As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Nike Inc (NKE).

Profile

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Recent Performance

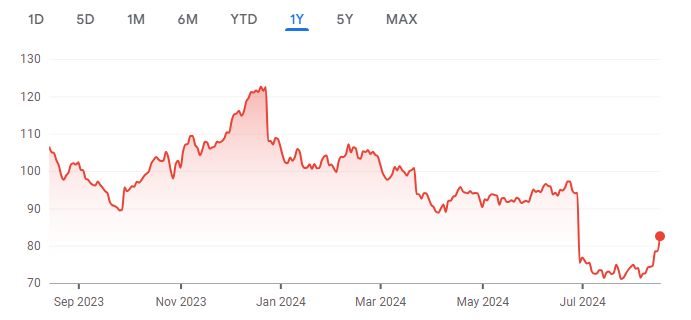

Over the past twelve months the share price is down 22.56%.

Source: Google Finance

Inputs

- Discount Rate: 8%

- Terminal Growth Rate: 4%

- WACC: 8%

Forecasted Free Cash Flows (FCFs)

| Year | FCF (billions) | PV(billions) |

| 2025 | 5.46 | 5.06 |

| 2026 | 5.92 | 5.08 |

| 2027 | 6.42 | 5.10 |

| 2028 | 6.97 | 5.12 |

| 2029 | 7.56 | 5.15 |

Terminal Value

Terminal Value = FCF * (1 + g) / (r – g) = 128.52 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 87.47 billion

Present Value of Free Cash Flows

Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 25.50 billion

Enterprise Value

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 112.96 billion

Net Debt

Net Debt = Total Debt – Total Cash = 1.53 billion

Equity Value

Equity Value = Enterprise Value – Net Debt = 111.43 billion

Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $74.34

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $74.34 | $82.50 | -10.98% |

Based on the DCF valuation, the stock is overvalued. The DCF value of $74.34 share is lower than the current market price of $82.50. The Margin of Safety is -10.98%.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

3 Comments on “Nike Inc (NKE) DCF Valuation: Is The Stock Undervalued?”

don’t you mean ‘is over-valued?’

Yes, Miles. Thank you.

Thank you Johnny. I was surprised by the result given the negative coverage of the company lately. I need to start doing the numbers myself! 😁