This week’s best investing news:

Mohnish Pabrai VALUEx BRK 2024 (Guy Spier)

Ray Dalio’s Principles of Investing in a Changing World (WSJ)

Inside the Investment Strategy of John Neff (Validea)

Why Did Warren Buffett Buy Chubb? (Forbes)

Where the Value Investing Strategy Still Works (Verdad)

Daily Journal: The Canary in the Coal Mine? (Rational Walk)

‘AI’s Year Of Disillusionment’ (Felder)

Nassim Nicholas Taleb on Investment, Hedging, and Mishedging (AIM Summit)

Private Equity: How Much Should You Allocate? (Morningstar)

Lazy Work, Good Work (Morgan Housel)

Five Moat Myths (Rob Vinall)

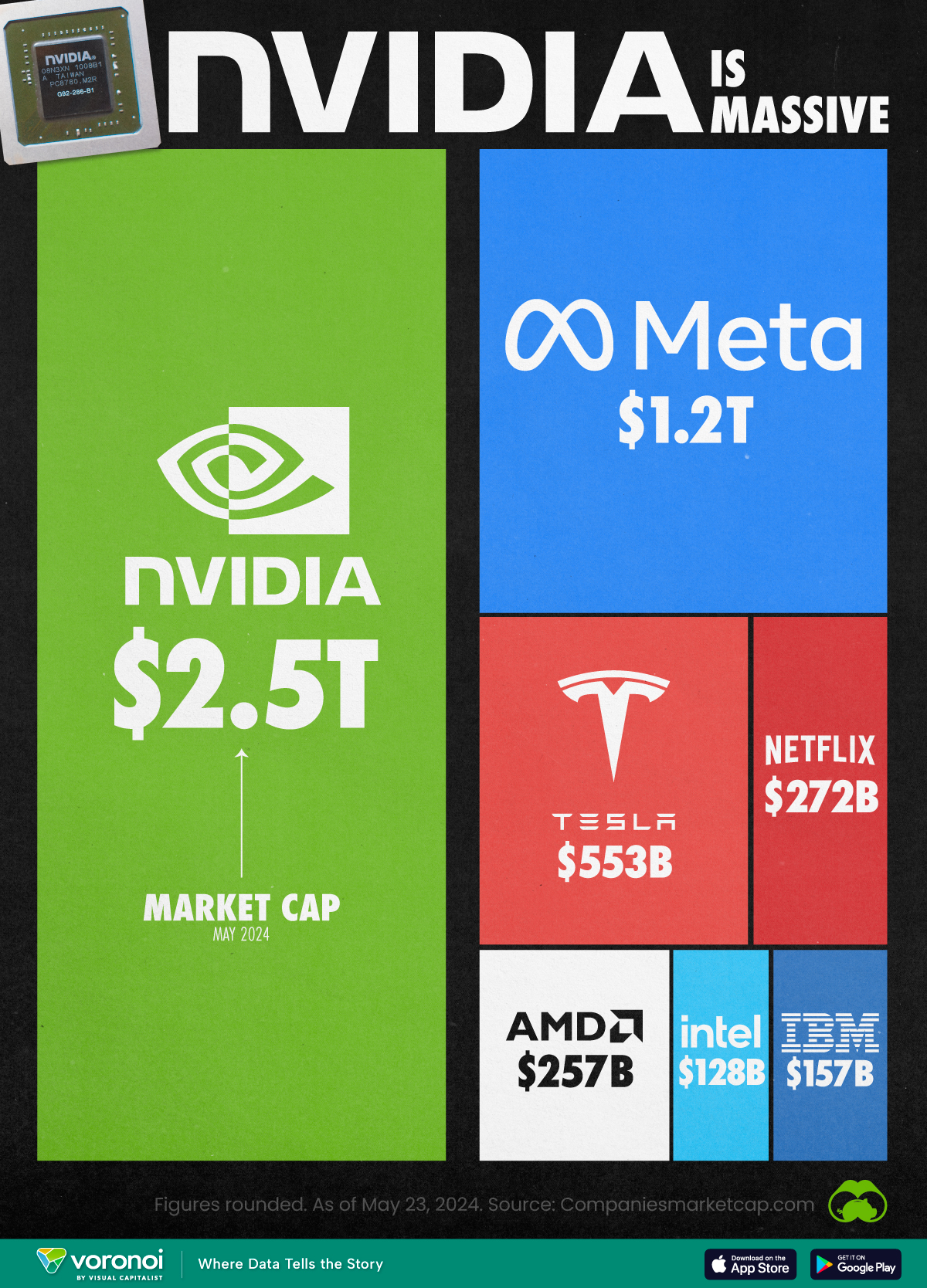

Aswath Damodaran – Nvidia valuation based on expectations that it can do no wrong (CNBC)

Transcript: Anand Giridharadas (Big Picture)

Me and the Dow (HumbleDollar)

Why do companies do stock splits? (Sherwood)

Dodge & Cox: Emerging Markets – Why and Where (D&C)

Interview with Sound Shore portfolio managers, John DeGulis, Peter Evans and David Bilik (WST)

May Views from First Eagle Global Value Team (FEIM)

Mairs & Power: Seeing the Potential in Small Cap (M&P)

This week’s best value Investing news:

Where the Value Investing Strategy Still Works (Verdad)

Victor Cunningham of Third Avenue Management discussing small-cap value investing (VAH)

Value Investing: Avoiding “Shiny Objects” for Greater Profit Potential ((MoneyShow)

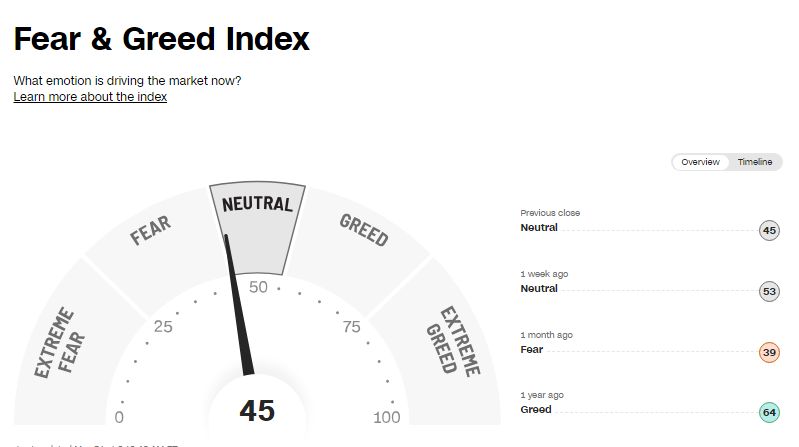

This week’s Fear & Greed Index:

This week’s best investing podcasts:

#195 Morgan Housel: Get Rich, Stay Rich (KP)

Episode #534: Michael Melissinos – Mastering the Art of Trend-Following (MF)

Nicolas Mirjolet – Multivariate Trend Following (FWM)

The Superinvestors of MicroCap (MCC)

Inside the Investment Strategy of John Neff (Validea)

Consuelo Mack – Host of WealthTrack (Business Brew)

Ep 453. Asset-Earnings Equivalence, Cyclical Downturns, and Thoughts on NVDA (FC)

Howie Liu – Building Airtable (ILTB)

#430 – Charan Ranganath: Human Memory, Imagination, Deja Vu, and False Memories (Lex Fridman)

Ep. 109 – Ian Cassel: Master of Microcaps (Investing City)

Invest in SpaceX Alongside Elon Musk? Why This Closed-End Fund Is Not Worth the Ride (Morningstar)

Energy Infrastructure Investing with Greg Reid (Excess Returns)

Chris Wilcha — Flipside (Infinite Loops)

Dr. Wes Gray discusses the unique tax benefits of ETFs and other topics of interest, host Rick Ferri (Bogle)

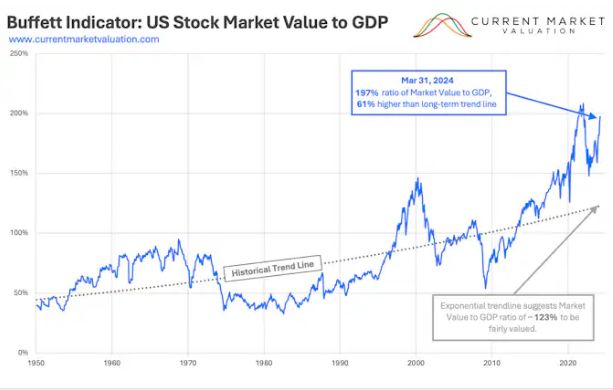

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Does Diversity add value to asset management? (AlphaArchitect)

The Bond Market Knives Come Out (ASC)

Valuation and Private Debt (AllAboutAlpha)

Stocks for the Long Run? Setting the Record Straight (CFA)

This week’s best investing tweet:

“Given their cheap valuations, an upswing in economic activity in the US following the next recession could see small caps soar over a 6-to-18-month timeframe. Actively managed small cap positions can also be attractive. Academic research shows that most equity factors and… https://t.co/HkS2DgThL9

— Tobias Carlisle (@Greenbackd) May 30, 2024

This week’s best investing graphic:

Nvidia is Worth More Than All of These Companies Combined (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: