As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks.

While doing this research we’ve also uncovered a number of stocks that superinvestors have sold, or reduced in their portfolios, according to their latest 13f’s. So we’re now providing a new weekly feature article called ‘One Stock Superinvestors Are Selling‘. This week we’ll take a look at:

Oracle Corp (ORCL)

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

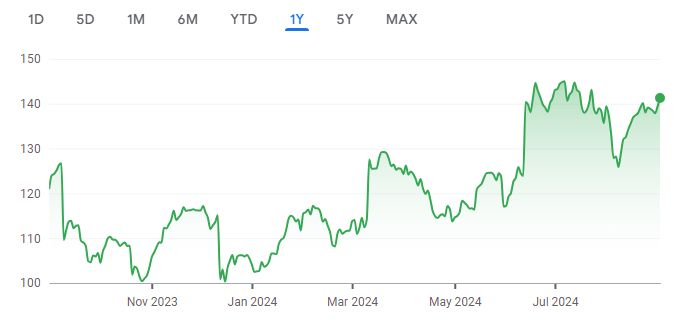

A quick look at the price chart below for the company shows us that the stock is up 16.84% in the past twelve months.

Source: Google Finance

Superinvestors who reduced, or sold out of the company’s stock, according to their latest 13Fs, include:

(Remaining shares)

Ken Fisher – 17,587,320

Jean-Marie Eveillard – 14,128,774

David Tepper – 2,000,000

Israel Englander – 968,029

Donald Yacktman – 883,535

Ken Griffin – 666,722

Cliff Asness – 285,038

Wally Weitz – 214,700

Joel Greenblatt – 84,077

John Rogers – 60,420

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

2 Comments on “The One Stock That Superinvestors Are Dumping: Is It Time to Sell?”

This is confusing and unclear to me.

Is this the number of shares they sold, the number of shares they are still holding onto?

Without two numbers I don’t see how the data has value.

If they had 2mil shares and now have zero, then that needs to be clearly shown, otherwise there is no valuable information here.

Example:

Ken Fisher – 17,587,320 sold, zero still held

OR

Ken Fisher – 3,000,000 sold, 17,587,320 still held

This is objective and usable information and gives weight to your comments.

Thank you for your time.

Thanks for your comment.

The data includes only the number of shares remaining in the investor’s portfolio after they sold the stock, according to their latest 13f.

You will notice the heading shows (Remaining shares). E.g. David Tepper – 2,000,000 (Remaining shares).