This week’s best investing news:

Oaktree’s Howard Marks Weighs In on Market Risks, PE and Credit (Bloomberg)

Bill Nygren Q2 2024 Commentary: What goes up… keeps going up. But we aren’t buying it (Oakmark)

Bill Ackman Is Behind the Market. Now He’s Launching the Biggest Closed-End Fund Ever (Barron’s)

Fundsmith 2024 Semi Annual Letter to Shareholders (Fundsmith)

Interview with Steve Scruggs, Portfolio Manager of the FPA Queens Road Small Cap Value Fund (JRo)

The American Liquidity Advantage (Verdad)

The Transition to a Higher Cost of Capital (Bridgewater)

Understanding Shareholder Yield: Beyond Dividend Yield (Validea)

Oakmark’s David Herro: Amidst elections and volatility in Europe – we see opportunity (Oakmark)

‘The AI Bubble Is Reaching A Tipping Point’ (Felder)

Why International Investing Makes Sense for Long-Term Investors (Morningstar)

Unemployment Enters the Conversation (Ep Theory)

Guy Spier – Avoiding Cognitive Bias, Solving Problems & Finding Meaning In A Chaotic World (GS)

“We are not overbuilt, we are under demolished” (Havenstein)

Does ‘Skin in the Game’ Really Matter? (BI)

The Coming Housing Market Washout (Stef)

Bill Ackman wants to monetize his X account to the tune of $25 billion (Sherwood)

Exit Strategy (Humble Dollar)

Aswath Damodaran – The ‘Mag 7’ have become the value stocks of the market (CNBC)

AI’s $600B Question (Sequoia)

Is Private Equity Smarter or Just More Arrogant? (Stephen Clapham)

Why Your Fund Manager Can’t Beat Today’s Stock Market (WSJ)

Bad Assets, Good Liabilities (Fundoo)

Why the Walmart Model Doesn’t Work in Healthcare (WSJ)

MiB: Brian Klaas on Flukes, Chance & Chaos (MiB)

Polen Capital Management: Investing in the Next Phase of Artificial Intelligence (Polen)

This week’s best value Investing news:

Is Value Investing Dead? Why Buffett’s Strategy May No Longer Work (Forbes)

Value stocks in a growth stock world (FT)

Value investors cooling their heels as growth stocks stay hot (Investment News)

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Key Investment Lessons Of The Last 20 Years From Noted Strategist Richard Bernstein (WealthTrack)

Passive Investing, Inflation and the Bifurcated Economy with Mike Green (Excess Returns)

The Value Perspective with Cole Smead (Value Perspective)

Martin Casado – Entering Uncharted AI Territory (ILTB)

#198 Maya Shankar: The Science of Identity (Knowledge Project)

The Right Way To Think – Conversations with Vitaliy (Vitaliy Katsenelson)

Episode 313 – When Should You Hire a Financial Advisor? (Rational Reminder)

Training Grounds: Bain Capital, John Connaughton (EP.395) (Capital Allocators)

Expert: Jennifer Wu – the core ingredients of a sustainable investing strategy (Equity Mates)

This week’s Buffett Indicator:

Overvalued

This week’s best investing research:

Overconfidence May Lead to Poor Emergency Planning (Alpha Architect)

No, It’s NOT just Large-cap Tech (All Star Charts)

Know What You Own (All About Alpha)

Equities Market: Trend-Following Or Momentum? (PAL)

Mr Momentum driving stocks – but unlikely to last (DSGMV)

Commodities for the Long Run? (CFA)

This week’s best investing tweet:

“Nature abhors an undiversified bet”

Related to Kris’ poll results below, here’s a talk from MIT’s Andrew Lo in which he elegantly works through an evolutionary explanation for the puzzle of probability matching. Technical at certain points, but he goes on to make it intuitive. https://t.co/F8SN7fTndH pic.twitter.com/ORF6Yy7LI7

— Jesse Livermore (@Jesse_Livermore) July 11, 2024

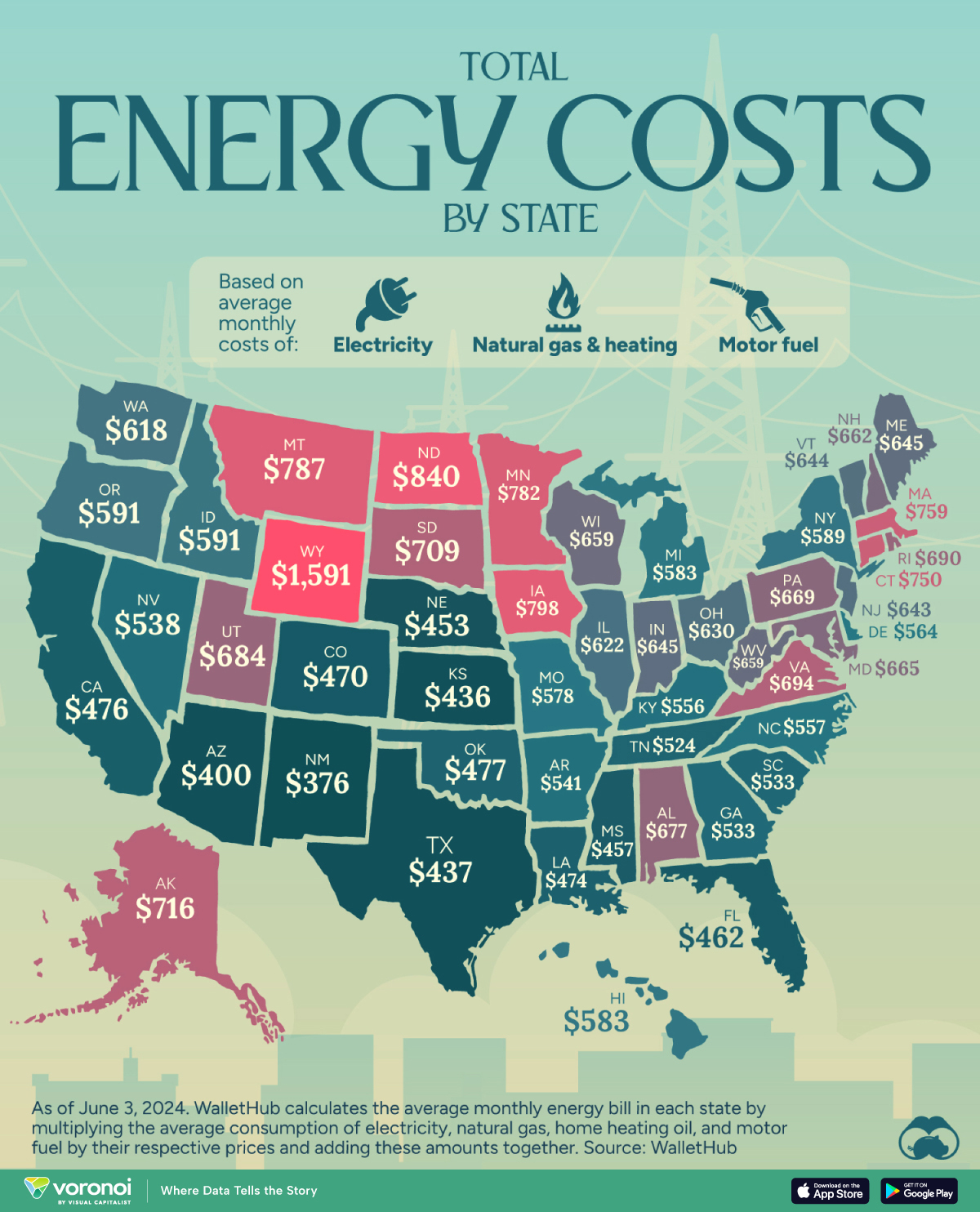

This week’s best investing graphic:

Mapped: Energy Costs by State in 2024 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: