This week’s best investing news:

Oaktree Capital’s Howard Marks on US Growth, China Market, Evergrande (Bloomberg)

Ray Dalio at GEF-Hong Kong (GEF)

The Calm Before the Storm (Verdad)

Are the Markets Broken? AQR’s Cliff Asness Weighs In (Bloomberg)

Could Lululemon Be Buffett’s Next Buy (Validea)

Einhorn’s Greenlight Slams ‘Head of Macro’ in Fresh Lawsuit (Bloomberg)

Buffett’s Investment Evolution (WealthTrack)

Jeffrey Gundlach: Looking Back to 1968 and Forward to What Might Lie Ahead (DoubleLine)

Terry Smith’s four things the industry needs to improve on (Fundsmith)

The Roundup: Top Takeaways from Oaktree Conference 2024 (OakTree)

Pzena Investment Management: Brazilian Equities – Unveiling Undervalued Opportunities (Pzena)

Why aren’t there more Warren Buffetts? (Morningstar)

It’s not illegal if Congress is complicit (Havenstein)

The 2024 Broyhill Book Club (Broyhill)

Letter #196: Bruce Karsh and Howard Marks (2017) (A Letter A Day)

Henry Singleton & Teledyne (Twenty Punch Investments)

Stoic & Wealthy: 4 Essays on Stoicism and Investing (Darius)

We’re too obsessed with cash (Cautiously Optimistic)

The ETF Innovation Black Hole (Ep Theory)

Jamie Dimon believes U.S. public debt is the ‘most predictable crisis’ the economy faces (Yahoo)

Raising the Bar (Humble Dollar)

A New Golden Age for Savvy Stockpickers w/ Bob Robotti (RWH)

‘Jensanity,’ Part Deux (Felder)

MiB: Peter Rawlinson, Lucid CEO/CTO (MiB)

Michael Mauboussin – Wall Street’s favorite strategist discusses how to be a better investor (MarketWatch)

Nvidia’s Murky AI Future Isn’t Reflected in Its Price (Bloomberg)

Standard Deviation: In Defense of an Often-Dismissed Investing Metric (Morningstar)

Three Things – Is a Stock Bubble Forming? (Discipline Funds)

The Ticker Trap Explained (Stef)

First Eagle Investments: The Small Idea – It Don’t Come Easy (FEIM)

This week’s best value Investing news:

A Veteran Value Investor on 3 Things to Avoid—and Why He Likes Meta Stock (Barron’s)

A Better Take on Small-Cap Value Investing (VettaFi)

Q&A with Bob Robotti, Robotti & Co. live from Planet MicroCap (Yet Another Value Blog)

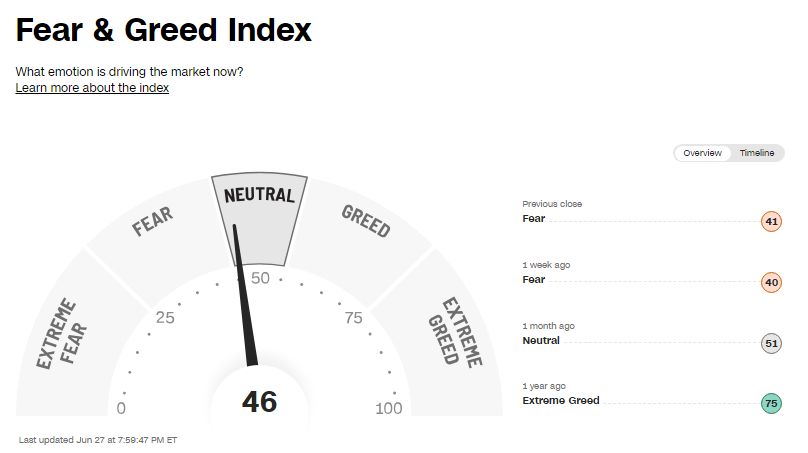

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Show Us Your Portfolio: Eric Crittenden (Excess Returns)

Ben Hunt – The Stories that Drive Markets (EP.393) (Capital Allocators)

Finding Great Leaders Early (MicroCapClub)

#197 Michaeleen Doucleff: TEAM Parenting (Knowledge Project)

Robert Greene – Optimizing Your Reality (ILTB)

The Value Perspective with Stephen Lezac (Value Perspective)

Al Goldstein – Stoic Lane (Business Brew)

‘Resistance Money’: Decoding Bitcoin’s True Value Proposition (Barron’s)

Ep 454. Cable Talk: Charter’s Valuation, A Ted Weschler Position, and Thoughts on the Industry (FC)

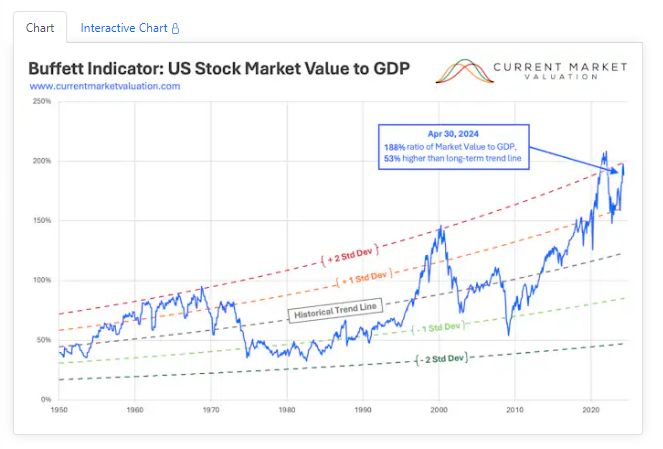

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Smart rebalancing for factor strategies (AlphaArchitect)

There Is More Than One Amazon (ASC)

Bear Markets Have Lasted Longer Than Most Permabulls Think (PAL)

Hedge Funds: A Poor Choice for Most Long-Term Investors? (CFA)

This week’s best investing tweet:

Private is the place to be. Brought to you by KKR. pic.twitter.com/WB61Dol8Ji

— Bill Brewster (@BillBrewsterTBB) June 27, 2024

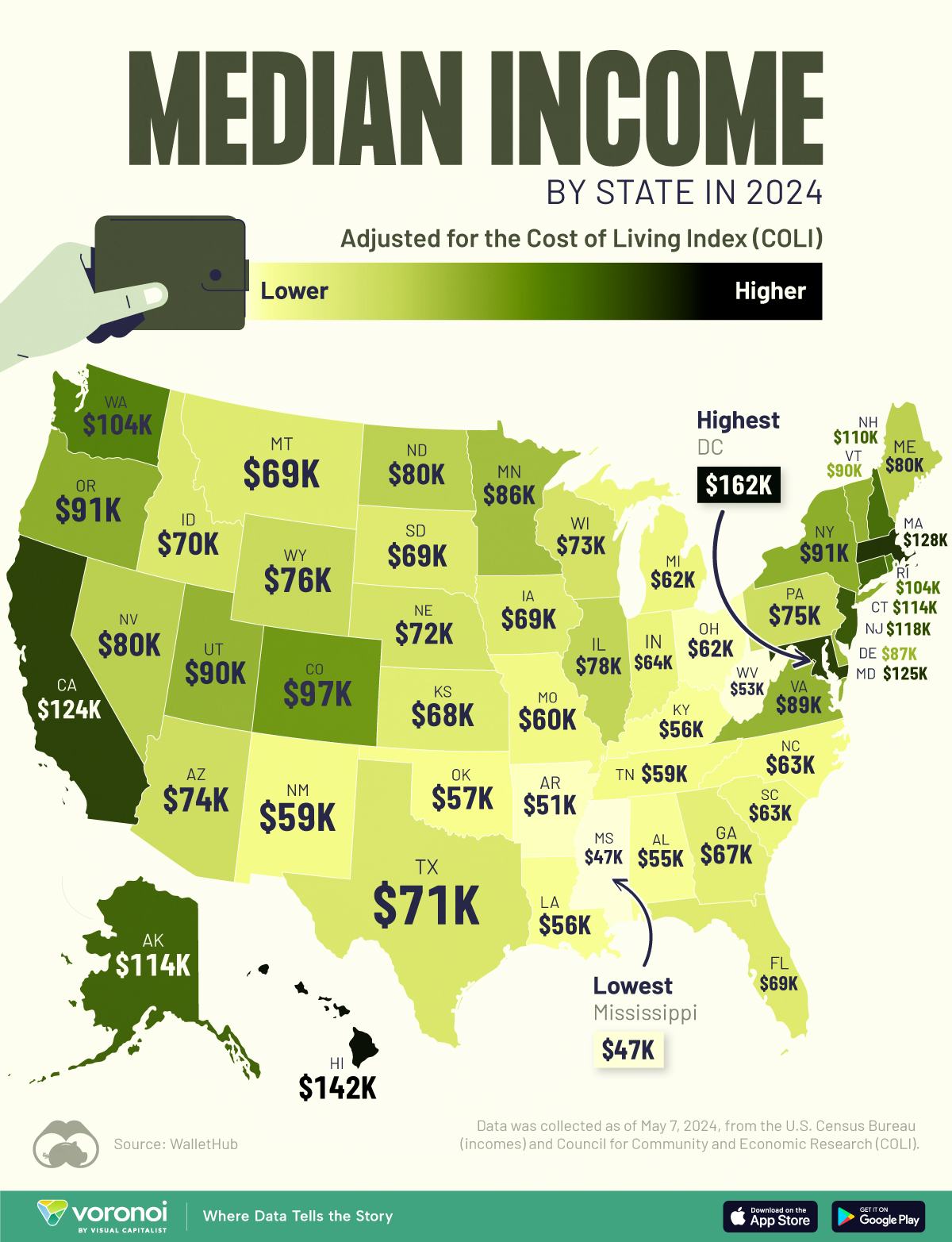

This week’s best investing graphic:

Mapped: Median Income by State in 2024 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: