This week’s best investing news:

David Einhorn – Greenlight Capital Q2 2024 Letter (Greenlight)

Activism at Scale in Japan (Verdad)

Oakmark – International equities: Avoiding value traps (Oakmark)

Guy Spier Track Record | Investing Risk | VALUEx (TIP)

Five Fundamentally Sound Dividend Aristocrats (Validea)

Howard Marks Memo – Mr. Market Miscalculates (OakTree)

Pershing Square 2024 Interim Report (PS)

ATM: Aswath Damodaran on the LifeCycles of Companies (Barry Ritholz)

The Skills of Stock Picking by Ian Cassel (MicroCapClub)

Pandemic Darlings That Never Bounced Back (Investment Talk)

Howard Marks Memos: Finding Fewer Losers and More Winners (Millennial Investing)

The CEO Who Made a Fortune While His Hospital Chain Collapsed (WSJ)

Google’s Summer Of Reckoning: A Wake-up Call For Big Tech (BW)

15 Ways to Lose Money in the Markets (Ben Carlson)

Carl Icahn charged with hiding billions in loans (CNN)

Long Win Streaks Happen in Bull Markets (Carson)

‘Nothing Ado About Much’ (Felder)

A Number From Today and A Story About Tomorrow (Morgan Housel)

A Cautionary Tale of Forecasting (Novel)

Insider Trading by Other Means (SSRN)

Avoiding Bad Guys (Humble Dollar)

119 Great Investors Share the One Lesson They Would Teach the Average Investor (Excess Returns)

Why Disney+ Has Succeeded While Other Netflix Rivals Struggle (Vulture)

Seth Klarman’s Baupost Group cuts stake in Alphabet and snaps up Humana (Morningstar)

MiB: Mike Green, Simplify Asset Management (MiB)

Markel Group Second Quarter 2024 Earnings Call Transcript (InsuranceNewsNet)

This week’s best value Investing news:

The Eclectic Value Investor – Ep 229 (Vitaliy Katsenelson)

Tim Travis: Deep Value, Options, and Distressed Investing (SA)

Value Investing: The Case as Rate Cuts Appear Closer Than Ever (VettaFi)

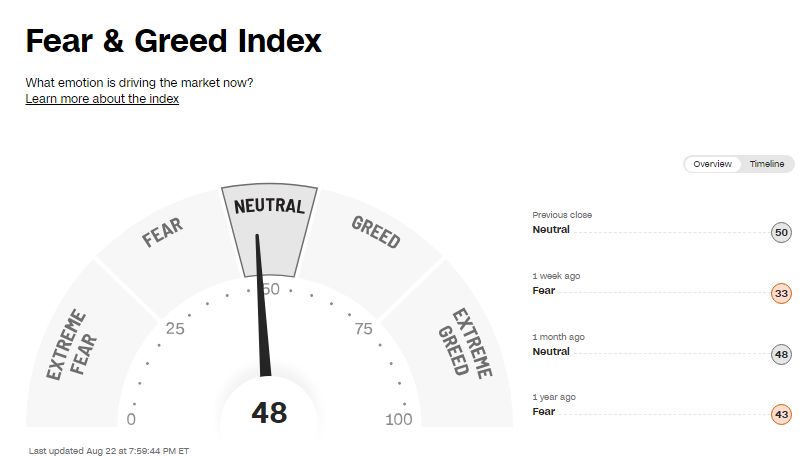

This week’s Fear & Greed Index:

This week’s best investing podcasts:

#2190 – Peter Thiel (Joe Rogan)

Why Index Investing: You don’t miss out on growth (Equity Mates)

A Conversation with Charlie Munger & John Collison- REPLAY (ILTB)

Richard Cook – Traversing For Value (Business Brew)

Challenging “Stocks for the Long Run” with Jason Buck (Excess Returns)

#201 April Dunford: Perfecting Your Product’s Positioning (KP)

Too Many Investment Accounts? Here’s How to Reduce the Clutter (Investing Insights)

Is Modern Capitalism Broken? | Patrick Boyle (Hidden Forces)

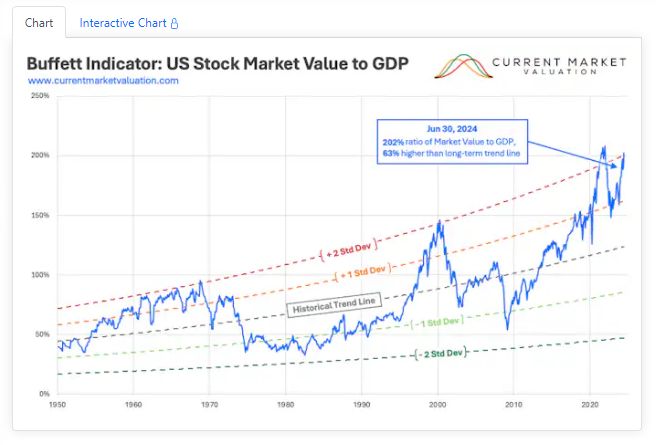

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Fixing the poor performance of the book-to-market ratio (AlphaArchitect)

No Correction without Stocks Falling in Price (AllStarCharts)

From Darwin to Wall Street: Harnessing Evolutionary Theory for Smarter Investments (CFA)

An Introduction to Carry Strategies (AllAboutAlpha)

Sector performance comes and goes – Prepare for mean revisions (DSGMV)

This week’s best investing tweet:

Like The Economist’s burgernomics index for purchasing power parity, the Rolex index offers an interesting insight into the top-end consumer.

The chart shows the same spike-and-collapse pattern observable over the last five years in everything from meme stocks to real estate to… pic.twitter.com/ADPnaNKyuJ

— Tobias Carlisle (@Greenbackd) August 22, 2024

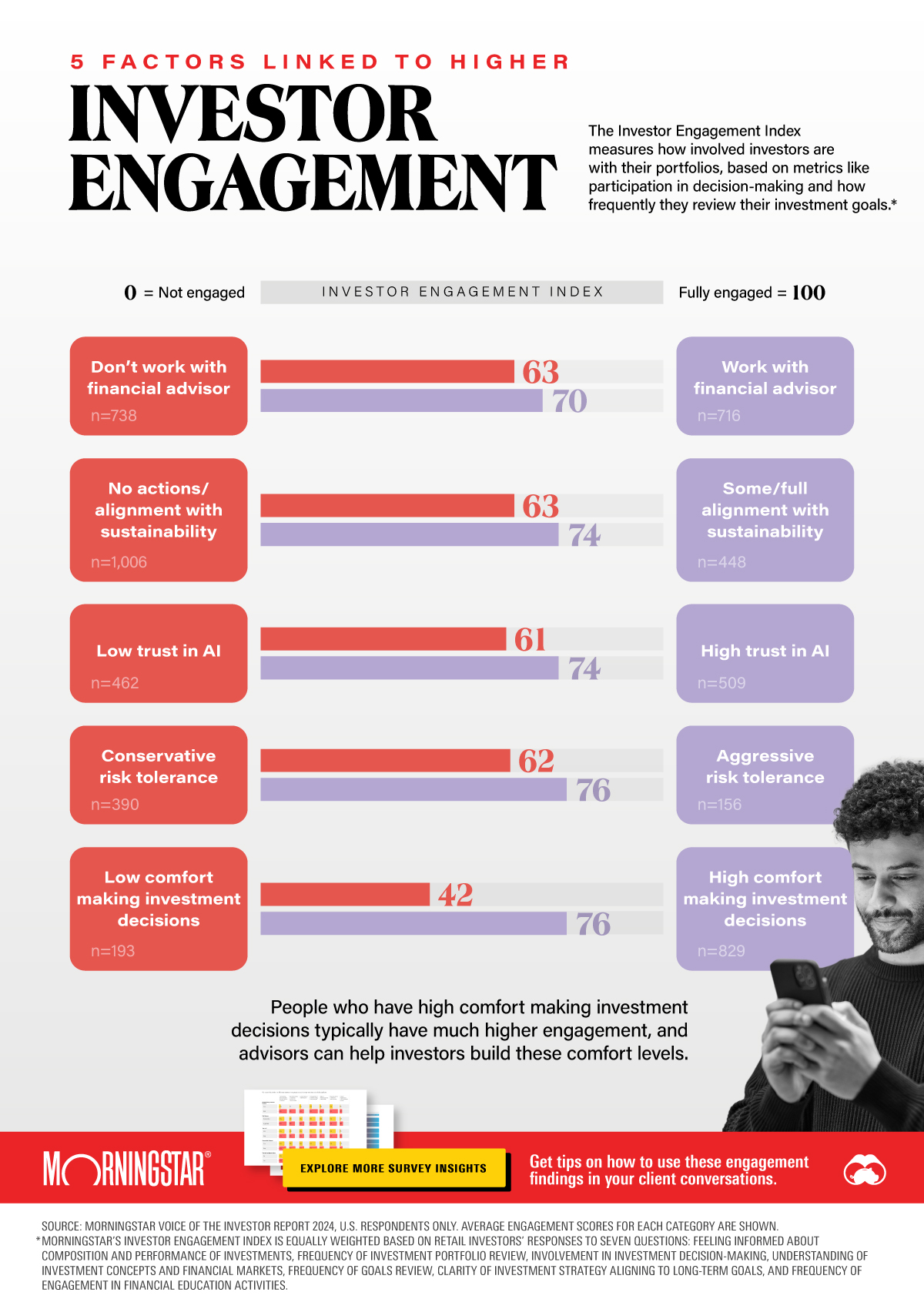

This week’s best investing graphic:

5 Factors Linked to Higher Investor Engagement (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: