As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Mastercard Inc (MA).

Profile

Mastercard is the second-largest payment processor in the world, having processed close to over $9 trillion in volume during 2023. Mastercard operates in over 200 countries and processes transactions in over 150 currencies.

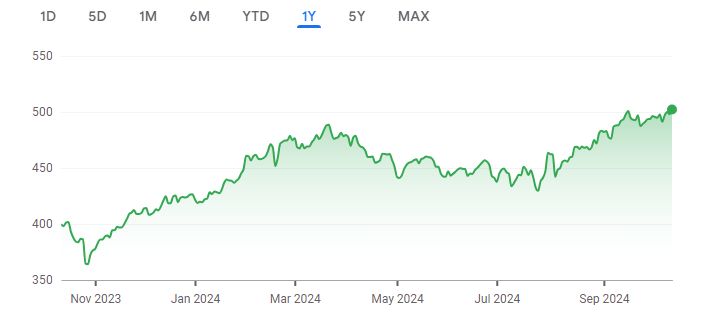

Recent Performance

Over the past twelve months the share price is up 25.60%.

Source: Google Finance

Inputs

- Discount Rate: 8%

- Terminal Growth Rate: 2%

- WACC: 8%

Forecasted Free Cash Flows (FCFs)

| Year | FCF (billions) | PV(billions) |

| 2024 | 12.51 | 11.58 |

| 2025 | 13.91 | 11.93 |

| 2026 | 15.46 | 12.27 |

| 2027 | 17.19 | 12.64 |

| 2028 | 19.11 | 13.01 |

Terminal Value

Terminal Value = FCF * (1 + g) / (r – g) = 324.87 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 221.10 billion

Present Value of Free Cash Flows

Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 61.42 billion

Enterprise Value

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 282.52billion

Net Debt

Net Debt = Total Debt – Total Cash = 8.25 billion

Equity Value

Equity Value = Enterprise Value – Net Debt = 274.27 billion

Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $299.43

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $299.43 | $502.26 | -67.74% |

Based on the DCF valuation, the stock is overvalued. The DCF value of $299.43 share is lower than the current market price of $502.26. The Margin of Safety is -67.74%.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

One Comment on “Mastercard Inc (MA) DCF Valuation: Is The Stock Undervalued?”

Good Day,

In the article entitled “Mastercard Inc (MA) DCF Valuation: Is The Stock Undervalued?” dated Oct. 24th, 2024, we can read that:

” Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $299.43 ” .

Since the result of this calculation is being compared to the share price ($502.26) which is the equity share price, should the above equation use “Equity Value” instead of “Entreprise Value”?

Thank you in advance

Regards

M. Charbonneau