This week’s best investing news:

Howard Marks: How to Think About Risk (OakTree)

Ray Dalio – Great Powers Index 2024: The Most Important Facts and Charts (LinkIn)

Diversifying Equity Portfolios (Verdad)

Whitney Tilson on lessons learned from knowing Warren Buffett, Charlie Munger & Bill Ackman (WealthTrack)

Guy Spier – Becoming Antifragile: How To Navigate Chaos, Hard Times & A Financial Crisis (GS)

Berkshire’s way of investing (Morningstar)

Finding Wide Moat Stocks: A Qualitative and Quantitative Guide (Validea)

Howard Marks on investing: Hold long and fail smart (SHM)

When Chasing More Dividends Leaves You With Less (Jason Zweig)

The Macro Winds Are Shifting (Felder)

Aswath Damodaran – The Power of Expectations: Nvidia’s Earnings Report and Market Reaction (AD)

Is the Stock Market Tipping Over? (Ben Carlson)

False Comparisons (Humble Dollar)

Learning From Peter Keefe (Masters Invest)

Before the Deluge, Part 2 (Rudy Havenstein)

Why This Wall Street Firm Wants Its Traders to Play Poker (WSJ)

Boating Season Is Over, but Don’t Overlook These Recreational Vehicle Stocks (Morningstar)

Yield Pigs, Durability Value, & Diversification (Investment Talk)

Aswath Damodaran – Dealing with Decline: Intel, Walgreens and Starbucks put to the test! (AD)

Investing Update: Is This As Good As It Gets? (Spilled Coffee)

Let’s Not Sugar Coat It – Risks Are Rising (Carson)

The Definitive Playbook for Election-Year Investing (DM)

One Bargain You Can’t Find at Costco Is Its Stock—Does That Matter? (WSJ)

MiB: Mike Wilson, Morgan Stanley (MiB)

Peter Lynch on Big Winners and Patience (DGI)

Davis Funds 2024 Fall Review (Davis)

First Eagle Investments: Summertime Observations (FEIM)

This week’s best value Investing news:

Will Value Stocks Finally Take the Lead? (finews)

Uncovering Hidden Value in Overlooked Small-Cap Companies (AM)

Value stocks outperform this quarter as growth equities struggle in ‘downtrend’ (MarketWatch)

10 U.S. value stocks in outperforming sectors (G&M)

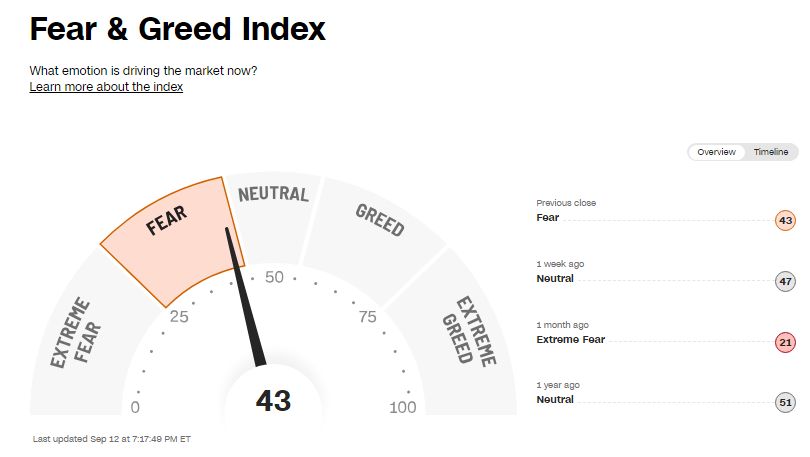

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Nelrae Pasha Ali: How to Teach Teens About Money and Investing (Barron’s)

Why Index Investing: Because indexes are forever | iShares by BlackRock (Equity Mates)

The Case for a Roaring 2020s | Ed Yardeni (Excess Returns)

Alex Smith, Shane Battier, & Ravi Gupta – What Makes A Glue Guy? (ILTB)

MacroVoices #445 Jim Bianco: Still No Landing, and Inflation is Not Transitory (MV)

Judas Goat (MicroCapClub)

Dylan Morello – Raging Bull (Business Brew)

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Adding Leveraged, Long-Short Factor Strategies to Improve Tax Alpha (AlphaArchitect)

The Impact of Passive Investing on Short Sellers (AllAboutAlpha)

Distress Investing: Crime Scene Investigation (CFA)

The Kahneman legacy (DSGMV)

Two Indicators Spell Trouble for the Stock Market (PAL)

This week’s best investing tweet:

This is Ted Weschler’s last letter at Peninsula Capital Advisors before he left to work at Berkshire Hathaway . pic.twitter.com/MxhjhpzAyc

— Finding Compounders (@F_Compounders) September 5, 2024

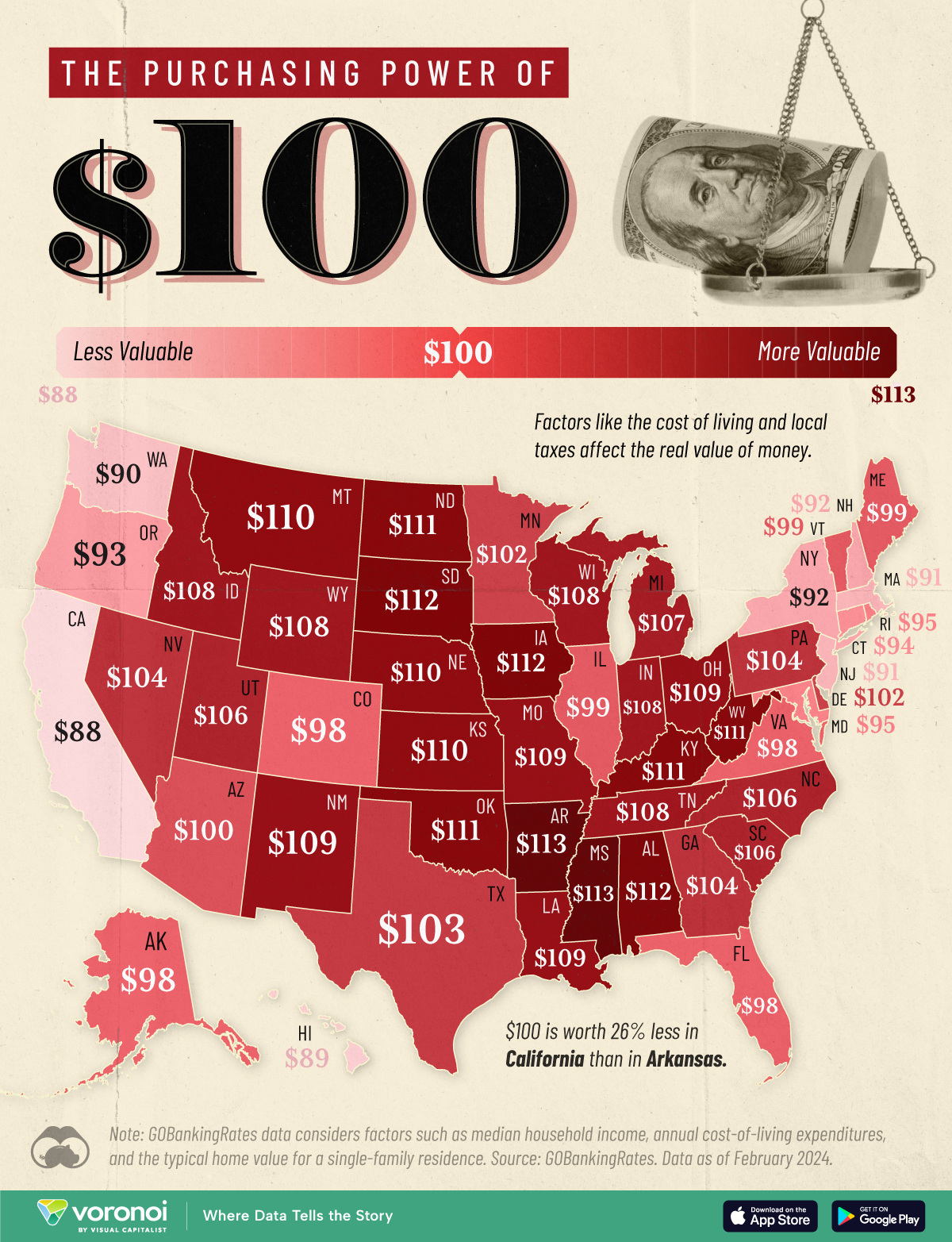

This week’s best investing graphic:

Mapped: The Purchasing Power of $100 in Each U.S. State (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: