This week’s best investing news:

David Eihorn – Greenlight Capital Letter Q1 2024 (Greenlight)

François Rochon – Intelligent & Rational Long-Term Investing (TIP)

The Bull Case For Commodities Is As Strong As Ever (Validea)

10 Tough Questions for Warren Buffett at Berkshire’s Annual Meeting (Barron’s)

Mohnish Pabrai’s Session with MIT’s Brass Rat Investments (MP)

Inflation Revisited (Verdad)

Guy Spier – Pitfalls Of Crypto, Cash & Debt – Navigating A Chaotic World For Long-Term Investing (GS)

Jim Rogers Interview EGSI Financial (EGSI)

Monetary Shoplifting! (Rudy Havenstein)

Ron Baron: You can do quite well by being a long-term investor (CNBC)

Not Scared of Bears (HumbleDollar)

Invest in a company that cannot go bankrupt (Klement)

How I Think About Debt (Collab Fund)

Omaha, My Everest (Safal)

Michael Mauboussin – NBIM Investment Conference 2024 (NBIM)

Forewarned (Scott Galloway)

The Biggest Investor in the World (Net Interest)

The Bull Case For Commodities Is As Strong As Ever (Felder)

Even If the Fed Cuts, the Days of Ultralow Rates Are Over (WSJ)

Clickbait vs. Reality (Security Analysis)

Warren Buffett or Not, Berkshire Hathaway Stock Is Built to Last (Barron’s)

Why they say stocks are an inflation hedge (TKer)

GMO – Timing Your Swing (GMO)

The Curious Case of Catalysts (Behavioural Investment)

Ed Yardeni on the Roaring 20s (MiB)

Large-Growth Stocks Are Overvalued. Small-Value Stocks Are Undervalued. Here’s Why It Matters (Morningstar)

Expecting average returns doesn’t mean you should expect average years (TKer)

What to Do With Bonds When Inflation Won’t Die (WSJ)

When Low Risk Means High Risk (Morningstar)

The Man Who Killed Google Search (WYEA)

First Eagle Investments Q1 2024 Market Overview (FEIM)

Third Point Q1 2024 Investor Letter (TP)

Mairs & Power Growth Fund Q1 2024 Commentary (M&P)

This week’s best value investing news:

Tobias Carlisle: Value Investing – Simple, Not Easy (AdvisorAnalyst)

Can value investing help balance your portfolio? (Charles Stanley)

Why value investing no longer works. Plus, the surprising lack of interest in Canadian dividend ETFs (G&M)

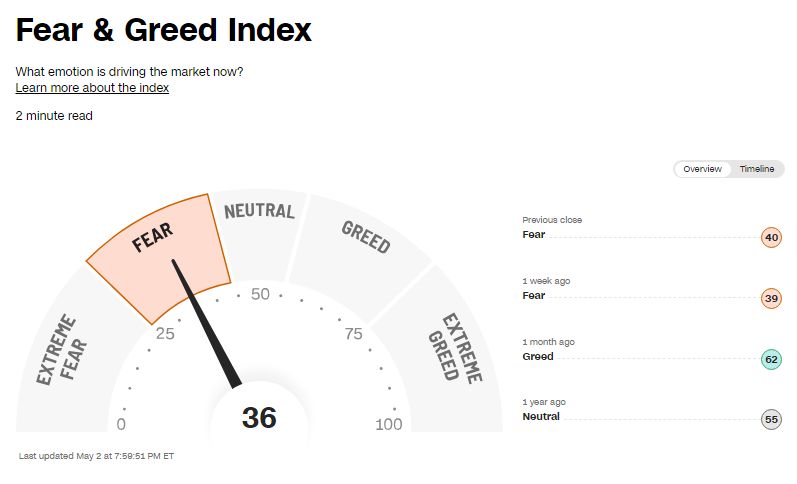

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Episode #531: GMO’s Catherine LeGraw – Capitalizing on Global Asset Allocation in 2024 (Meb Faber)

#193: Dr. Jim Loehr: Change the Stories You Tell Yourself (Knowledge Project)

Carl Vine: The Japan Earnings Story Has Legs (Long View)

From Records to Radio: Bill Wilson’s Journey to Leading a Digital Media Empire (Boyar)

Episode 303 – Scott Galloway: The Algebra of Wealth (Rational Reminder)

Residential Real Estate Opportunities (WealthTrack)

Lessons on valuation, Pimp my portfolio & is the stock market predictable long term? (Equity Mates)

Cem Karsan and Andy Constan | PNL For A Purpose (Excess Returns)

Marc Lasry – Making Bucks in Credit and Sports (ILTB)

Ep 169: Armen Panossian – Oaktree’s approach to navigating distressed credit (InsideTheRope)

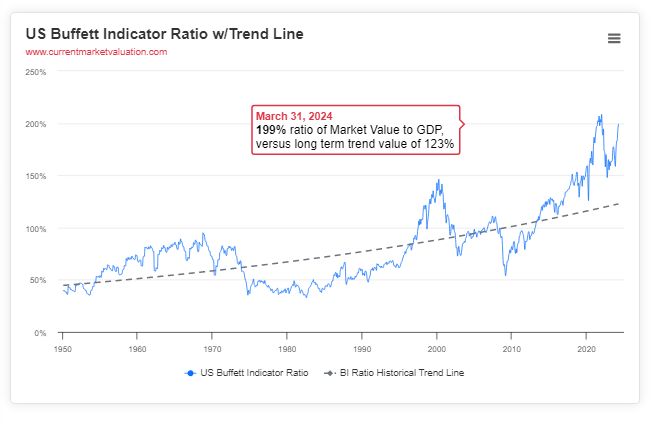

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

DIY Trend-Following Allocations: May 2024 (AlphaArchitect)

A Teachable Moment (ASC)

Cash is king, again? And stocks are overvalued (DGGMV)

Implementation Shortfalls Hamstring Factor Strategies (CFA)

The Secret Sauce to Source Multi-Manager Funds (AllAboutAlpha)

This week’s best investing tweet:

The S&P had its first rough month of 2024 in May, with stocks down, the https://t.co/jhPnIWv20l rate up and the ERP rising to 4.40%. Blame the fundamentals (inflation & the economy), not the Fed! ERP spreadsheet: https://t.co/TeH8Dqj4aw, Home Page: https://t.co/wy8WGu8ona pic.twitter.com/w8xHp6vczo

— Aswath Damodaran (@AswathDamodaran) May 2, 2024

This week’s best investing graphic:

Ranked: The Top 20 Countries in Debt to China (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: