This week’s best investing news:

Mohnish Pabrai’s Session at The University of Nebraska (MP)

Bonus Episode: Howard Marks on “In Good Company” (HM)

Ronald Olson – Partnership Lessons from Buffett-Munger (Bloomberg)

Buffett’s Investment Evolution (WealthTrack)

The Penny Stock Anomaly (Verdad)

Francis Chou – 2024 Ivey Value Investing Classes Guest Speaker (Ivey)

How to Analyze Backtests: What Average Investors Need to Know (Validea)

Experts vs. Imitators (Farnam Street)

Bill Nygren – GM management recognizes that they are in a relatively slow-growth business (CNBC)

Quiet Compounding (Collab Fund)

Bill Gates on “Face the Nation with Margaret Brennan” (Face the Nation)

We did it all over again (Havenstein)

Jason Zweig – Hot Funds and the Curse of ‘Self-Inflated Returns’ (WSJ)

Transcript: Erika Ayers Badan, Barstool Sports (Big Picture)

Invested in My Opinion (Humble Dollar)

Why Front-Page News Can Mislead Investors (Morningstar)

Investing and the Difficult Art of Saying No (Safal)

Google to Buy Clean Power From Buffett’s Nevada Utility (Bloomberg)

The Stock Market Will Crash! (and two other charlatan money-making claims) (Darius)

Concerned About Market Concentration and Lofty Valuations? Consider Small Caps (CFA)

One To The Negative 230 (Isola)

Jeremy Siegel: Expect the Fed to move to a ‘two-cut camp’ with one more good CPI reading (CNBC)

An ‘Acquired’ Taste (Investment Talk)

June Views from First Eagle Global Value Team (FEIM)

This week’s best value Investing news:

Value Investing in the Age of Intangibles (Dodge & Cox)

Bullish on Quality Small-Cap Banks (Royce)

Value Investing: How To Invest Like A God (Value Investing Substack)

Building on Value: A New Opportunity in Credit (Pzena)

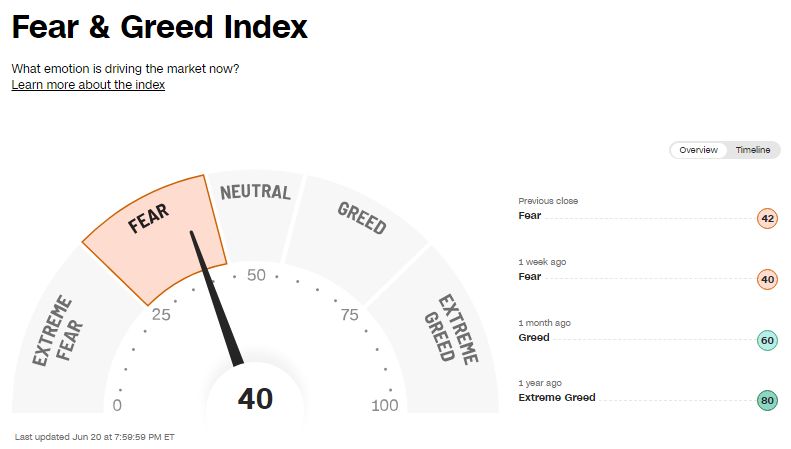

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Pat Grady – Relentless Application of Force (ILTB)

#434 – Aravind Srinivas: Perplexity CEO on Future of AI, Search & the Internet (Lex Fridman)

Discovering Canadian MicroCaps in 2024 (PlanetMicroCap)

The Benefits of a Simple Investment Approach with Rick Ferri (Excess Returns)

#36 The Runner (Stephen Clapham)

Jonathan Knee – The Platform Delusion and the Intricacies of Digital and Analog Platforms (VIWL)

Does Market Failure Justify Government Intervention? (EconTalk)

Alfonso Ricciardelli: Alternative Credit (Enterprising Investor)

The Return of Meme Stock Investing (Hidden Forces)

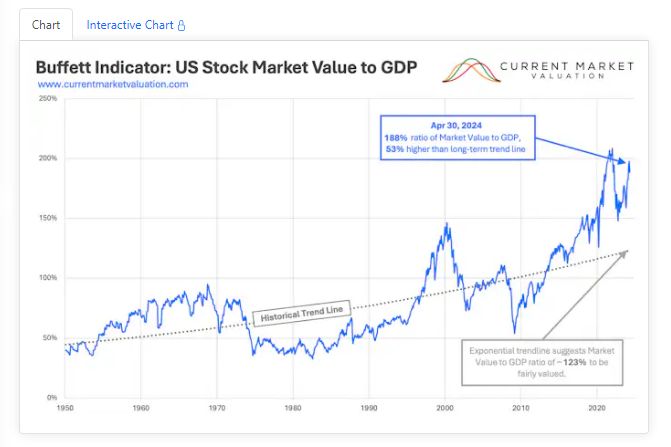

This week’s Buffett Indicator:

Overvalued

This week’s best investing research:

How to Track Retail Investor Activity in TAQ (AlphaArchitect)

Russell3000 All-time Highs (AllStarCharts)

How long is long enough with a inverted yield curve signal (DSGMV)

This week’s best investing tweet:

Michael Mauboussin on the two broad schools of thought regarding the setting of stock prices pic.twitter.com/nPmy8VV6KM

— Kevin Gee (@kevg1412) June 20, 2024

This week’s best investing graphic:

The Growth of $100 Invested in Jim Simons’ Medallion Fund (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: