This week’s best investing news:

Howard Marks – Getting The Odds On Your Side (3 Takeaways)

The Rise of Alternatives (Verdad)

Pzena Investment Management Q2 2024 Commentary: US Dominance and Global Market Trends (Pzena)

Oakmark’s Bill Nygren on Alphabet’s Q2 earnings (CNBC)

Aswath Damodaran – Country Risk: The 2024 Update (AD)

Phil Fisher: Common Stocks & Uncommon Profits (Security Analysis)

Chris Davis on a Portfolio Well Suited to a Market in Transition (Davis)

Markel CEO Tom Gayner Talks Berkshire at Omaha Brunch (Kingswell)

GMO’s Valuation Metrics in Emerging Debt: 2Q24 (GMO)

Let Compounding Do Its Work (BI)

Inside Mark Zuckerberg’s AI Era | The Circuit (Bloomberg)

One Is Not Enough (Humble Dollar)

The Death of the Dollar (in Perspective) (DF)

Practical Alternatives to the 60-40 Portfolio (Excess Returns)

At The Money: Behavior Beats Intelligence (Barry Ritholz)

Time For The Defense To Shine? (Felder)

What We Can Learn From The Oil Market – 1980 (Gene Hoots)

3 Investment Fallacies I’ve Had to Unlearn (Morningstar)

Sizing up the small-caps rally (FT)

Research Review | 18 July 2024 | Artificial Intelligence and Finance (Capital Spectator)

The King of Luxury | Bernard Arnault & LVMH w/ Christian Billinger (TIP)

The dangers of passive (Havenstein)

Gold long-term ‘will continue to do well’, says Mark Mobius (CNBC)

Most Big Winners were Ugly Ducklings (Ian Cassel)

MiB: Gregory Peters, Co-CIO of PGIM Fixed Income (MiB)

Expect drawdowns (magazinebailliegifford)

Crashes and Competition (Stratechery)

Weitz Investment Management: Investing in a Tech-Driven Market (Weitz)

Ariel Focus Fund Q2 2024 Commentary (Ariel)

July Views from First Eagle Global Value Team (FEIM)

Polen Global Growth Q2 2024 Commentary (Polen)

This week’s best value Investing news:

Value Investing, the Mag 7 and Making Sense of a Changing Market with Tobias Carlisle (Validea)

The Power of Patience: Unlocking Value Investing’s Long-Term Rewards (Pzena)

Searching for value outside large-cap U.S. equities (Globe & Mail)

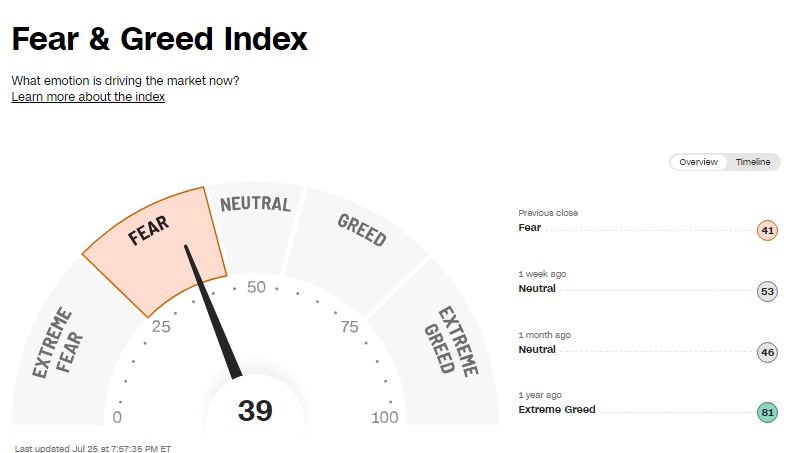

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Is There a New Leader in the AI Race? (Morningstar)

Most Big Winners were Ugly Ducklings (MicroCapClub)

Jeremy Giffon – Special Situations in Private Markets (ILTB)

Behind the Memo: The Indispensability of Risk with Howard Marks, Bruce Karsh, and Maurice Ashley (The Memo)

The Magnificent 7 and the Dangers of Market Hype (Vitaliy Katsenelson)

Brian Feroldi: ‘The Biggest Edge That Individual Investors Have’ (Long View)

Unlocking REIT Potential with Bill Chen (Business Brew)

Stop Paying Too Much for Stocks (Stansberry)

#199 Esther Perel: Cultivating Desire (Knowledge Project)

Rob Small and Anil Seetharam – Public Equity Adjacent to Private Equity (Capital Allocators)

The Intentional Investor #9: Ryan Krueger (Ep Theory)

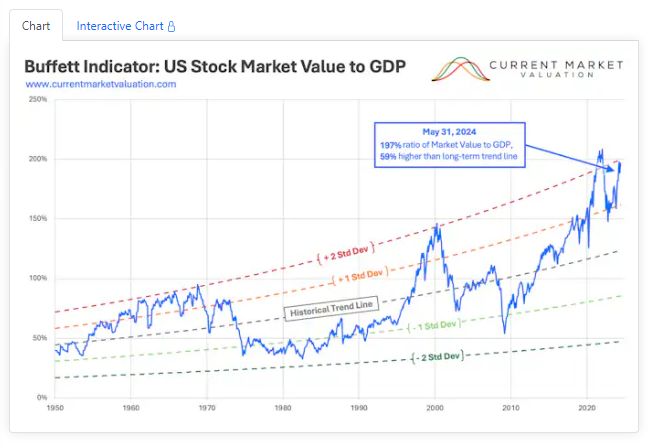

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Using Bayesian Solutions to Resolve the Factor Zoo (AlphaArchitect)

Now You Want A Correction? (AllStarCharts)

Should you prefer stocks or bonds? (DSGMV)

Both Log and Linear Charts Are Useful (PAL)

Measuring Corporate Impact: The Gold Is in the Details (CFA)

This week’s best investing tweet:

Couple of interesting tables from the latest @InvestGabelli small-cap review:

1/ You can get almost the same future growth with small and mid-caps (Russell 2000) – 14% as with large caps (Russell 1000) – 16%, but at a better price (16x vs 22x).

2/ Russell 1000 is dominated by a… pic.twitter.com/5TSHoGQQLZ

— Hidden Value Gems (@HiddenValueGems) July 25, 2024

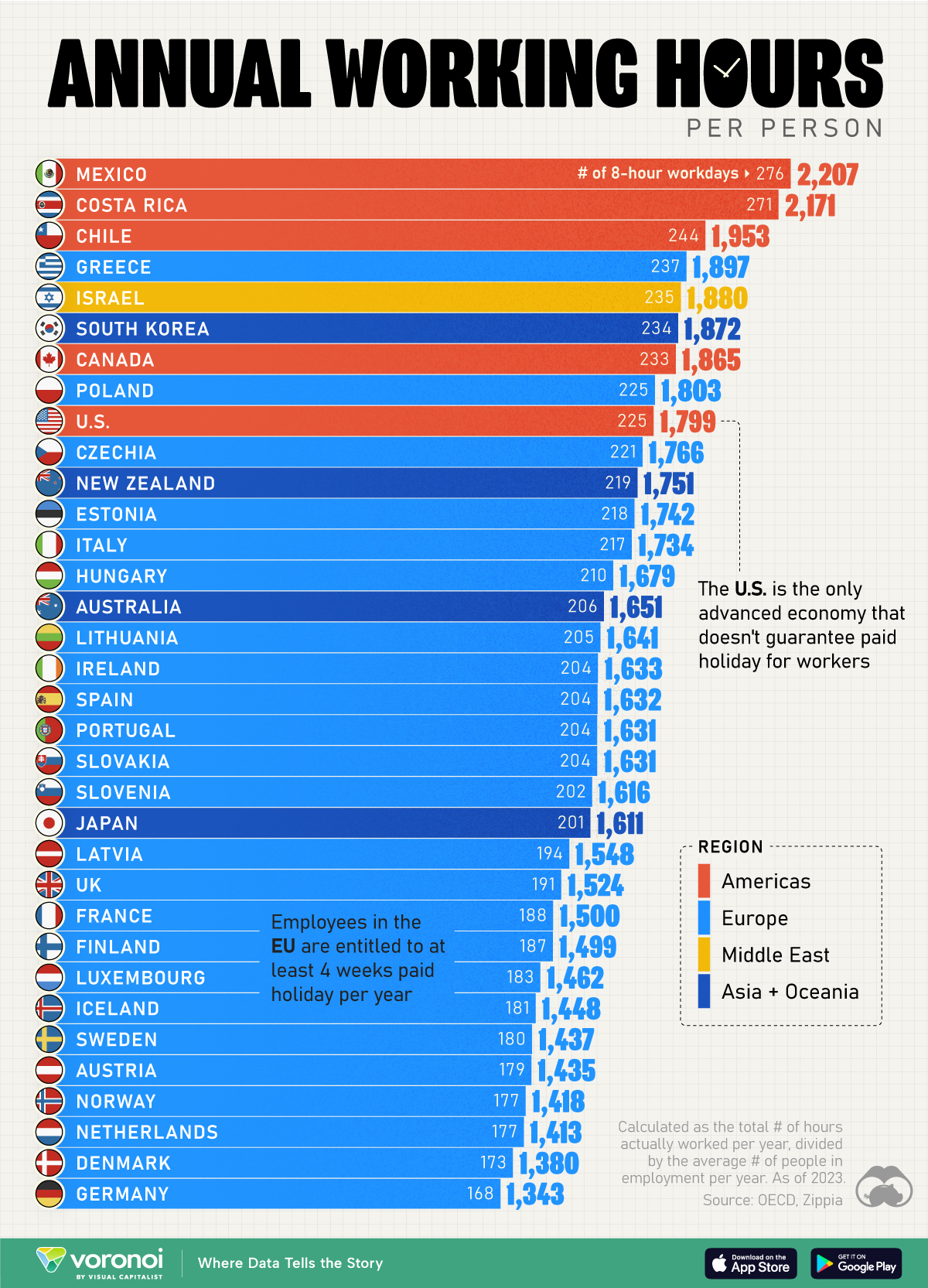

This week’s best investing graphic:

Ranked: Average Working Hours by Country (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: