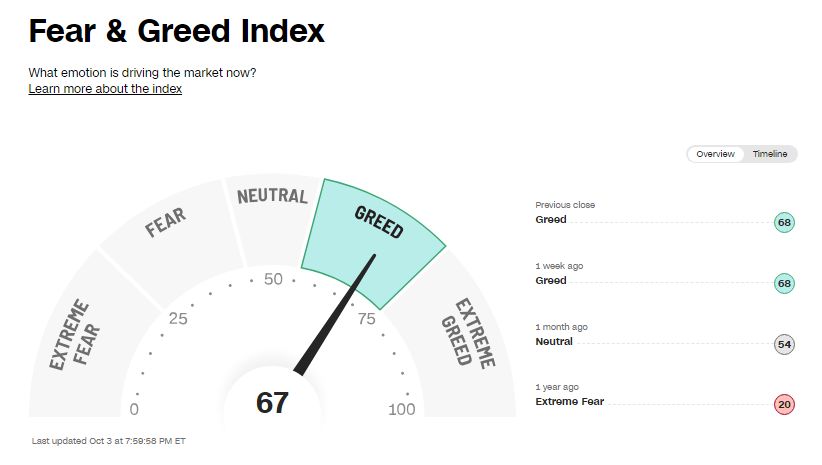

This week’s Fear & Greed Index:

This week’s best investing podcasts:

The Hidden Risk in “Religion” Stocks (Vitaliy Katsenelson)

Investing in a Flows Driven World | Cem Karsan (Excess Returns)

Ray Ozzie – The Future of Intelligent Machines (ILTB)

Phil Ordway Returns to Discuss the Equity Market Environment and Outlook (TWII)

Ted Seides Shares Insights from His Book, Private Equity Deals (MOI)

The Blueberry Billionaire | John Bragg (KP)

David Salem – Investment Wisdom from the Owner’s Box (Capital Allocators)

ASX’s best start since 2013 (Equity Mates)

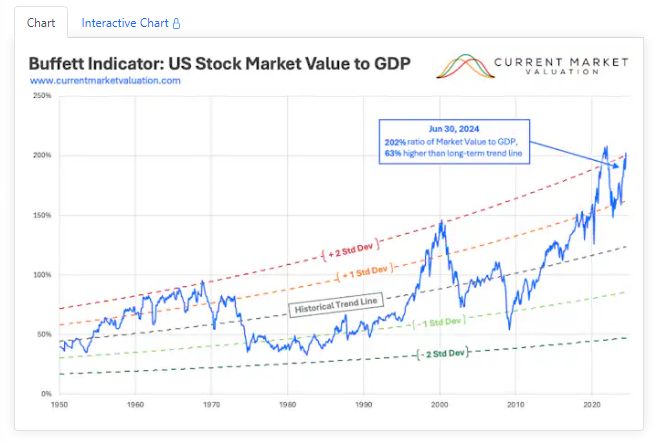

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

DIY Trend-Following Allocations: October 2024 (AlphaArchitect)

What Is Direct Indexing and Why Should You Care? (AllAboutAlpha)

What Determines Consumer Sentiment and Business Confidence? (CFA)

Discretionary versus quant – Tied to the growth value choice (DSGMV)

This week’s best investing tweet:

— Sidecar Investor (@sidecarcap) October 3, 2024

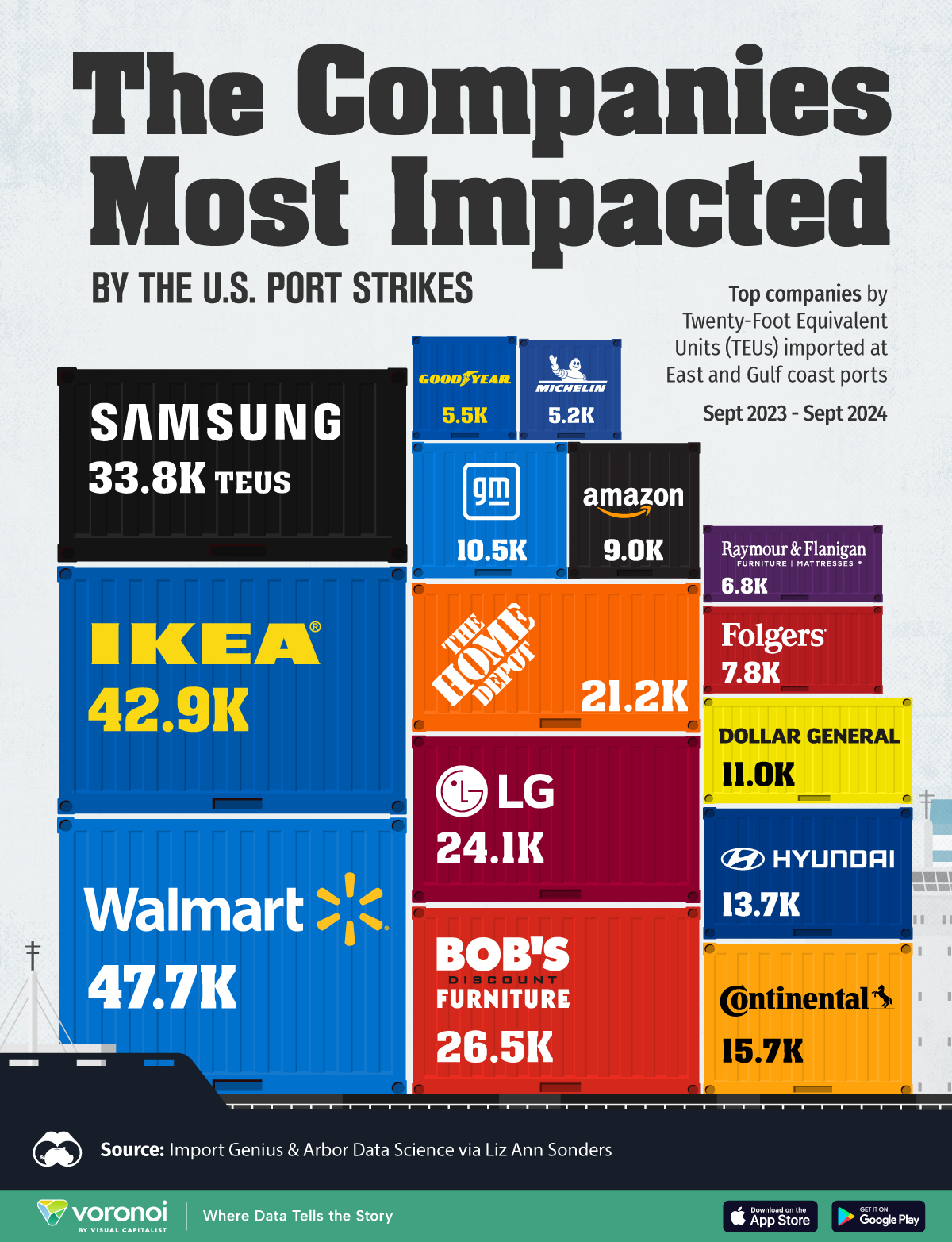

This week’s best investing graphic:

The Companies Most Exposed to the U.S. Port Strike (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: