This week’s best investing news:

Jeremy Grantham – A History of Stock Market Bubbles (TIP)

Howard Marks: Yicai (2024) (OakTree)

Berkshire Hathaway Q2 2024 Report (BH)

Bill Ackman’s Pershing Square sees 2024 gains nearly wiped out after July loss (Fortune)

Why Warren Buffett’s Berkshire Dumped 55.8% Of Its Apple Stock (Forbes)

What Bill Ackman Got Wrong With His Bungled IPO (Jason Zweig)

Classifying Economic Regimes (Verdad)

Warren Buffett’s Berkshire Hathaway now owns more short-term Treasurys than the Fed (Yahoo)

Finding Opportunity in the Market Decline (Validea)

Ray Dalio On The Biggest Failure of His Career (RD)

Time For The Defense To Shine? Part Deux (Felder)

Jeremy Siegel discusses the Fed and interest rates (CNBC)

A very strange way to think of things (Havenstein)

The Intelligent Gambler: 10% x 1,000 > 90% x 100 (Value Investing)

Ted Weschler Case Study (Dirtcheapstocks)

Warren Buffett raises Berkshire cash level to record $277 billion after slashing stock holdings (CNBC)

A Few Little Ideas And Short Stories (Collab Fund)

Guy Spier – My 8 Key Rules For Investing & Refining The Checklist Process (GS)

So What Now What? (Ep Theory)

Why the stock market is suddenly freaking out (CNN)

Question of Interest (HumbleDollar)

Pzena investment Management: Energy Transition Update (Q2 2024) (Pzena)

10-year Treasury yield < 4% (Sherwood)

Berkshire Hathaway Q2 2024 Earnings Letter (BH)

MiB: Lakshman Achuthan, ECRI on Growth, Employment and Inflation Cycles (Big Picture)

Third Avenue Value Fund Q2 2024 Commentary (TA)

This week’s best value investing news:

Pzena Podcast: The Power of Patience – Unlocking Value Investing’s Long-Term Rewards (Pzena)

Tim Melvin: 40 Years of Deep Value Investing (Security Analysis)

Value Investing 101 (Canadian Value Investors)

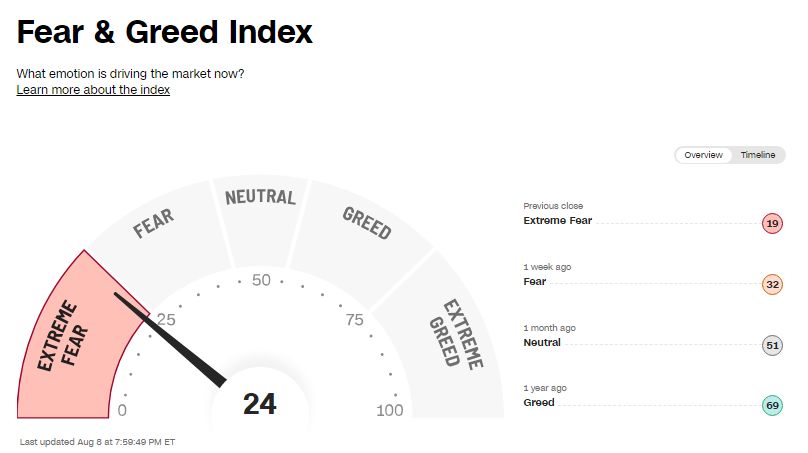

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Bruce Berkowitz – Focused on the Tails (Business Brew)

#438 – Elon Musk: Neuralink and the Future of Humanity (Lex Fridman)

Challenging Conventional Investing Beliefs with Meb Faber (Excess Returns)

Tilting the Odds in Your Favor with Yale Bock (PlanetMicroCap)

Matt Hougan: ‘Crypto Is Not Going Away’ (LongView)

The AI Bubble & What Comes Next… (Guest: Jesse Felder) (MarketHuddle)

Sarah Guo – The Power of Conviction (ILTB)

We’re Entering a New Bull Market in Gold (Stansberry)

#200 Brian Halligan: Scaling Culture from Startup to IPO (Knowledge Project)

Don’t panic: the power of long-term investing, actually useful rules of portfolio construction & is micro-investing worth it? (Equity Mates)

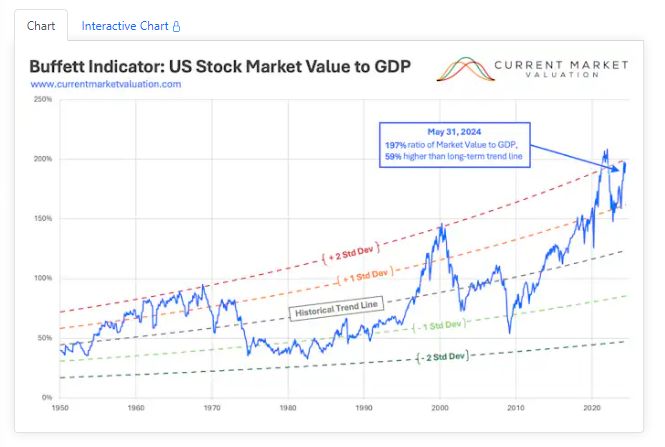

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Where are the new lows? (ASC)

Returns In Focus – Value Creation Shines in the Lower Middle Market (AllAboutAlpha)

The Value of WallStreetBets Investment Research Recommendations (AlphaArchitect)

Is Illiquidity a Blessing in Disguise for Some Investors? (CFA)

Equities Dive, Mean-Reversion Gains, And Managed Futures ETFs Plunge (PAL)

This week’s best investing tweet:

Small cap stocks are at their cheapest levels in the 21st century via JPM on the small cap underperformance since 2010!

J.P. Morgan – The Lion in Winterhttps://t.co/HIQ4oQ03jl pic.twitter.com/Gnfn82Ui1i

— Maverick Equity Research (@Maverick_Equity) August 6, 2024

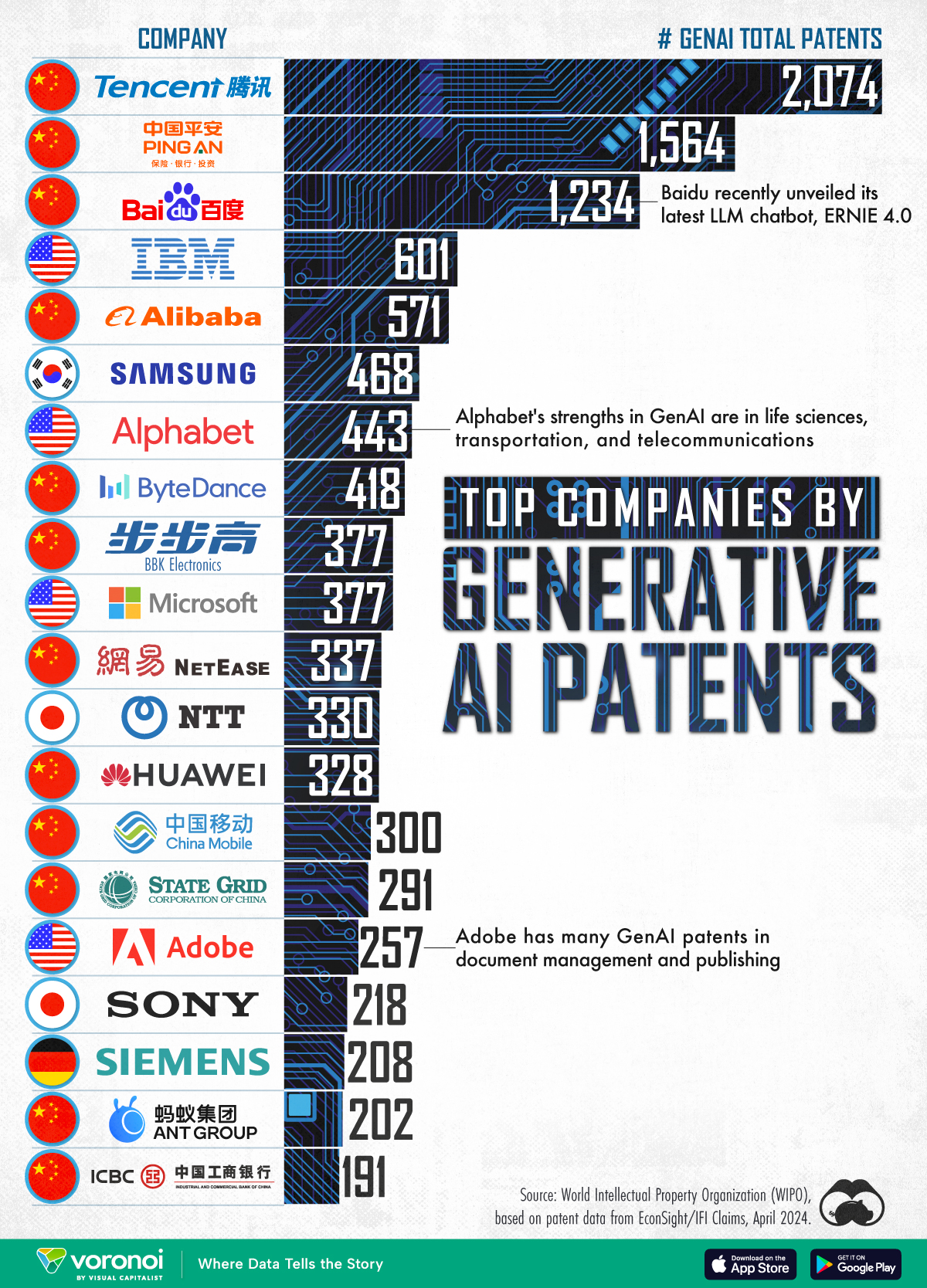

This week’s best investing graphic:

Ranked: Top Companies by Generative AI Patents (VC)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: