As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals.

One of the cheapest stocks in our Stock Screeners is:

HCA Healthcare Inc (HCA)

HCA Healthcare is a Nashville-based healthcare provider organization operating the largest collection of acute-care hospitals in the United States. As of June 2024, the firm owned and operated 188 hospitals, 123 freestanding outpatient surgery centers, and a broad network of physician offices, urgent-care clinics, and freestanding emergency rooms across 20 states and a small foothold in England.

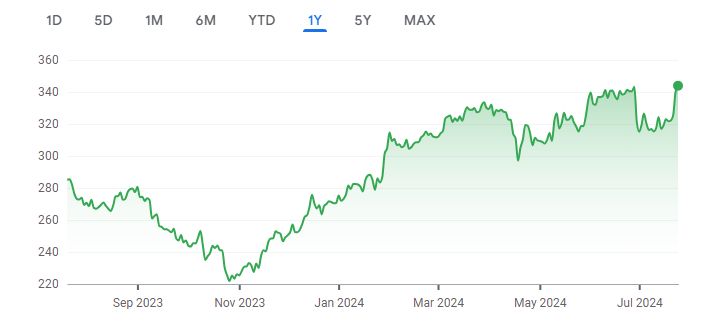

A quick look at the share price history (below) over the past twelve months shows that the price is up 20.60%. Here’s why the company is undervalued.

Source: Google Finance

Key Stats

Market Cap: $90.53 Billion

Enterprise Value: $134.39 Billion

Operating Earnings

Operating Earnings: $9.75 Million

Acquirer’s Multiple

Acquirer’s Multiple: 13.80

Free Cash Flow (TTM)

Free Cash Flow: $5.43 Billion

FCF/MC Yield %:

FCF/MC Yield: 6

Shareholder Yield %:

Shareholder Yield: 5.30

Other Indicators

Piotroski F Score: 7.00

Buyback Yield %: 4.60

ROA (5 Year Avge%): 17

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: