This week’s best investing news:

Ray Dalio & Deepak Chopra on Life and Death (RD)

Mohnish Pabrai’s Session with CFA Society, United Kingdom (MP)

Warren Buffett’s Berkshire Hathaway sells Bank of America for a ninth straight day (CNBC)

GMO – Concentrate!: Is it like 2000 again? (GMO)

Terry Smith – Our performance has been like watching paint dry (Telegraph)

Analogous Market Moments (Verdad)

Bridgewater – An Update from Our CIOs: How Durable Is the Economy? (Bridgewater)

Warning Signs – Lyrical Asset Management (LAM)

Quantitative Momentum Investing: A Data-Driven Approach to Momentum (Validea)

David Poppe – Giverny Capital Q2 2024 Letter (Giverny)

Insiders Send Up Important Smoke Signals (Felder)

Unlocking the Skills of Stock Picking w/ Ian Cassel (TIP)

Lessons in Business and Life from Andrew Carnegie (Novel)

Bill Gates – Can online classes change the game for some students? (BG)

Willingness, Need, and Ability: How To Determine Your Appropriate Risk (Best Interest)

Dog Days (Jason Zweig)

The Psychology of Investing #1: Conquering the Investor’s Worst Enemy (Safal)

Stock Picking Is as American as It Gets (Stef)

MiB: Natalie Wolfsen, Orion CEO (MiB)

We Are Losing Our Minds (Ep Theory)

Is the market more reasonably priced than we think? (DF)

Reasons To Sell (SC)

A pioneer of small-cap stockpicking steps back after five decades (FT)

Voting machines vs. weighing machines (Klement)

Why commodities are sinking even as small caps surge (Sherwood)

More fun with Jim and Bob (Havenstein)

Fewer Publicly Listed Companies Globally (Apollo)

Miller Value Partners Q2 2024 Investor Call (Miller)

Matrix Asset Advisors Q2 2024 Commentary (Matrix)

Mairs & Power Growth Fund Q2 2024 Commentary (M&P)

Polen Focus Growth Q2 2024 commentary (Polen)

This week’s best value Investing news:

Dodge & Cox: Staying the Course in Value Investing (D&C)

Style rotation from Growth to Value appears to be the real deal: Yardeni Research (Investing.com)

Value stocks are fueling the small-cap rebound, and these ETFs are outperforming (CNBC)

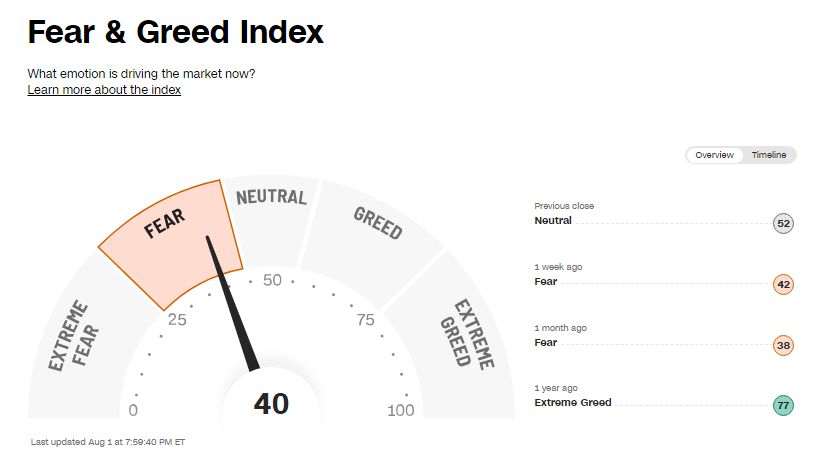

This week’s Fear & Greed Index:

This week’s best investing podcasts:

A Safety First Retirement | The 4% Rule and Managing Sequence of Returns Risk with Wade Pfau (ER)

3 Asset Classes That Could Raise Your Portfolio’s Risk Level (Morningstar)

Special Situations are Fun: Heavy Debt, Unidentified Moats (PM)

Kris Abdelmessih – Life Through a Volatility Lens (S7E10) (FWM)

Hemant Taneja – Engineering Global Resilience (ILTB)

Cockroach Investing – the infographic (RCM)

Carl Tannenbaum: Settling Into ‘Soft-Landing Territory’ (LV)

Blake Haxton – Industrials and High Yield (BB)

476- One Only (InvestED)

Ken Laudan: Investing in the Age of AI (EI)

Nuclear energy: Why it has been a top performing industry this year (Equity Mates)

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Transitioning from an ETF to Direct Indexing? Bad Idea. (AA)

Small Caps, Large Caps, and Interest Rates (CFA)

Two types of forecasters- both are not very good (DSGMV)

Finding the Right Blend (ASC)

This week’s best investing tweet:

Today’s market conditions are most similar, in reverse chronological order, to the following 8 periods: 2019, 2007, 2000, 1995, 1989, 1979, 1973, and 1969. These periods were generally defined by conditions that encourage risk taking. pic.twitter.com/lP1HP0hCYi

— Dan Rasmussen (@verdadcap) July 29, 2024

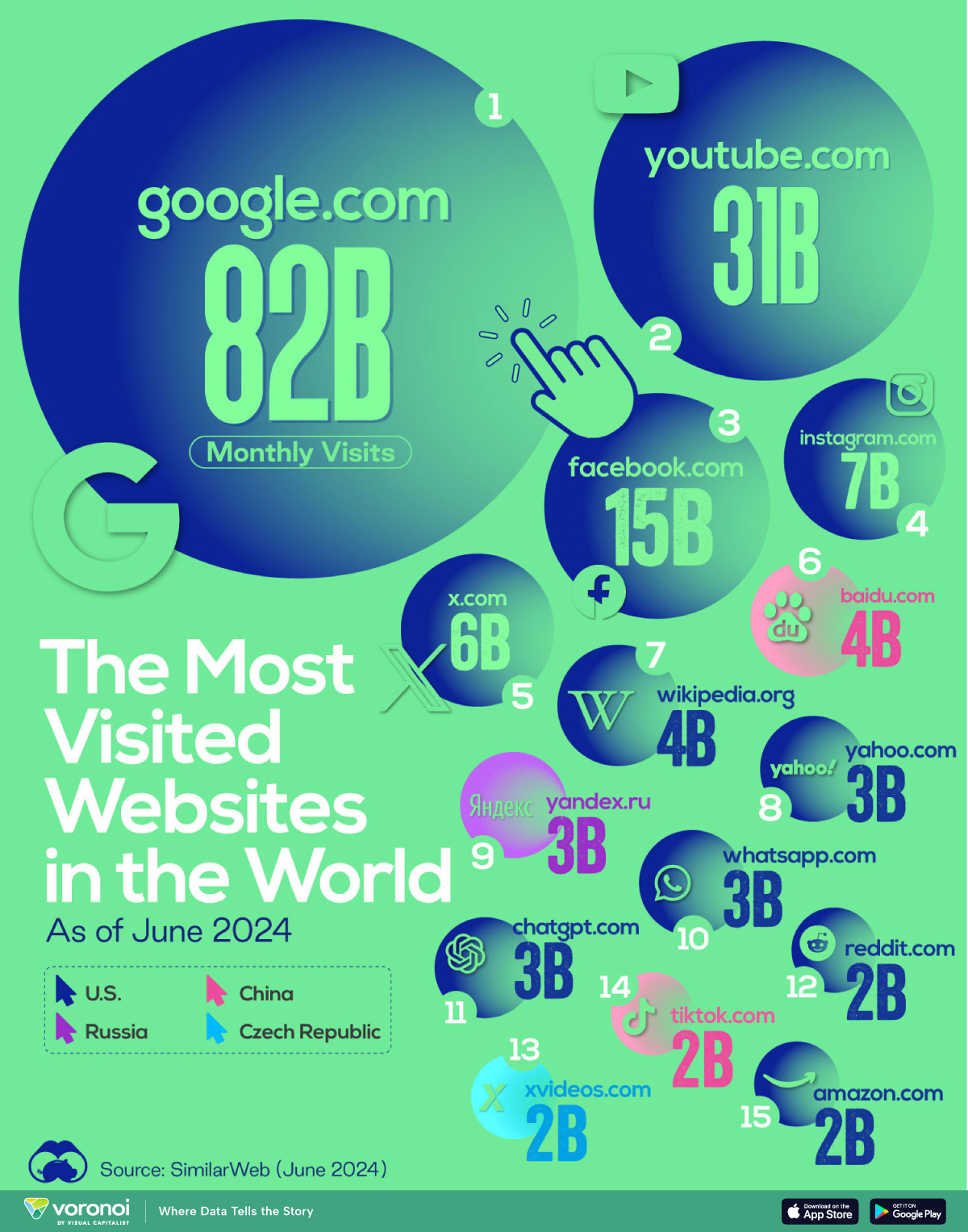

This week’s best investing graphic:

Ranked: The Most Visited Websites in 2024 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: