As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals.

One of the cheapest stocks in our Stock Screeners is:

Verizon Communications Inc (VZ)

Wireless services account for about 70% of Verizon Communications’ total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 21 million prepaid phone customers (following the acquisition of Tracfone) via its nationwide network, making it the largest US wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 29 million homes and businesses and serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers’ networks.

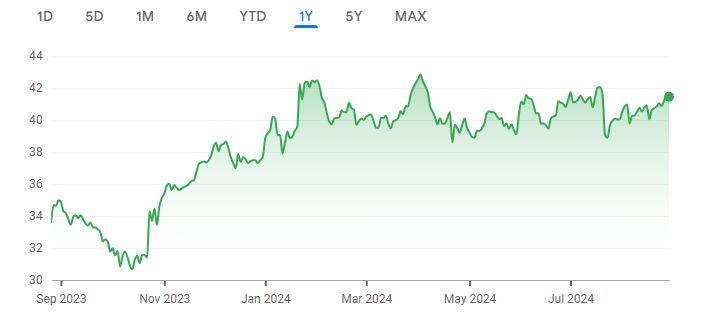

A quick look at the share price history (below) over the past twelve months shows that the price is up 23.55%. Here’s why the company is undervalued.

Source: Google Finance

Key Stats

Market Cap: $174.48 Billion

Enterprise Value: $345.05 Billion

Operating Earnings

Operating Earnings: $29.47 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 11.70

Free Cash Flow (TTM)

Free Cash Flow: $13.93 Billion

FCF/MC Yield %:

FCF/MC Yield: 7.98

Shareholder Yield %:

Shareholder Yield: 6.40

Other Indicators

Piotroski F Score: 5.00

Dividend Yield %: 6.40

ROA (5 Year Avge%): 8

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: