This week’s best investing news:

Howard Marks Memo: The Impact of Debt (OakTree)

Berkshire Hathaway Annual Meeting 2024 (CNBC)

Guy Spier – VALUEx Berkshire Hathaway 2024 Event: Life Lessons On Charlie Munger & Investing (GS)

Berkshire Hathaway Q1 2024 Report (BH)

Omaha Value Investor Conference (Gabelli)

Buffett Without Munger (Jason Zweig)

Markel Group 2024 Omaha Brunch (Markel)

Stanley Druckenmiller & SEC Chair Gary Gensler (CNBC)

The Insight: Conversations – Volatility Ahead? Featuring Howard Marks (Oaktree)

Berkshire Hathaway Q1 2024 Earnings Letter (BH)

There’s More to Warren Buffett’s Game Than Just Picking Great Stocks (WSJ)

Einhorn Says Markets Are ‘Broken.’ Here’s What Data Shows (Bloomberg)

Cliff Asness and Dr. David Discuss Success (Finserv)

Quality or Value – Why Not Both? (Verdad)

Charlie Munger and How Not to Invest (Morningstar)

Warren Buffett is Selling Apple – His Model Disagrees (Validea)

Good Company, Bad Stock (Best Interest)

Counting The True Cost Of ‘Quantitative Easing’ (Felder)

Todd Combs – Charlie Munger’s Legacy (Value Investing with Legends)

Studying for the Bar (Humble Dollar)

Ray Dalio – Success is a 5 Step Process (Ray Dalio)

Godzilla vs. King Kong (Ep Theory)

Carl Icahn’s IEP slumps after old rival Ackman reignites feud (Yahoo)

The Old Normal (Rudy Havenstein)

Billionaire investor Mario Gabelli: Warren Buffett has created enormous wealth for his shareholders (CNBC)

Politics Ruins Portfolios (Security Analysis)

Lessons Learned from Charlie Munger (Davis)

Berkshire Hathaway’s Sue Decker on the absence of Charlie Munger: His impact will go on forever (CNBC)

Mohnish Pabrai’s Inner Scorecard (TIP)

How to Find a Partner like Charlie Munger (Alchemy)

US stock charts are broken. The economy isn’t (Sherwood)

MiB: Joanne Bradford, Domain Money (Big Picture)

Third Avenue Value Fund Q1 2024 Commentary (TA)

This week’s best value Investing news:

Quality or Value – Why Not Both? (Verdad)

Tim McElvaine on Value Investing, His Process, and Selected Case Studies (MOI)

The succession wisdom of an iconic value investor (AFR)

This week’s Fear & Greed Index:

This week’s best investing podcasts:

The Impact of Debt (Howard Marks)

Todd Combs – Charlie Munger’s Legacy (VIWL)

Corey Hoffstein and Ben Hunt | PNL For a Purpose (Excess Returns)

Nico Wittenborn – Finding the Adjacent Possible (ILTB)

Eclectic Value, Intelligent Diversification, MicroCap Turnarounds (PlanetMicroCap)

Control Yourself (MicroCapClub)

Elliot Turner Returns (Business Brew)

Get Into Oil Before It Hits $100 Per Barrel (Stansberry)

Episode #532: Hendrik Bessembinder – Do Stocks Outperform T-Bills? (Meb Faber)

Magnificent Seven Stocks: What’s Going on With Apple, Tesla, and Alphabet? (Morningstar)

Highlights from Berkshire Hathaway, Apple’s record buyback & crypto’s record price (Equity Mates)

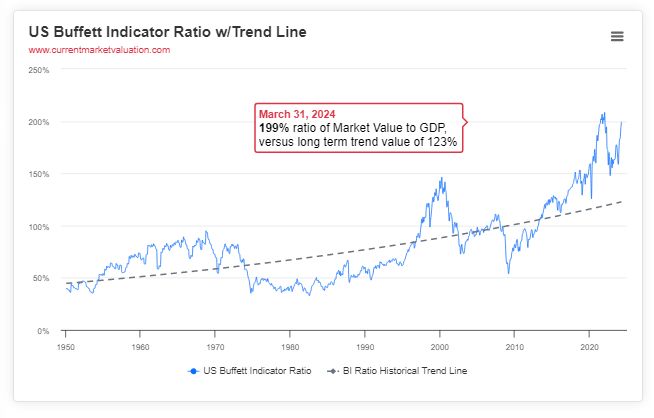

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Global Factor Performance: May 2024 (AlphaArchitect)

Small-caps do NOT matter (ASC)

Investment Returns Are NOT Random (CFA)

In Defense of Staying Private (AllAboutAlpha)

This week’s best investing tweet:

Stanley Druckemiller thinks copper is a pretty simple story.

I obviously agree with him.

Here’s the full quote:

“Copper is a pretty simple story. Takes about 12 years, greenfield to produce copper, and you got EVs, the grid, data centers, and believe it or not munitions.… pic.twitter.com/5mE50dpms1

— Brandon Beylo (@marketplunger1) May 9, 2024

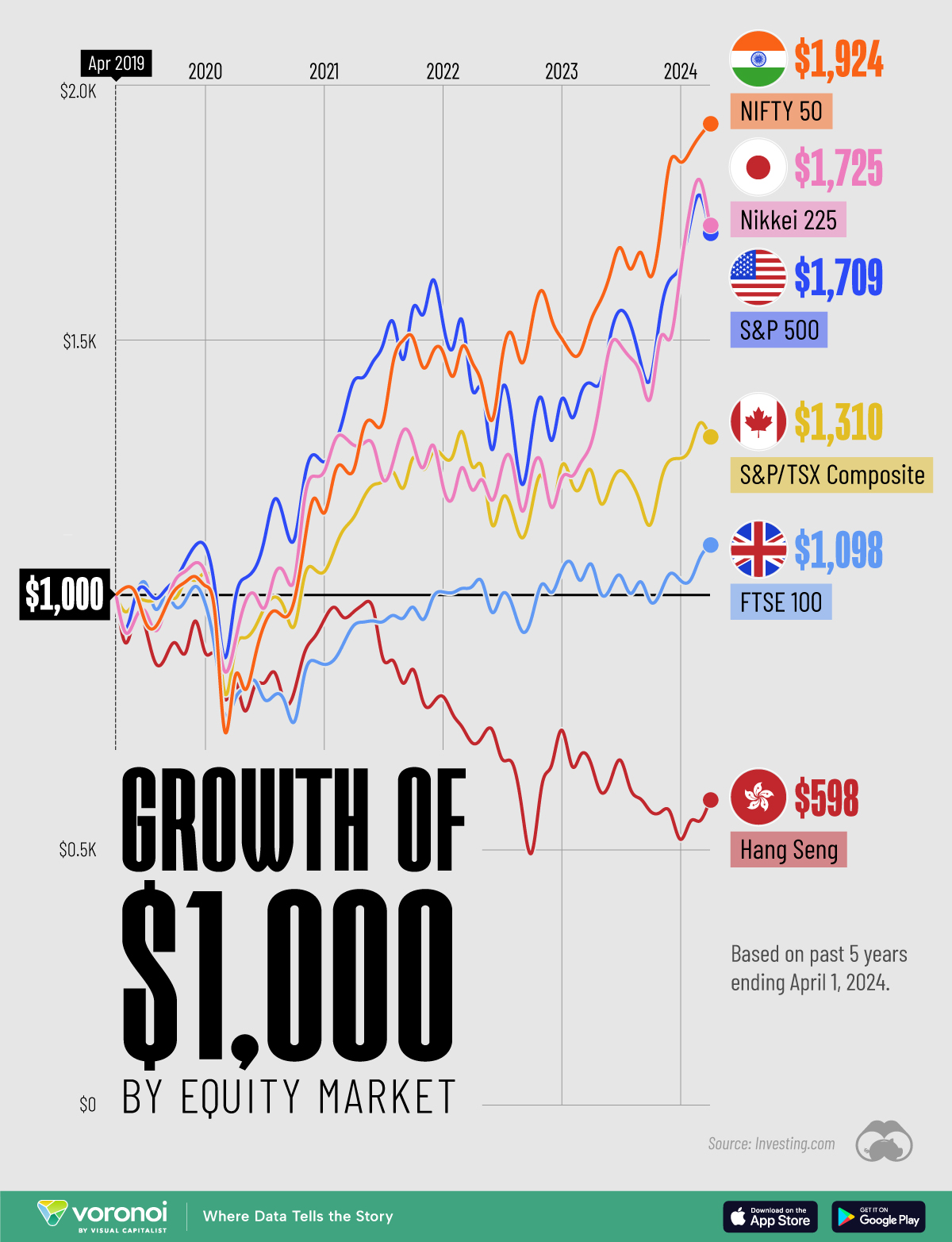

This week’s best investing graphic:

The Growth of a $1,000 Equity Investment, by Stock Market (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: