This week’s best investing news:

Howard Marks Memo – Shall We Repeal The Laws of Economics? (OakTree)

Mohnish Pabrai’s keynote address at TiECON Southwest (MP)

Terry Smith – Fundsmith – Dubai Eye Business Breakfast interview (DE)

Forecastability and Portfolio Optimization (Verdad)

GMO Commentary: The What-Why-When-How Guide to Owning Emerging Debt (GMO)

Guy Spier – Building a Robust Investment Strategy: Insights from Tobias Carlisle (Guy Spier)

The Most Important Edge in Investing: Patience (Validea)

Bill Nygren On Value And Growth Investing (RIA)

FMQ 2024: A Conversation with Jamie Dimon (Psaros Center)

Jeremy Siegel – The real economic indicators are holding at a moderate rate (CNBC)

Growth Isn’t Enough (HumbleDollar)

What’s Left to Be ETF’d? (Jason Zweig)

The ETF Market: A Zine (Ep Theory)

Persistence Pays – Matthew McLennan and Kimball Brooker of First Eagle Investments (VI Insight)

Take Something Away (Collab Fund)

Conversations: The Changing Face of Private Credit at Oaktree Conference 2024 (OakTree)

Invest Like a Stoic: Focus on the Best and Ignore the Rest (DF)

Should You Ignore Past Stock Market Returns? (Morningstar)

Some Things Never Change: The Timeless Teachings of Warren Buffett (Kingswell)

GIC and Bridgewater Identify the Major Issues Facing Investors in the Years Ahead (Bridgewater)

MiB: David Rubenstein, The Carlyle Group (MiB)

Why Should You Care When Stocks Plunge? (AP)

When You Should Invest More in Alternatives (Morningstar)

What Happens to the Money Market Cash on the Sidelines? (Ben Carlson)

Eleven Predictions: Here’s What AI Does Next (HB)

No, Casino Gambling Isn’t More Lucrative Than Day Trading (Morningstar)

The Optimism Trap: How We Misjudge Risk and Rewards (Safal)

Brookfield Corporation: 2024 Investor Day Presentation (Brookfield)

Laughing Water Capital Q2 2024 (LWC)

This week’s best value Investing news:

Reports Of Value Investing’s Death Are Greatly Exaggerated (Felder)

Fifty Years of Value Investing, Benjamin Graham, and the Future of Common Stocks (Brandes)

Fund Managers Highlight Four Under-The-Radar Value Stocks For Q3 2024 (Forbes)

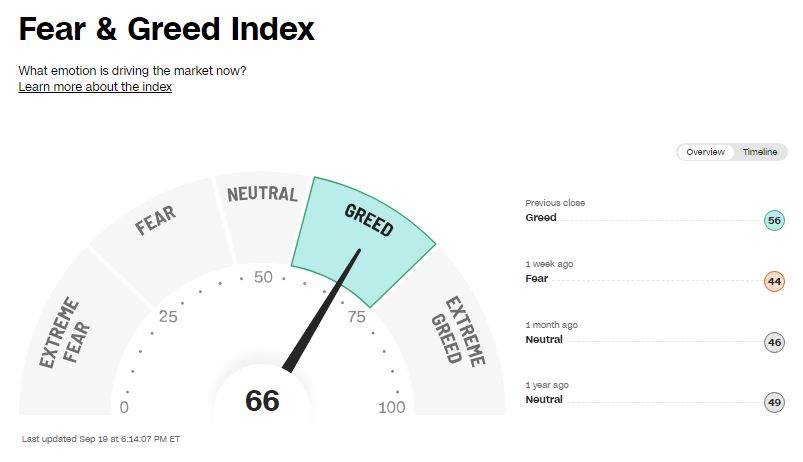

This week’s Fear & Greed Index:

This week’s best investing podcasts:

The Cockroach Approach and the Art of Portfolio Construction (PlanetMicroCap)

The Mac and Cheese Millionaire (KnowledgeProject)

How to Retire: Understand the Role of Working Longer (Morningstar)

The Three Sectors Investors Are Flocking to Today (Stansberry)

The Best and Worst Investment Decisions I’ve Made (VK)

What Regular Investors Need to Know About Options Flows (Excess Returns)

Drew Estes, CFA: Investing through an Evolutionary Lens (EI)

The Hidden Lessons from Monster Beverage Corporation (MicroCapClub)

Ric Elias – The Art of Living Well (ILTB)

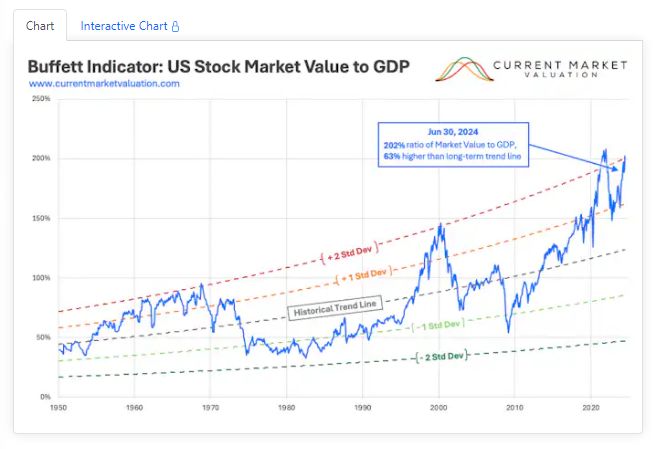

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

How to Think About Risk: Howard Marks’ s Comprehensive Guide (CFA)

Trend-Following Filters – Part 8 (AlphaArchitect)

Sharpe & Sortino – Does It Matter? (AllAboutAlpha)

This week’s best investing tweet:

Guy is a gentleman. This was a fun and interesting chat. https://t.co/gQr0fGMF3V

— Tobias Carlisle (@Greenbackd) September 18, 2024

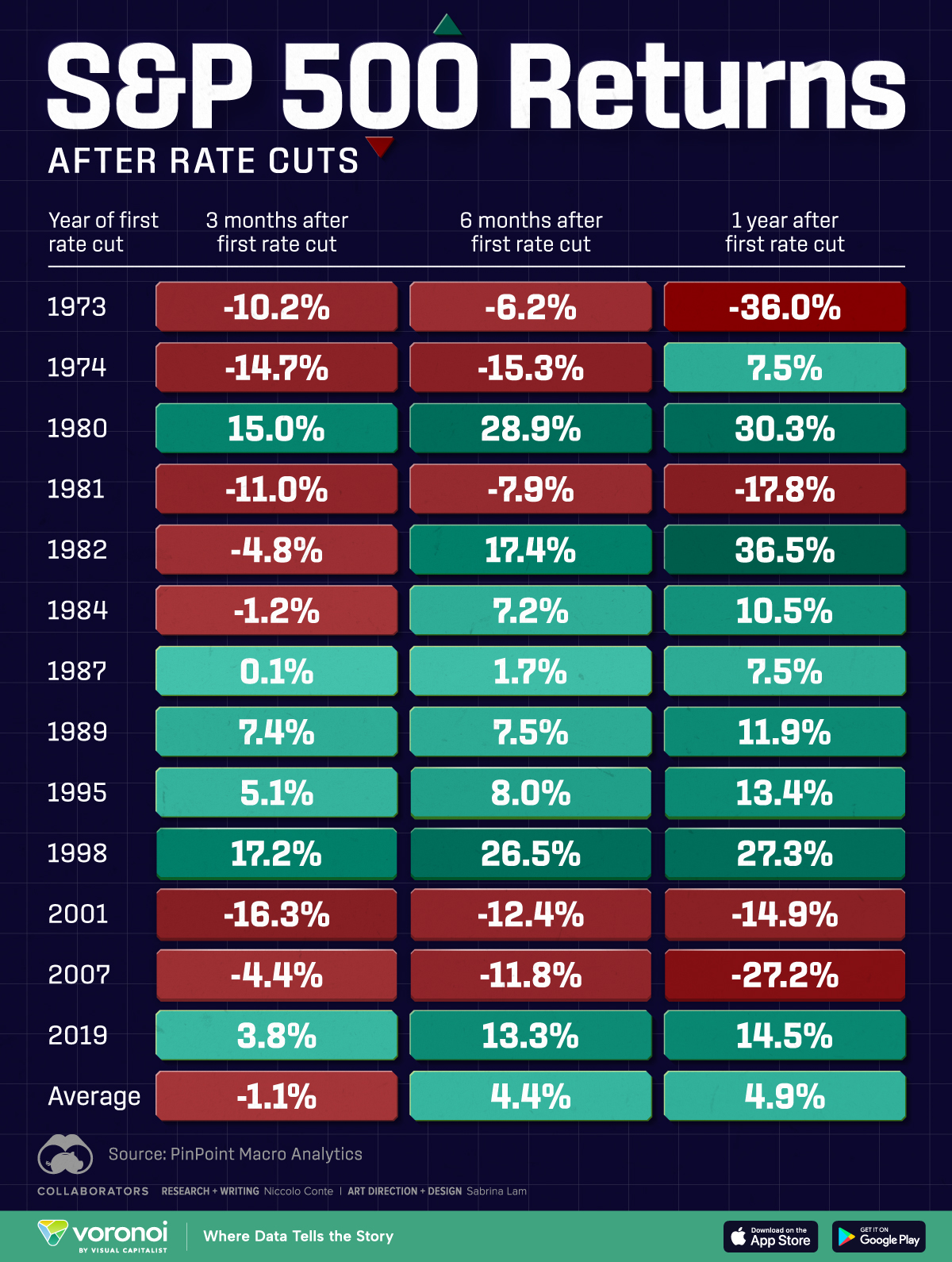

This week’s best investing graphic:

Visualizing S&P 500 Returns After Interest Rate Cuts (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: