This week’s best investing news:

Bill Ackman – An activist investor on challenging the status quo (TED)

Jim Simons, Math Genius Who Conquered Wall Street, Dies at 86 (Dealbook)

Warren Buffett’s Berkshire Reveals Its Mystery Stock: Chubb (WSJ)

Sizing PE Allocations (Verdad)

Mohnish Pabrai’s Session at The Investor’s Podcast (MP)

‘The Search For Stability’ (Felder)

Can Machines Time Markets? The Virtue of Complexity in Return Prediction (AQR)

Not Just Numbers (Humble Dollar)

In Conversation With Ken Griffin (Bloomberg)

A Collective Failure of Imagination (Havenstein)

John Rogers calls Berkshire one of ‘best investments of all time’ (CNBC)

Slay Dragons — Or Avoid Them? (Kingswell)

Hedge Fund Manager David Einhorn Has Bounced Back. How to Join in His Success (Barron’s)

The Alpha Cycle (Behavioural Investment)

Take It From Warren Buffett: Misses Are Inevitable (Morningstar)

When You Destroy the Tools of Creativity (Ep Theory)

GMO – Magnificently Concentrated (GMO)

Steven A. Cohen on a Career in Investing (Point72)

Can AI Replace Stock Analysts? (SSRN)

3 Assets That Might Not Diversify as Well as You Think (Morningstar)

Warren Buffett has a $285 billion problem (SMH)

‘Jim Simons was the greatest’ – Ray Dalio, others pay tribute to trading legend (Morningstar)

Bill Nygren – Navigating market highs and (avoiding) value traps (Oakmark)

Cliff Asness – Simple Investing is Hard (Capital Allocators)

Jim O’Shaughnessy, O’Shaughnessy Ventures (MiB)

Wise Words from Jim Simons (Novel)

Ben Graham, Columbia Man, Risked Everything and Lost (Beyond Ben Graham)

The Dow Is a Terrible Index. But It Is Telling Us Something Important (WSJ)

Blackstone’s big gamble (Business Insider)

Public finances are like stocks (Klement)

Miller Value Partners insights: Coupang Inc. (CPNG) (Miller)

Q1 2024 – Sequoia Strategy Letter (Sequoia)

This week’s best value Investing news:

Value investing in an uncertain world (UBS)

Growth Stocks. Value Stocks. What Do Those Labels Mean? (NYT)

Cliff Asness – Simple Investing is Hard (Capital Allocators)

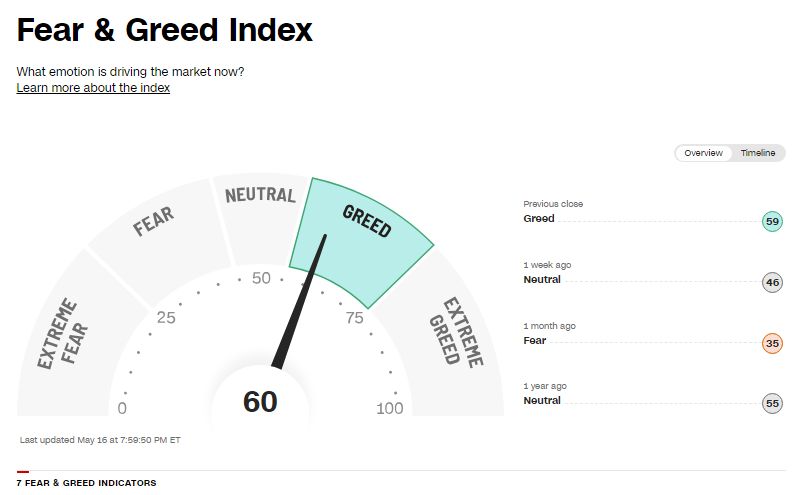

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Cliff Asness – Simple Investing is Hard (Capital Allocators)

Episode #533: Eric Crittenden & Jason Buck Explain Why Best Investors Follow the Trends (Meb Faber)

Robert Hagstrom, CFA: Unpacking Warren Buffett’s Approach (EI)

Investing in “Special” Situations (MicroCapClub)

Exciting Bond Returns (WealthTrack)

Hunter Hopcroft – In Defense of REITS (and Marty Whitman!) (Business Brew)

Rory McIlroy, Professional golfer – Be open-minded (David Novak)

Dev Ittycheria – The Database Evolution (ILTB)

#429 – Paul Rosolie: Jungle, Apex Predators, Aliens, Uncontacted Tribes, and God (Lex Fridman)

#35 The 100 Bagger Hunter (Stephen Clapham)

#194 Abigail Shrier: The Parent-Therapy Trap (KP)

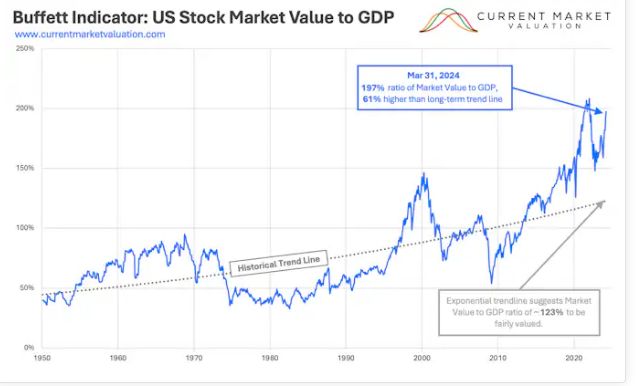

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Using Machine Learning Programs to Forecast the Equity Risk Premium (AlphaArchitect)

Sit On Your Hands! (ASC)

Macro Analysis and Capital Markets(PAL)

This week’s best investing tweet:

“Levered portfolios are subject to variance drain!”

So are your long-only active stock funds.

Don’t believe me? Read on.

— Corey Hoffstein 🏴☠️ (@choffstein) May 15, 2024

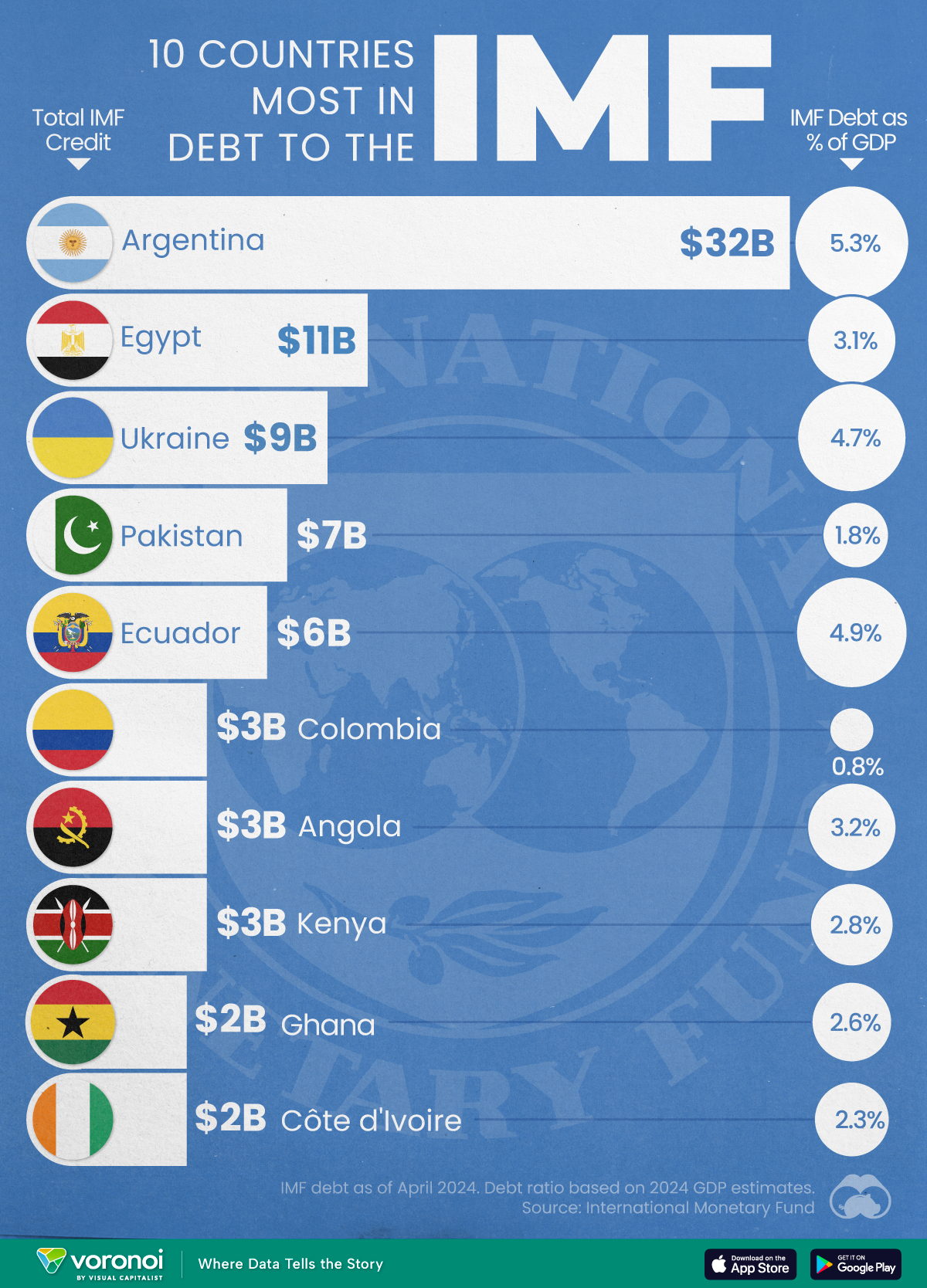

This week’s best investing graphic:

Top 10 Countries Most in Debt to the IMF (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: