This week’s best investing news:

Top Takeaways from Oaktree’s Quarterly Letters – September 2024 Edition (OakTree)

AQR’s Cliff Asness on Stocks Value Gap, Nvidia, ‘Inefficient’ Markets (Bloomberg)

Guy Spier – Outperforming The S&P500, Building Wealth & Managing Risk (Guy Spier)

The Great Rotation (Part 2) (Verdad)

Calgary Herald interview with Berkshire’s Greg Abel (CH)

The Shiller P/E Ratio: What It Means in the Real World (Validea)

Bill Nygren Interview with Stephen Clapham (Behind the Balance Sheet)

John Rogers on How You Can Still Win With Value Investing (Bloomberg)

Appaloosa’s David Tepper explains why he’s not buying Nvidia on the dip here (CNBC)

China’s Ray Dalio Troubles Are Only Just Beginning (Forbes)

The Fed Wants Your Cost of Living to Go Up (Havenstein)

Lessons for investors from Henry Singleton, the greatest capital allocator of all time (MOI)

Short Term Investing is a Long Shot (BI)

Leon Cooperman on his favorite holdings (CNBC)

Never Quite Enough (HumbleDollar)

Practical Lessons from Michael Mauboussin (Excess Returns)

Royce – Four Key Holdings in Our Small-Cap Opportunistic Value Strategy (Royce)

Lose All Your Money (Rubin Miller)

The Dangers of Storytelling in Investing (Safal)

Retail Investors Won on Fees But Are Losing on Risk (WealthManagement)

Was Jack Bogle Right About Smart Beta All Along? (Morningstar)

Contrarians Everywhere, Contrarians Nowhere (RiskofRuin)

Aswath Damodaran – Fed up with Fed Talk? Factchecking Central Banking Fairy Tales! (Musings)

Solving the Mystery of an Investment That’s Too Good to Be True (Jason Zweig)

MiB: Victor Khosla, Strategic Value Partners (MiB)

Observations: Learned & Earned, on the 100-BAGGER Portfolio Return (Gnostic)

This week’s best value Investing news:

2024 Seminar on Value Investing and the Search for Value Guest Speaker: Lorne Steinberg (Ivey)

Value Investing Is Still Possible in Today’s Bloated Market (Stansberry)

Investors are gravitating to value stocks after Fed rate cut: Sam Stovall (Fox)

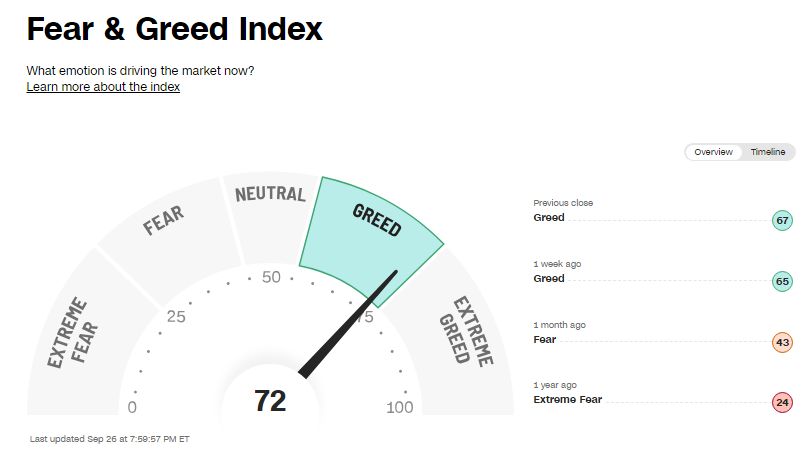

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Why Invest Outside the US (Pzena)

Tiger Cub Rob Citrone on Milei’s Argentina (Meb Faber)

Investor John Paulson & A 200% Tariff Threat 09/24/24 (CNBC)

Mike Alkin – Talking Uranium (BusinessBrew)

Ted Seides – Investment Industry Paradigms (ILTB)

How to Retire: Stay Flexible with Your Retirement Spending (Morningstar)

50 Trades in 50 Weeks | Brent Donnelly (Excess Returns)

#39 The Optimizer (Stephen Clapham)

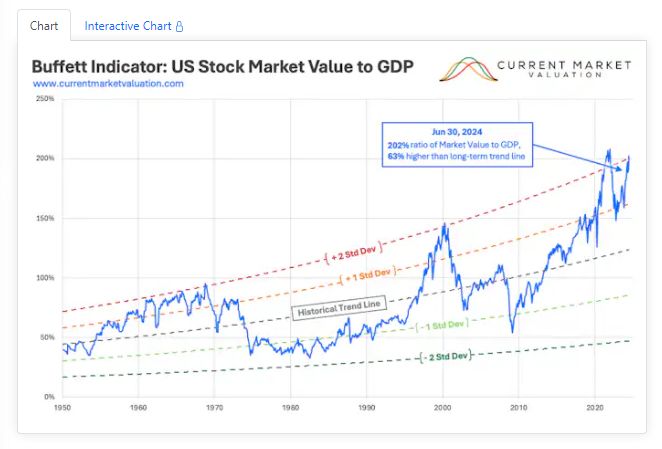

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Data-driven Approach to Clustering Similar Macroeconomic Regimes (AlphaArchitect)

Equal Versus Fair (AllAboutAlpha)

Whatever happened to the average inflation rate policy? (DSGMV)

Interest Rate Volatility: Measures and Implications (PAL)

So, You Want to be an Investment Consultant? (CFA)

This week’s best investing tweet:

New article is out!

“CapEx to Cash Flow Ratio: Why is no investor using this valuation hack?”

Tagging some accounts that might appreciate uncommon methods: @Quant_Kurtis @XDays @ValueStockGeek @DividendGrowth @marketplunger1 @Greenbackd

Link:https://t.co/i6QWCB7R1l pic.twitter.com/q6g8baAR7T

— The Onveston Letter (@onveston) September 24, 2024

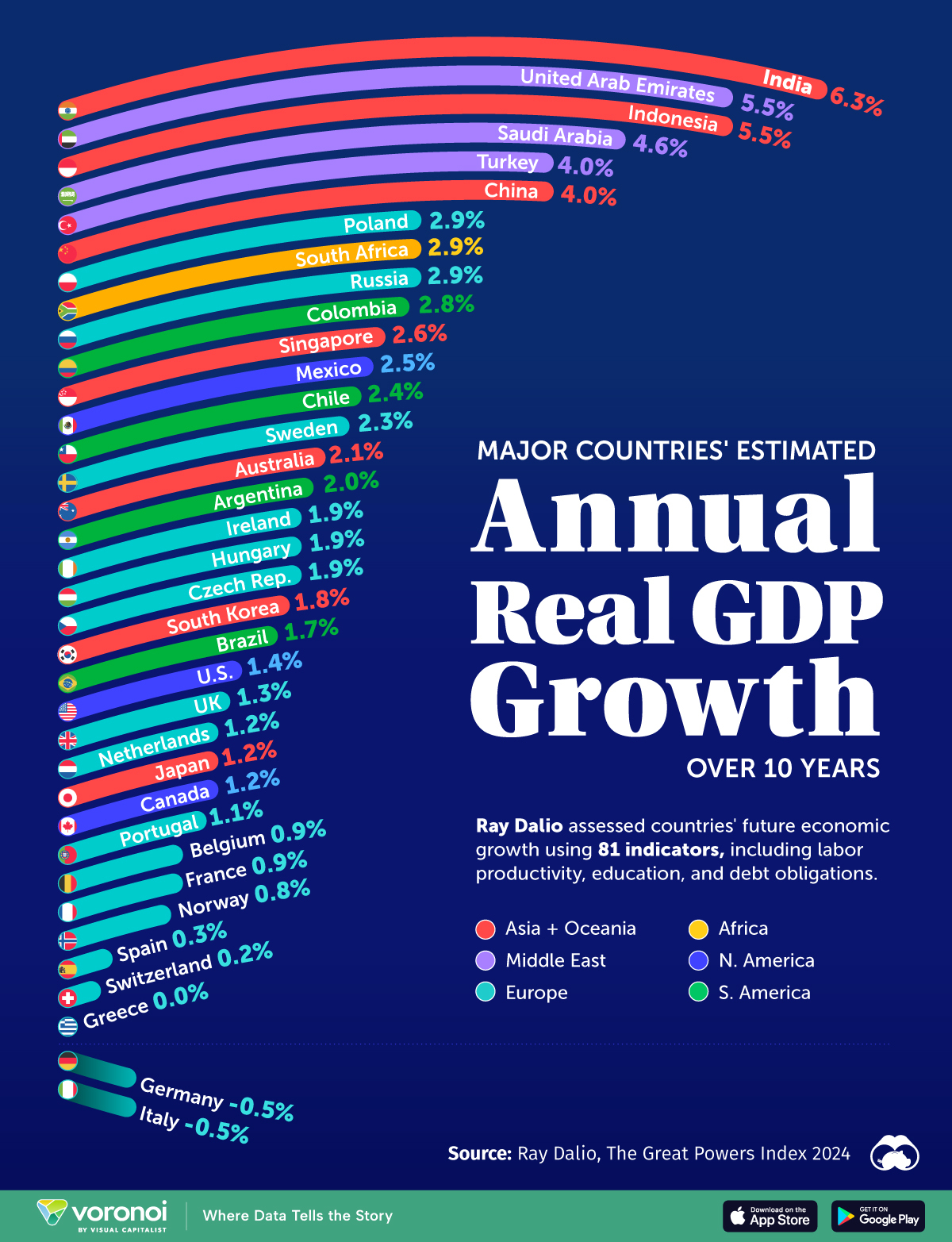

This week’s best investing graphic:

Ranked: Average GDP Growth Rates for the Next 10 Years, by Country (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: