As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Eli Lilly and Co (LLY).

Profile

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly’s key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

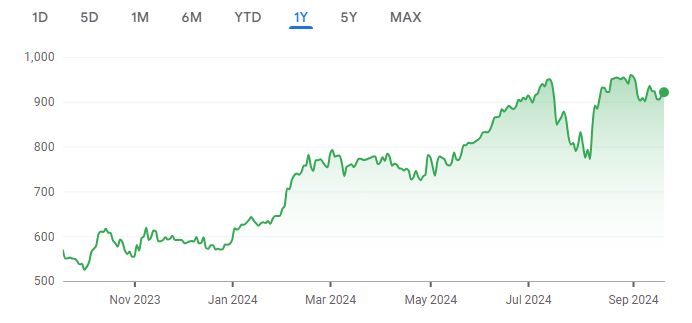

Recent Performance

Over the past twelve months the share price is up 61.77%.

Source: Google Finance

Inputs

- Discount Rate: 5%

- Terminal Growth Rate: 4%

- WACC: 5%

Forecasted Free Cash Flows (FCFs)

| Year | FCF (billions) | PV(billions) |

| 2024 | 4.54 | 4.32 |

| 2025 | 5.06 | 4.59 |

| 2026 | 5.64 | 4.87 |

| 2027 | 6.28 | 5.17 |

| 2028 | 7 | 5.48 |

Terminal Value

Terminal Value = FCF * (1 + g) / (r – g) = 728.00 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 570.41 billion

Present Value of Free Cash Flows

Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 24.44 billion

Enterprise Value

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 594.84 billion

Net Debt

Net Debt = Total Debt – Total Cash = 25.53 billion

Equity Value

Equity Value = Enterprise Value – Net Debt = 569.31 billion

Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $632.57

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $632.57 | $921.49 |

-45.67% |

Based on the DCF valuation, the stock is overvalued. The DCF value of $632.57 share is lower than the current market price of $921.49. The Margin of Safety is -45.67%.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: