As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals.

One of the cheapest stocks in our Stock Screeners is:

Liberty Media Corp Series C (LSXMK)

Liberty SiriusXM Group through its subsidiary holding is engaged in providing a subscription-based satellite radio service. It transmits music, sports, entertainment, comedy, talk, news, traffic, and weather channels, as well as infotainment services. The firm’s segments include Sirius XM Holdings, Formula 1, and Braves Group. The company distributes its satellite radios through automakers and rental car companies, as well as through its retail locations and Website; and satellite radio services to various automaker customers. Geographically it offers services in the region of the US and UK.

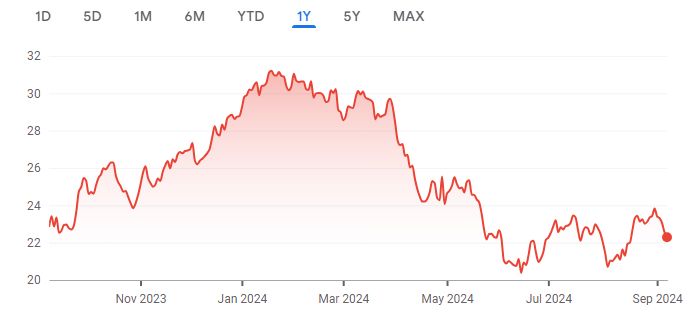

A quick look at the share price history (below) over the past twelve months shows that the price is down 2.37%. Here’s why the company is undervalued.

Source: Google Finance

Key Stats

Market Cap: $7.28 Billion

Enterprise Value: $21.03 Billion

Operating Earnings

Operating Earnings: $1.93 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 10.90

Free Cash Flow (TTM)

Free Cash Flow: $1.06 Billion

FCF/MC Yield %:

FCF/MC Yield: 15.95

Shareholder Yield %:

Shareholder Yield: 3.40

Other Indicators

Piotroski F Score: 7.00

Buyback Yield %: 2.90

ROA (5 Year Avge%): 6

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: