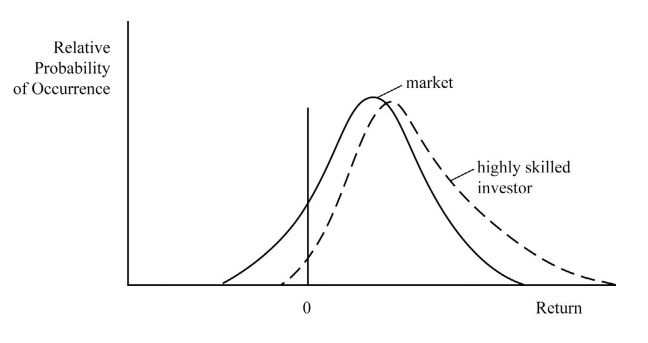

In his book – Mastering the Market Cycle, Howard Marks argues that truly successful investors are neither overly aggressive nor defensive. They excel at both market timing and picking good investments.

This “asymmetrical performance” means they have a higher win rate than the market. Most investors can’t do this, and some lack both skills.

The best investors, however, can anticipate market trends and build portfolios that thrive in those conditions. This rare combination is what makes them superior.

Here’s an excerpt from the book:

Finally, the investor who is neither habitually aggressive nor habitually defensive—but who possesses skill at both cycle positioning and asset selection—correctly adjusts market exposure at the right time and has the asymmetrical performance that comes from a better-than-average ratio of winners to losers. This is the best of all worlds:

Almost anyone can make money when the market rises and lose money when it falls, and almost anyone can have the same ratio of winners to losers as the market overall.

It takes superior skill to improve in those regards and to produce the asymmetry that marks the superior investor.

Please note that in this discussion I have separated skill at cycle positioning from skill at asset selection. This bifurcation is somewhat artificial.

I do it to describe the two elements that influence performance, but many great investors have both, and most of the rest have neither. Investors who are capable of both have a better sense for the market’s likely tendency and can put together portfolios that are better suited for the market environment that likely lies ahead in terms of the ratio of winners to losers.

That’s what makes them great . . . and rare.

You can find a copy of the book here:

Howard Marks – Mastering The Market Cycle

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: