This week’s best investing news:

Navigating the Sea Change with Howard Marks (Oaktree Conference 2024)

Mohnish Pabrai’s Session with YPO Delhi (MP)

Bill Nygren – Where to find value in the market (CNBC)

Berkshire Hathaway’s Parabolically-Growing Cash Pile (Felder)

On the Brink? (Verdad)

Guy Spier – “Most Investors Make This Mistake” (Guy Spier)

Howard Marks – This Time Might Be Different (Oaktree)

How to Stay Sane When Markets Get Wild (Jason Zweig)

Inside the Recent Market Volatility | What You Need to Know to Navigate It (Validea)

Warren Buffett did something curious with his Apple stock holding (CNBC)

At War with the Truth (Havenstein)

Barrons’s Roundtable featuring John Rogers of Ariel Investments and Mario Gabelli of Gabelli Funds (Barron’s)

Relative Valuation Charts (Investment Talk)

Jamie Dimon – JPMorgan CEO on inflation getting back to 2% (CNBC)

The Process Is The Reward (Kingswell)

Aswath Damodaran- NVIDIA, The AI Hype, and a Changing Investing Landscape (Global Macro)

Recession Or No Recession? (Spilled Coffee)

Yes we’re in an AI bubble. But actually, we’re not. (Sherwood)

Metametastasis (Ep Theory)

The paradox of lottery thinking (Seth Godin)

Ignore the Rule (HumbleDollar)

The 60/40 Portfolio: Bonds Are So Back (Morningstar)

The Analyst’s Code (Albert Bridge)

Transcript: Meir Statman (MiB)

Polen Capital Management: Is AI a Threat to Software as a Service Companies? (Polen)

Jensen Quality Value Fund Update: 2Q 2024 (Jensen)

This week’s best value investing news:

Rob Arnott – Value investing is due for a big comeback (FT)

Michael Mauboussin: Modern Value Investing Strategies: Buying Low Expectations (AM)

Favour Value vs Growth amid volatile recovery: BofA (Investing.com)

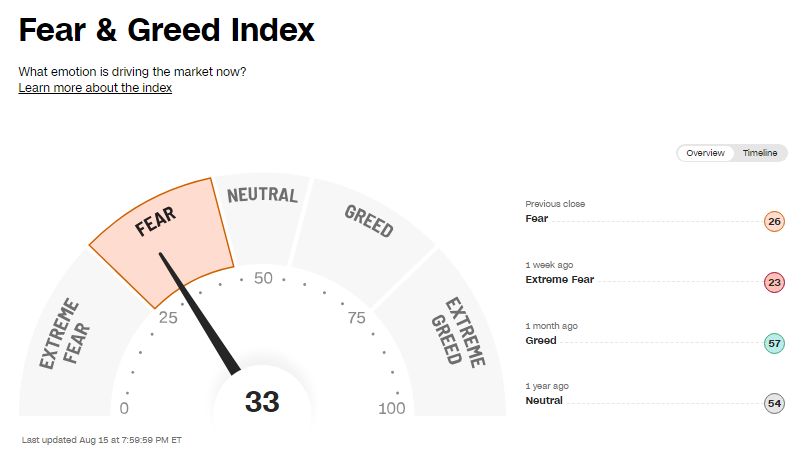

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Michael Schaffer: Long-Term Investing in a Short-Term World (Barron’s)

#38 The Cyclist (Stephen Clapham)

Now’s the Time to Diversify Beyond Magnificent Seven Stocks (Investing Insights)

Vlad Tenev – Navigating Robinhood’s Evolution (ILTB)

Cam Harvey: Forecasting Recessions (Enterprising Investor)

Building Platform Companies by Ron Nixon (MicroCapClub)

AI, Indexes, and Independent Research (Boyar)

Daniel Peris: The Case for Dividend Investing (LongView)

How to Identify the Best Mining and Exploration Companies (Stensberry)

The Mechanics of Deleveragings – And Where the Current One Fits In (Excess Returns)

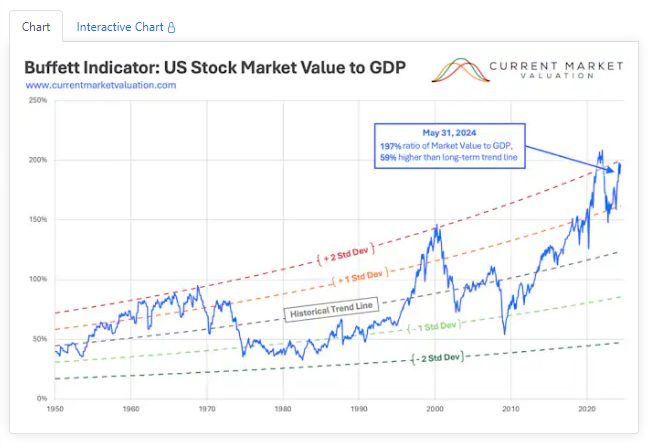

This week’s Buffett Indicator:

Overvalued

This week’s best investing research:

Global Factor Performance: August 2024 (AlphaArchitect)

Big Changes In Sentiment (ASC)

Opportunities in the Evolving Cannabis Consumption Market (CFA)

The Increased Accuracy of GDP Models Raises Some Questions (AllAboutAlpha)

This week’s best investing tweet:

Are all (market weighted) #smallcap indices the same? Absolutely not – they differ much more than large cap indices!

All large cap indices are driven by the same dominant players. How many stocks they include and when they rebalance has only a very moderate impact.

For small… pic.twitter.com/EdunCFVqQX

— Marcial Messmer (@EquityQuant) August 12, 2024

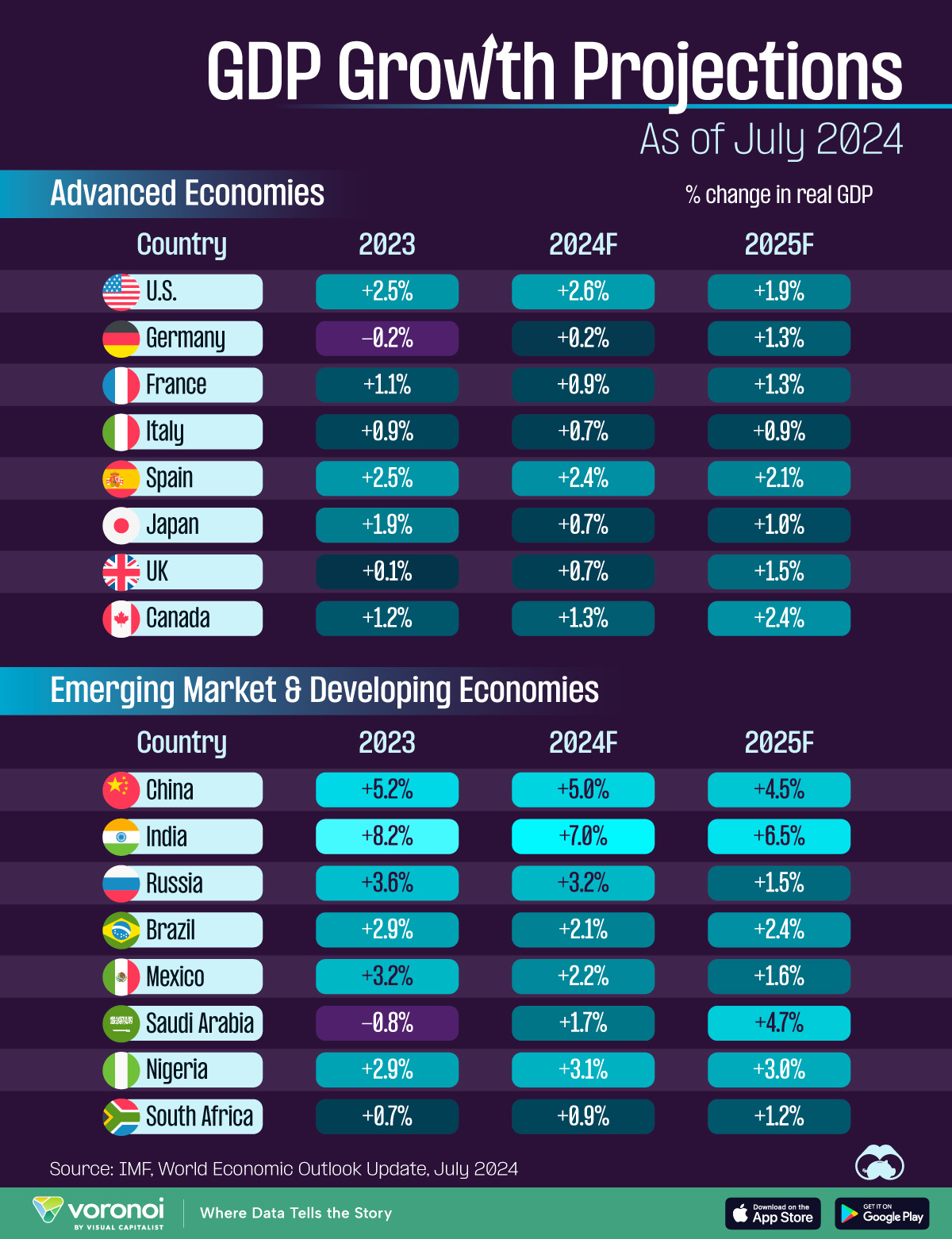

This week’s best investing graphic:

Visualized: GDP Growth Projections for Key Economies (2024-2025) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

One Comment on “This Week’s Best Value Investing News, Podcasts, Interviews (08/16/2024)”

Good lord how is all this content free?