As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals.

One of the cheapest stocks in our Stock Screeners is:

Philip Morris International Inc (PM)

Created from the international operations of Altria in 2008, Philip Morris International sells cigarettes and reduced-risk products, including heatsticks, vapes, and oral nicotine offerings primarily outside of the US. With the 2022 acquisition of Swedish Match, a leading manufacturer of traditional oral tobacco products and nicotine pouches primarily in the US and Scandinavia, PMI has not only diversified away from smokeable products but also gained a toehold into the US to sell its iQOS heatsticks.

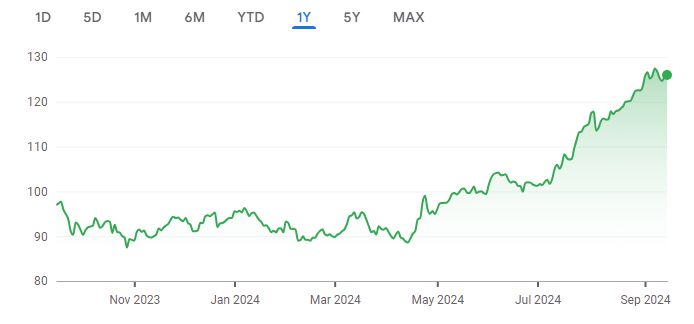

A quick look at the share price history (below) over the past twelve months shows that the price is up 29.92%. Here’s why the company is undervalued.

Source: Google Finance

Key Stats

Market Cap: $195.85 Billion

Enterprise Value: $241.92 Billion

Operating Earnings

Operating Earnings: $13.65 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 17.70

Free Cash Flow (TTM)

Free Cash Flow: $10.12 Billion

FCF/MC Yield %:

FCF/MC Yield: 5.17

Shareholder Yield %:

Shareholder Yield: 4.10

Other Indicators

Piotroski F Score: 6.00

Dividend Yield %: 4.10

ROA (5 Year Avge%): 21

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: